In September of 2017, I received slightly over $100K from my former employer which represented the commuted value of my pension plan. I decided to invest 100% of this money in dividend growth stocks.

Each month, I publish my results on those investments. I don’t do this to brag. I do this to show my readers that it is possible to build a lasting portfolio during all sorts of market conditions. Some months we might appear to underperform, but you must trust the process over the long term to evaluate our performance more accurately.

Performance in Review

Let’s start with the numbers as of June 3rd, 2022 (around 10am):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Portfolio value: $206,517.00

- Dividends paid: $4,22.60 (TTM)

- Average yield: 2.05%

- 2021 performance: +16.78%

- SPY= 28.75%, XIU.TO = 28.05%

- Dividend growth: +3.14%

Total return since inception (Sep 2017- June 2022): 89.88%

Annualized return (since September 2017 – 56 months): 14.73%

SPDR® S&P 500 ETF Trust (SPY) annualized return (since Sept 2017): 13.54% (total return 80.89%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 11.04% (total return 63.00%)

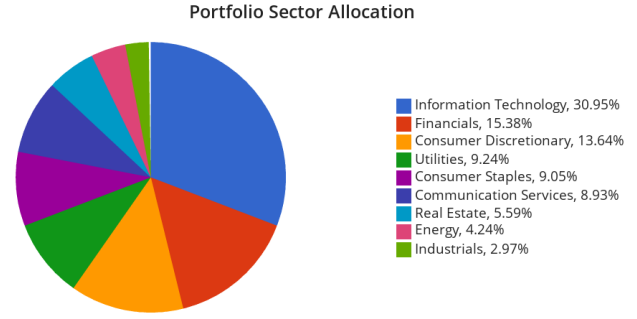

Sector allocation calculated by DSR PRO

Are We in a Bear Market? Is The Recession Coming?

Since the beginning of the year, it seems that we keep reading more bad news. Inflation keeps rising, and variants of Covid are forcing lockdowns in China. This does nothing to help supply chain disruptions across many industries, a war is going on in Eastern Europe, and interest rates are being raised routinely by central banks.

We had a funny discussion on a recent DSR PRO forum where we were discussing the type of bear market we are in the midst of today. A member suggested the following classification:

| Market Return | Type of Bear Market |

| -5% | Panda Bear |

| -10% | Yogi Bear |

| -20% | Bear |

| -30% | Polar Bear |

| -35% | Grizzly Bear |

| -50% | Russian Bear |

Jokes aside, I prefer to stick to classic definitions:

- Starting at -10% and down to -20%, it’s a market correction

- Going below -20%, it’s a bear market

I don’t give additional “points” for the intensity (how fast it drops) or the length of the correction or bear market. Some are more painful than others, but since there is little you can do, you might as well not spend too much time discussing the definition of the current market.

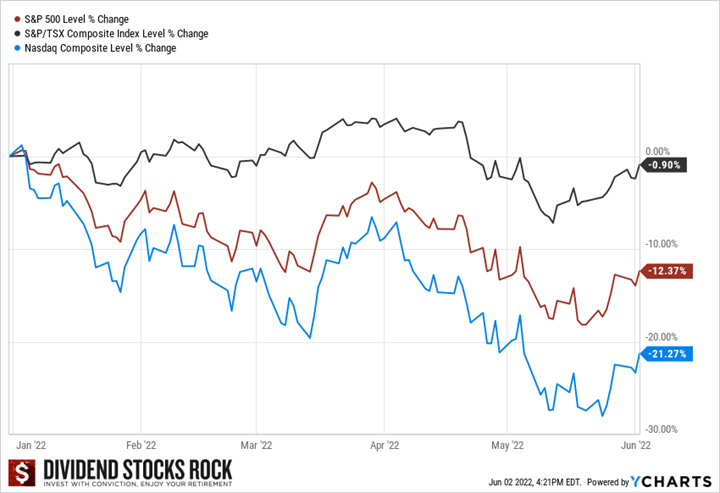

The Canadian market went through a quick correction between April 4th and May 12th of this year, but the market is somewhat improved since then. Between Jan 1st and June 2nd, the Canadian market is almost flat. When you turn to the U.S. markets, you will notice that the S&P 500 got very close to being in a bear market (-20%), but the only index having major problems currently is the Nasdaq (mostly driven by tech stocks).

