The past few weeks have been quite hectic on the market. First, the market was going sideways throughout all summer and now that we got some new earnings results, we hit new record highs. Now, everybody’s talking about when this madness will stop. I mean, the market must crash and burn one day, right?

I wanted to write this article about confidence which happens to be a key component in successfully managing your investments and your life. The problem isn’t fear or being overwhelmed by information. The problem is the lack of confidence preventing you from making the right decisions and achieving your goals.

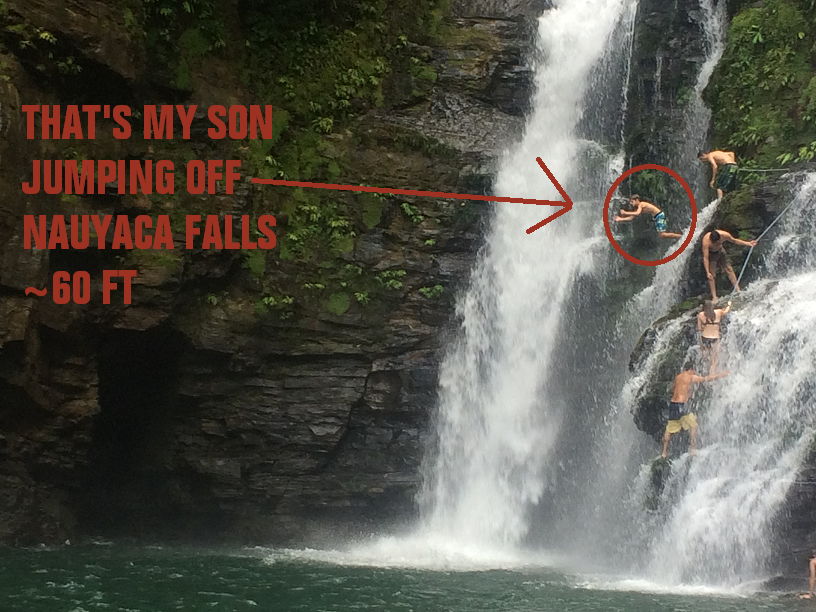

“Come on! Just jump! You don’t have to be afraid, just do it!”

~ My son William

Some people may see that as a flaw, but I like to see it as one of my greatest qualities. I’m over-confident in pretty much everything I do. This excess of confidence led me to do great things… and broke my teeth on a baseball bat on a few occasions. When we were in Costa Rica, we hiked a few kilometers to reach Nauyaca Falls. For a rare moment, I didn’t have the guts to climb the waterfalls and throw my body in the air at such a height. I was paralyzed by this monument of slippery rocks and powerful running water. My son William did it first (and I eventually followed). He told me what I was telling him the entire trip until that day: don’t be afraid, just do it! This is when I realized how a lack of confidence could completely throw you off your game. I needed someone to show me the way.

Lack of Confidence Leads to Paralysis by Analysis

Today, let me do what my son William did for me back at the waterfall. Let me be your guide to attaining a state of confidence. Fear is a powerful emotion that is not easily dismissed. It is often the reason fueling your lack of confidence. A rationale behavior in front of a lack of confidence is to seek more information. Your brain asks you to validate if your opinion/belief/investment thesis is right by digesting more information. Unfortunately, the more articles you read, the more people you talk to and the more analysis you do, the less likely you are to act. Words are fun, but they are meaningless if they don’t prompt actions. This is how you can suffer from paralysis by analysis.

Investing plan in Focus

“When you have confidence, you can have a lot of fun. And when you have fun, you can do amazing things.”

~Joe Namath

I’m not going to ask you to fill in an online investor profile questionnaire or to determine how much money you need to comfortably retire. I’ll assume you are past that stage and you are seeking more advanced advice.

Knowing your risk tolerance and what your budget should look like at retirement are part of a strong financial plan. But, once you have figured out that part, many people feel lost. What do you do now? The “Plan” doesn’t tell you how to invest. Your plan doesn’t tell you where to focus. This is what we are about to discuss.

Your Plan Should Be About Dividends

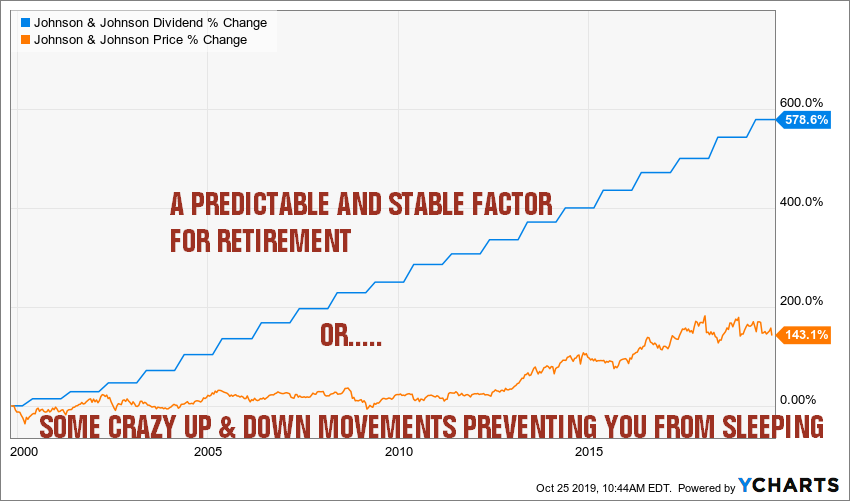

When I write “your plan should be about dividends”, I want to focus on the predictability and stability of dividends in your investing plan. Which line is easier (and more emotionally comfortable) to follow in that graph?

