While I’m done with my children’s tuition fund, I had a few dollars uninvested left in my retirement portfolio. Agrium (AGU) has been on my watch list for a while and I decided to enter in a position on February 26th. Please note that Agrium is trading on the TSX as AGU.TO and on the NYSE as AGU. All figures in this article is in Canadian dollars to avoid any confusion.

I purchased 13 shares of Agrium (AGU)

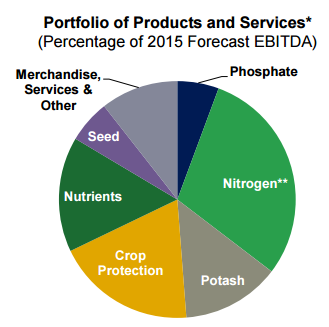

Agrium is the largest global retail and distributor of crop inputs. It is also the leader of agricultural nutrients providing farmers with all they need to improve their production. The company shows a less dependent link to potash prices as it counts on other products such as:

Source: Agrium investor presentation May 2015

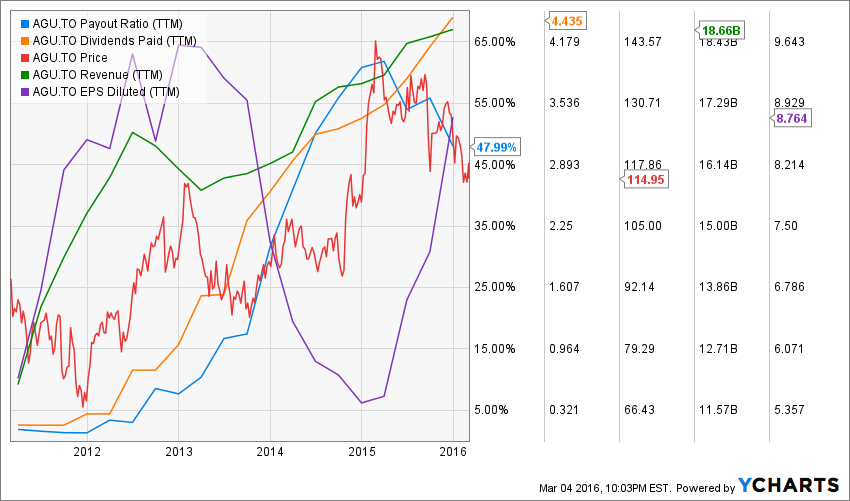

This is probably the reason why Agrium saw its profit jump by 24% in 2015 while Potash (POT) saw theirs down by 17%…. No wonder Potash cuts its dividend while Agrium’s dividend payment is safe with a payout ratio under 50%.

Investment Thesis

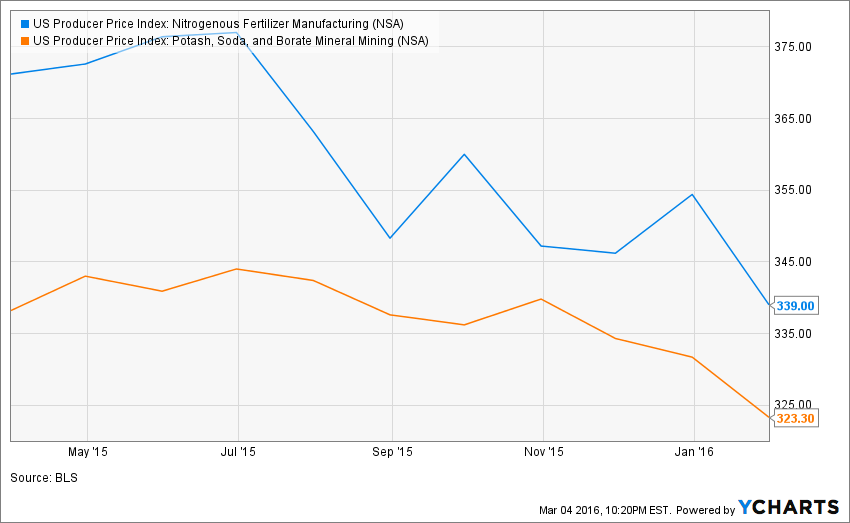

The fact that the ratio of arable land per person is continuously declining puts constant pressure on farmers to become as efficient as possible. The first solution for farmers is to improve their production with additional fertilizer. A second solution is to protect the crops they own and make sure their land is protected from any catastrophe that would affect their production. The consumption of meat in emerging markets will continue to increase in the upcoming year putting additional pressure on farmers to become even more productive. Agrium retail business will continue to overcome the drop in commodity prices for Potash and Nitrogen.

source: ycharts

Another interesting opportunity for Agrium is the fact that the retail agriculture market is highly fragmented. A leader such as Agrium can then easily swallow smaller competitors and ensure continuous growth in the upcoming year. Not to mention the low price of commodities have been hard for many of AGU peers. Being bigger in such markets will lead to improved bargaining power with suppliers and farmers.

Finally, with a 4%+ dividend yield and a relatively low PE ratio (12.31), the stock shows a great entry point at this time.

Risk

I didn’t put an enormous amount of cash into AGU just yet. In fact, this company represented roughly 2.5% of my portfolio at the moment of buying. The reason is quite simple; the high commodity price volatility hurts the company profit and cash flow from time to time. Also, the health of Agrium’s nitrogen business is closely tied to the cost of natural gas. If natural gas prices rise, it would create additional pressure on margins.

This is a volatile stock compared to most dividend growth companies. For example, AGU dropped by 20% while the TSX dropped by only 13% over the past 12 months.

Valuation

As I previously mentioned, I think AGU’s low PE ratio is a very good entry point at this time:

I usually use a 10 year PE ratio history to make my mind on what multiplier is used by the market, but the anomaly of 2007 (the PE ratio went up close to 200) makes it impossible to analyze on such long period. On the other hand, the enormous drop to a PE ratio near 8 in 2012 is related to the potash price collapse. Since 2014, the stock hasn’t been any cheaper.

In order to have a better idea of what AGU’s intrinsic value is, I use a double stage dividend discount model (DDM). This enables me to use a 8% dividend growth rate for the first 10 years and reduce it to 7% afterward. I also use a 11% discount rate considering the high volatility of commodity prices:

| Input Descriptions for 15-Cell Matrix | INPUTS |

| Enter Recent Annual Dividend Payment: | $4.84 |

| Enter Expected Dividend Growth Rate Years 1-10: | 8.00% |

| Enter Expected Terminal Dividend Growth Rate: | 7.00% |

| Enter Discount Rate: | 11.00% |

I’ve updated my calculations with the most recent dividend increase in December at $1.211 (CAD) per share:

| Calculated Intrinsic Value OUTPUT 15-Cell Matrix | |||

| Discount Rate (Horizontal) | |||

| Margin of Safety | 10.00% | 11.00% | 12.00% |

| 20% Premium | $225.19 | $168.38 | $134.32 |

| 10% Premium | $206.42 | $154.35 | $123.13 |

| Intrinsic Value | $187.66 | $140.32 | $111.93 |

| 10% Discount | $168.89 | $126.28 | $100.74 |

| 20% Discount | $150.13 | $112.25 | $89.55 |

Source: Dividend Monk Calculation Spreadsheet

As you can see, the company is trading at almost a 20% discount (which is where its price was 12 months ago). This is an opportunity I couldn’t ignore.

What do you think? Are you one of investors who preferred Potash not so long ago?

disclaimer: I own shares of AGU