If you have little exposure to energy (like me), your portfolio is probably suffering a little bit more. On the other hand, if you jumped onto the energy train in the past 12 months, chances are you are smiling right now (if you didn’t try to catch the oil bottom of 2016 instead!).

In general, the market is trying to tell us its vision of the future. When we see a gloomy market for the first 5 months of 2022, we can surmise that a recession may be coming. It seems the market thinks it’s a fair possibility. Now, depending on who you ask, you’ll get a different answer. I recently read comments from analysts at Royal Bank who think we have a 50-50 chance to see a recession. A 50% chance… you might as well say nothing, and you wouldn’t add less value to the conversation!

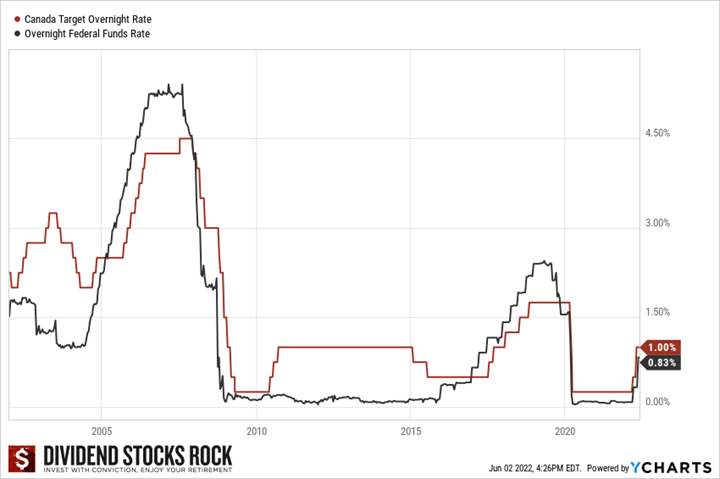

The most recent comments coming from the FED and the Bank of Canada lead us to think they will do whatever is necessary to kill the inflation even if it means forcing a recession. In other words, they are ready to amputate if it means it will save the patient’s life. When we take some relative perspective, we realize that even if interest rates are going up quickly, we are only getting back to more “normal” levels:

At this point, we are very far from pre-pandemic levels, and we are even further from the pre-financial crisis (2008) levels. This tells me we are far from being done with interest rate increases. Should it be a source of concern? Not at all. In fact, as frustrating as it could be, it’s only normal to have a bad year occasionally. It enables the market to do some cleansing and the investors with the most conviction will stick around.

The market anticipates weaker economic conditions and, therefore, the PE ratios of many companies are declining. This is a necessary cycle that will help make the difference between a great company and a company that benefited from great hype. You are still in a good position to review your portfolio and make sure you don’t have too many speculative plays in your portfolio.

Smith Manoeuvre Update

I must admit, I feel a mix of pride and joy to invest new capital monthly. I’ve always invested systematically until I took a sabbatical year in 2016. For 13 years in a row, I saved as much as I could and built an interesting nest egg. In fact, if I use a 6.5% investment return on my portfolio, I know I can retire comfortably at the age of 60 without having to add a single penny in capital.

However, it felt weird to spend all my money on my business for the past 5 years. Therefore, it’s great to see how I can build a new portfolio in a different market. This month, I added another $500 that went towards the purchase of 11 shares of Exchange Income Corp (EIF.TO) at an average price of $44.78.

Prior to COVID-19, Exchange Income Corp. was part of the list of companies that we liked at DSR. A growth-by-acquisition strategy combined with steady dividend increases (and a generous yield) seemed like a good deal for retirees. Unfortunately, EIF is now stuck in the struggling aerospace industry. The company is slowly but surely recovering from the pandemic and its stock price has recovered significantly; we can count on better days ahead. Its latest quarter shows that the company is headed in the right direction and that growth will become part of the discussion. EIF exhibited impressive resilience in 2020 and 2021. Toward the end of 2021, EIF returned to its pre-pandemic revenues in the Maritimes while the central Canadian and Nunavut markets are at about 75% of pre-pandemic levels. The EIF manufacturing business is on solid ground and is well-diversified. It provides a great mix of growth potential and a decent yield (~5%).