With no hesitation, following how your dividend payments evolve in your portfolio will provide you with more joy and a feeling of success. Watching Johnson & Johnson stock bouncing like Bugs Bunny craving for his carrot will not help you sleep at night. Get your focus on your dividend payment growth will.

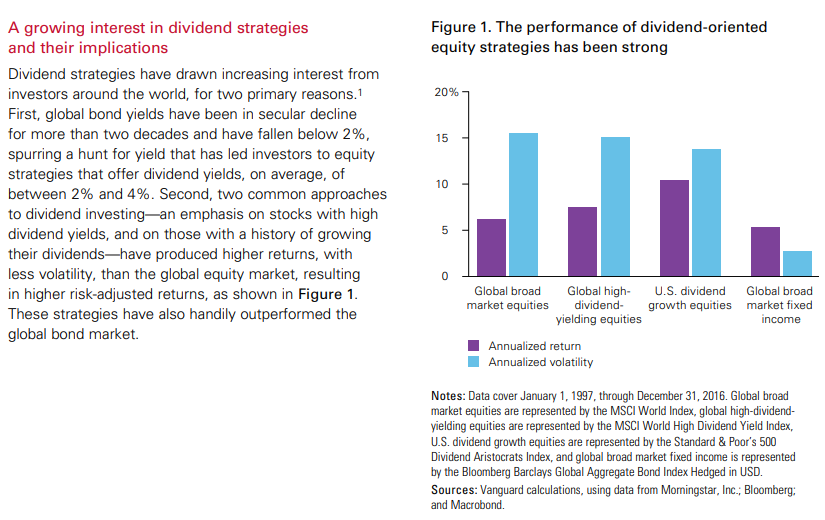

In a document where Vanguard tries to convince us that dividend investing isn’t that amazing, it clearly missed the point by providing the following graph:

During this 10-year period, dividend growth stocks not only beat the market, but they did it with less volatility. While dividend growers usually provide investors with less volatility, you will still go through challenging periods where your favorite holdings will show red numbers. This is where you may start losing confidence and start wondering if it would be appropriate to cash your profits and protect your capital.

Instead of looking at your investment performance over the past 3 months or 12 months, you may want to look at your dividend payments over the same period? Whenever I do that with my portfolio, I smile as I made more money in the past 3 months than I did a year ago. I would bet you do too. Here’s my question now:

“If you made more money in dividend than last year, why would you want to change anything?”

Tracking dividend growth instead of portfolio fluctuation is just step 1. If you want to learn more about my strategy, I’ll share it with you in my next webinar.

Learn how to manage your portfolio with no stress – New Webinar

As the market continues to break records, many investors are concerned to lose money in the next market crash. Are you one of them? Are you comfortable adding more capital in your portfolio right now? In this webinar, I’ll explain my strategy to reduce stress and make sure I make money from my investments… no matter what happens on the market. No, it’s not a magic formula, but it works.

Register here (100% free!) (you can register for the replay if you missed the live presentation!)

This webinar is for you if:

- You are already invested in the market, but wonder what will happen next.

- You want to avoid major losses and getting cut by a market crash.

- You aim to build a safe portfolio generating income for the future.

- You enjoy discussing the market with a passionate investor!

The webinar will be hosted on November Thursday 21st at 1PM EST. If you register, you will have access to a full free replay (at anytime).

Topic: Invest With Confidence – More Money in Your Pockets, Less Stress

Date: Thursday, November 21st at 1PM EST

Description: In this webinar, I’ll share strategies I use to navigate through this crazy market without hesitation. I’ll show you how you can reduce your stress and make better investment decisions. No more waiting for the right time or the right price. You will discover why you don’t need to be right all the time and still achieve your investing goals.

- If it’s your first time, you must provide your email address to register to the webinar. This is completely free and the webinar is free as well.

- Webinar Ninja is the platform we use to run all our webinars. It works well and provides an optimal experience for everyone.

- The presentation is about 45 minutes.

- There will be a Q&A session of about 25-30 minutes.

- The webinar works on Google Chrome or Safari from a laptop or computer. (not compatible with smartphones or tablets)

- If you can’t make it on time, there will be a full replay available, but you must register to access the replay.

Register here

The post Tracking your dividend growth is just step 1 of investing with confidence appeared first on The Dividend Guy Blog.