Here’s my portfolio as of June 3rd:

| Company Name | Ticker | Sector | Market Value |

| Canadian Net REIT | NET.UN. V | Real Estate | 583.86 |

| National Bank | NA.TO | Financials | 516.34 |

| Exchange Income | EIF.TO | Industrials | 466.86 |

| Cash (Margin) | -27.42 | ||

| Total | 1,539.64 |

Let’s look at my CDN portfolio. Numbers are as of June 3rd, 2022 (before the bell):

Canadian Portfolio (CAD)

| Company Name | Ticker | Sector | Market Value |

| Algonquin Power & Utilities | AQN.TO | Utilities | $6,240.99 |

| Alimentation Couche-Tard | ATD.B.TO | Cons. Staples | $20,771.74 |

| National Bank | NA.TO | Financials | $11,778.14 |

| Royal Bank | RY.TO | Financial | $7,920.60 |

| Brookfield Renewable | BEPC.TO | Utilities | $6,483.18 |

| CAE | CAE.TO | Industrials | $6,780.00 |

| Enbridge | ENB.TO | Energy | $9,490.95 |

| Fortis | FTS.TO | Utilities | $6,265.71 |

| Magna International | MG.TO | Cons. Discre. | $5,637.10 |

| Sylogist | SYZ.TO | Inf. Technology | $3,356.85 |

| Granite REIT | GRT.UN.TO | Real Estate | $11,650.56 |

| Cash | 725.48 | ||

| Total | $97,101.30 |

My account shows a variation of +$1,857.48 (+1.95%) since the last income report on May 5th. As mentioned in the previous portfolio update, now it’s time to look at how my Canadian holdings fared this quarter.

Algonquin Power & Utilities raises its dividend again!

Algonquin reported a solid quarter beating analyst expectations on both EPS (+5%) and revenue (+16%). The company counts on a CAPEX plan of $12.4B from 2022 through 2026 to drive additional growth. It was another busy quarter for AQN as it closed the acquisition of New York American Water Company, and it also completed the Blue Hill Wind Facility (now generating 175MW). Here’s another sign of great conviction as management announced a 6% dividend increase! Congratulations to both management and all the shareholders!

Alimentation Couche-Tard is tard (or late if you prefer)

No update yet! Still waiting for the next quarter to be released!

National Bank is the best bank… period

National Bank reported another impressive quarter with EPS growth of 13% and a generous dividend increase of 6%. Considering the new dividend ($0.92/share) and recent EPS ($2.55), the payout ratio is at 36%. This gives plenty of room for the Bank to continue its growth path. The Personal & Commercial and Wealth management segments were up modestly by 2.6% and 4%, respectively. The growth came, once again, from capital markets (+17%) with higher total revenues and lower provisions for credit losses, and US specialty & Intl (+18%) driven by revenue growth at both the Credigy and ABA Bank subsidiaries.

Royal Bank was among the best performing banks this quarter

RY reported a solid quarter (EPS +7%, and net income +6%) as it benefited from the release of provisions on performing loans and strength in its Personal & Commercial Banking and Insurance operations, partly offset by weaker results from Capital Markets. P&C Banking net income was up 17%, primarily attributable to lower PCL, higher interest rates, and strong volume growth. Wealth management was up 10% primarily due to higher average fee-based client assets reflecting net sales and market appreciation. Unfortunately, capital markets net income went down by 26%, mainly due to lower Global Markets revenue largely resulting from lower fixed income and equity trading revenue.

Brookfield Renewable is ready to pull the trigger on more acquisitions

Brookfield Renewable reported Q1 2022 FFO of $243 million or $0.38 per share, an 18% increase compared to the same quarter last year. The company’s operations benefited from strong asset availability, higher power prices, and recent acquisitions. While generation for the quarter was in-line with their long-term averages, strong generation in BEPC’s lower priced markets and weaker performance in its higher priced markets translated to lower-than-expected FFO. The company closed the quarter with close to $4B in total available liquidity. Finally, the company declared a dividend increase from $0.3038 to $0.32, representing a 5.3% increase.

CAE is getting closer to pay a dividend!

CAE made us wait as they reported their earnings late due to a lack of accountants! The wait was well worth it as the company reported revenue up 7% and adjusted EPS up 32%. Keep in mind we are still in the early days of a cyclical recovery. The Civil aviation segment revenues were up 11% and the Civil training centre utilization was 69% and has been trending at a similar level since the end of the quarter. Defense and security segment revenue was up 40%, mostly driven by recent acquisitions. The healthcare segment was down 69% as last year included the Government contract for ventilators ($130M). Excluding this one-time contact, revenue would have been up 27%. Unfortunately, there was no mention of a dividend.

Enbridge is literally transporting cash

Enbridge reported another solid quarter with double-digit Distributable cash flow per share growth (+11%). Strong results were primarily driven by contributions from the U.S. portion of the Line 3 Replacement Project and the acquisition of the Enbridge Ingleside Energy Center. ENB said it transported 3M bbl/day on its Mainline system during Q1, which was higher than the 2.75M bbl/day sent in the year-earlier quarter. Enbridge reiterated FY 2022 guidance for adjusted EBITDA of $15B-$15.6B and distributable cash flow of $5.20-$5.50/share. ENB anticipates that its businesses will continue to experience strong utilization and good operating results through the balance of the year.

Fortis is a synonym of stability

Fortis reported Q1 2022 EPS of $0.61, missing estimates by $0.01. Revenue reported for the quarter was $2.23B representing a 7.58% increase over Q1 2021 and beating estimates by $76.93M. Earnings in Arizona were broadly consistent with the first quarter of 2021. The impact of higher electricity sales and lower planned generation maintenance costs was offset by the timing of earnings related to the Oso Grande wind generating facility, as expected. Fortis’ $4.0 billion annual capital plan remains on track with approximately $1.0 billion invested during the first quarter. Finally, the company declared a dividend payment of $0.535, which is flat when compared to Q4 2021.

Magna International’s struggle continues

MGA reported Q1 2022 EPS of $1.28, beating estimates by $0.18. Revenue reported was $9.64B, representing a 5.28% decrease when compared to Q1 2021. The revenue decrease was primarily driven by lower global light vehicle production and assembly volumes, and the net weakening of foreign currencies against the U.S. dollar, partially offset by the launch of new programs. EBIT as a percentage of sales decreased to 5.3% in Q1 2022 compared to 7.6% in Q1 2021, largely as a result of higher production input costs. Magna’s operations in Russia remain substantially idled. These operations consist of 6 facilities and 2,000 employees which generated sales of $371M in 2021.

I’ve given more details on Magna International in this recent podcast episode.

6 Companies that Lost Their Magic Touch [Podcast]

Sylogist is on the right path (even if the stock doesn’t tell you that)

While Sylogist reported strong revenue growth (+48%), it failed to show EPS growth (down 11%). Recurring revenues from subscriptions and maintenance reached $8.7M, an increase of 24%. Considering past acquisitions and their growing backlog, management expects organic growth in the high single digits through fiscal 2022. SYZ’s EPS was down 11% as expenses more than doubled. The acquisitions of three companies drove most of the increases in expenses. We should see those expenses slow down in the coming months (unless we see more acquisitions which could also be good for the long-term growth of the company). SYZ lost its PRO rating of 5 due to the lack of dividend growth.

Granite REIT, I’m glad I added this one!

Granite REIT reported another solid quarter with double-digit growth (AFFO per unit up 12% and revenue up 13%). The growth was supported by recent acquisitions. The strengthening Canadian dollar relative to the US dollar and Euro had a negative impact on FFO of $0.02 per unit in the first quarter of 2022 relative to 2021. The REIT continued its growth by acquisition during the quarter. The dividend is safe and should be increased in 2022 with an AFFO payout ratio of 77% for the first quarter of 2022 compared to 78% in the first quarter of 2021.

Here’s my US portfolio now. Numbers are as of June 3rd, 2022 (around 10am):

U.S. Portfolio (USD)

| Company Name | Ticker | Sector | Market Value |

| Activision Blizzard | ATVI | Communications | $9,029.44 |

| Apple | AAPL | Inf. Technology | $10,949.99 |

| BlackRock | BLK | Financials | $9,413.10 |

| Disney | DIS | Communications | $4,903.65 |

| Gentex | GNTX | Cons. Discret. | $7,175.73 |

| Microsoft | MSFT | Inf. Technology | $14,840.10 |

| Starbucks | SBUX | Cons. Discret. | $6,755.80 |

| Texas Instruments | TXN | Inf. Technology | $8,751.50 |

| VF Corporation | VFC | Cons. Discret. | $4,110.75 |

| Visa | V | Inf. Technology | $10,587.00 |

| Cash | $524.37 | ||

| Total | $87,059.53 |

The US total value account shows a variation of -$3,241.43 (-3.6%) since the last income report on May 5th.

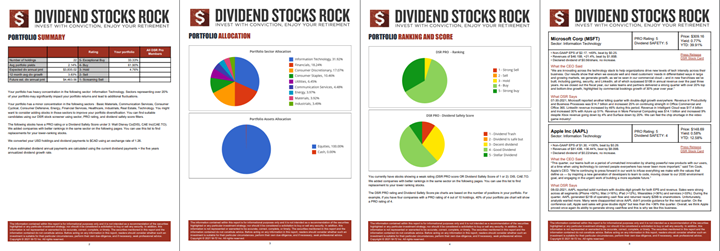

My Entire Portfolio Updated for Q2 2022

Each quarter, we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of March 31st, 2022.

Download my portfolio Q2 2022 report.

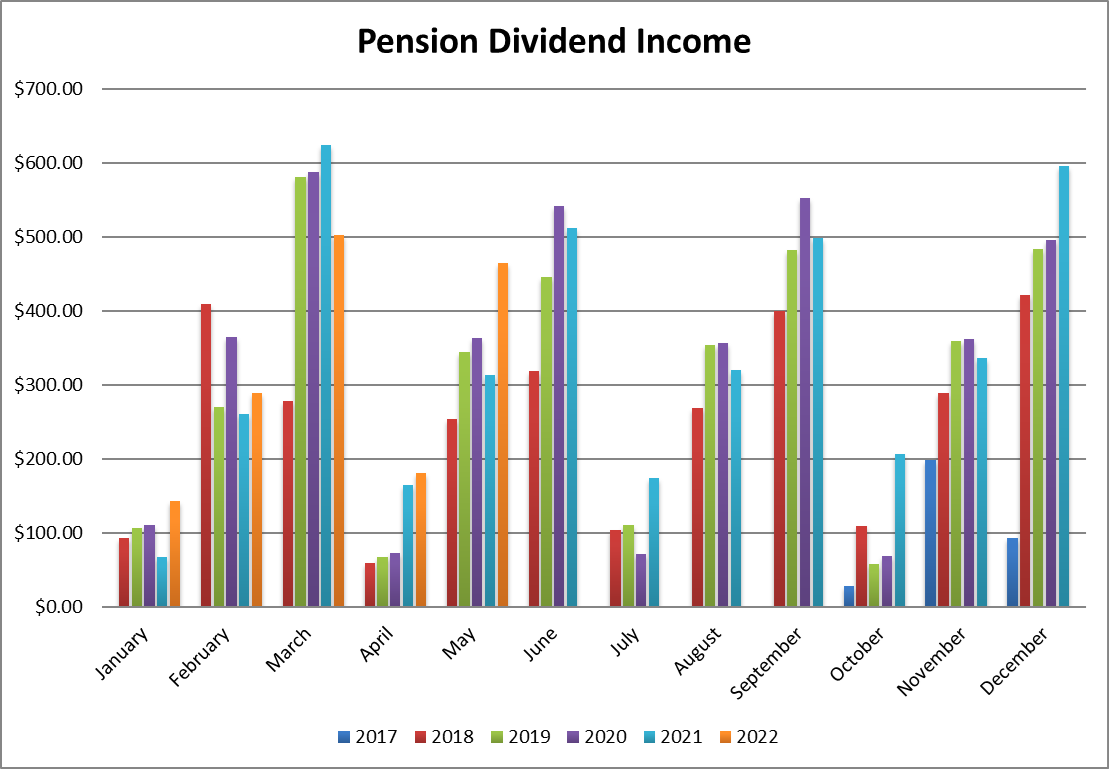

Dividend Income: $464.80 CAD (+48.64% vs May 2021)

That’s a healthy jump in dividends earned by the portfolio, right? This is explained by several dividend increases vs. last year (National Bank, Royal Bank, Texas Instruments and Starbucks), some new additions to my portfolio (more of National Bank, Granite REIT, Activision Blizzard), the fact that Magna’s dividend was recorded in May this year and in June last year, and finally by a small currency factor bump (about 5%).

Most importantly, my dividends received over the past 12 months is going up since the beginning of the year. If I compare my first 5 months vs 2021, my dividend payments are up 10.50%. This is more than enough to beat inflation!

Here are the details of my dividend payments.

Dividend growth (over the past 12 months):

- National Bank: +85% (I added shares of NA)

- Granite REIT: New

- Royal Bank: +11%

- Magna Intl: +10.4% (was recorded in July last year)

- Activision Blizzard: New

- Apple: -18% (I trimmed my position in December)

- Texas Instruments: +12.7%

- Starbucks: +8.9%

- Currency factor: +4.97%

Canadian Holding payouts: $249.99 CAD

- National Bank: $105.27

- Granite REIT: $33.06

- Royal Bank: $72.00

- Magna Intl: $39.66

U.S. Holding payouts: $170.92 USD

- Activision Blizzard: $54.52

- Apple: $17.25

- Texas Instruments: $57.50

- Starbucks: $41.65

Total payouts: $464.80 CAD

*I used a USD/CAD conversion rate of 1.2568

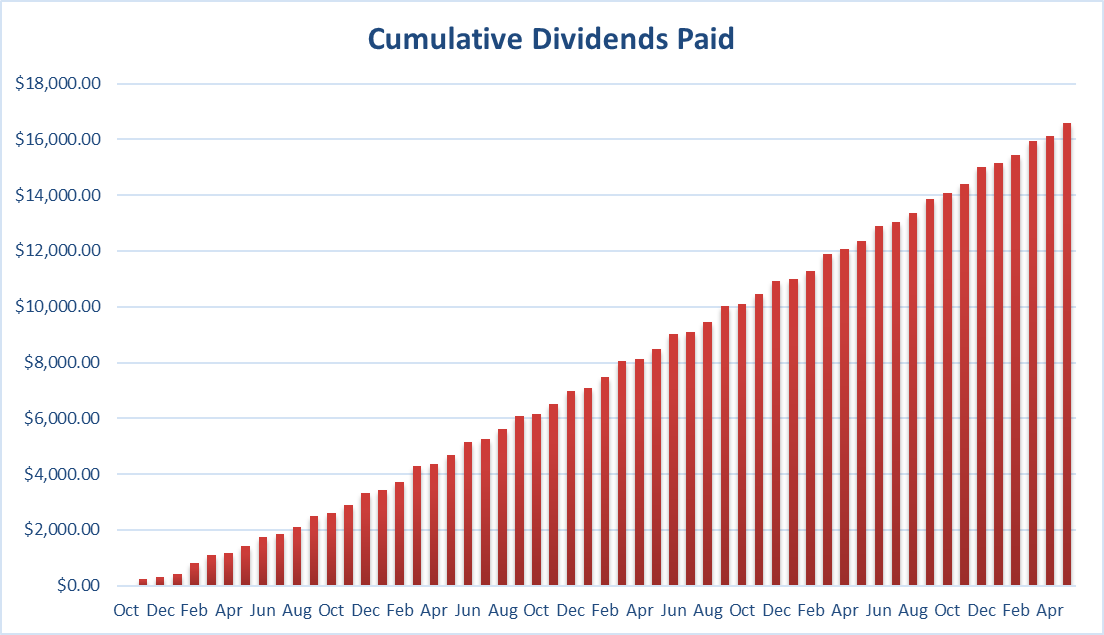

Since I started this portfolio in September 2017, I have received a total of $16,589.40 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added to this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital being added to the account.

Final Thoughts

I’ve been asked if I intend to take any action to protect my portfolio against a potentially more violent bear market. I usually answer that question the same way at any time of the year no matter what is happening on the market: I review my portfolio quarterly and rebalance it yearly.

Please remember that I sold some shares of my tech stocks in December to rebalance and reduce my exposure to the Tech Sector. I happened to be lucky with this move, but most importantly, I was disciplined. If you follow your plan, it will all be successful over time.

Cheers,

Mike.

The post Are We in A Bear Market? – May Dividend Income Report appeared first on The Dividend Guy Blog.