In September of 2017, I received slightly over $100K from my former employer which represented the commuted value of my pension plan. I decided to invest 100% of this money in dividend growth stocks.

Each month, I publish my results on those investments. I don’t do this to brag. I do this to show my readers that it is possible to build a lasting portfolio during all sorts of market conditions. The market will inevitably go down, as it did last year. But I continued to enjoy cashing consistent and growing dividends despite that negative market action! And, most importantly, I stayed fully invested in the market and have enjoyed the market recovery in 2020 that has continued into 2021.

As you know, I also take the opportunity during my monthly income report to add some relevant market commentary. This time, I quickly review some of my holdings’ most recent earnings, including Lazard (LAZ).

Performance in Review

Let’s start with the numbers as of November 3rd, 2021 (at market close):

Original amount invested in September 2017 (no additional capital added): $108,760.02.

- Portfolio value: $219,092.24

- Dividends paid: $3,997.99 (TTM)

- Average yield: 1.82%

- 2020 performance: +20.3%

- SPY=20.3%, XIU.TO = 5.27%

- Dividend growth: +7.7%

Total return since inception (Sep 2017- Nov 2021): 101.40%

Annualized return (since September 2017 – 50 months): 18.30%

SPDR® S&P 500 ETF Trust (SPY) annualized return (since Sept 2017): 18.27% (total return 101.20%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 12.29% (total return 62.11%)

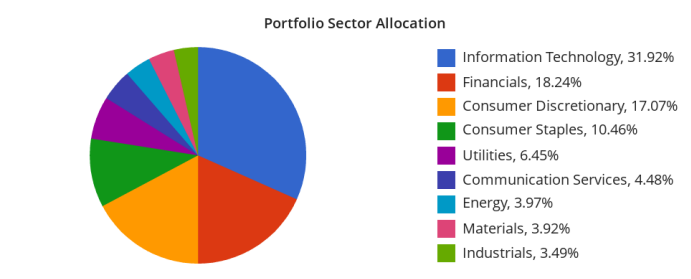

Sector allocation calculated by DSR PRO.

Let’s look at my CDN portfolio. Numbers are as of November 3rd, 2021 (at market close):

Canadian Portfolio (CAD)

| Company Name | Ticker | Market Value |

| Algonquin Power & Utilities | AQN.TO | 6,047.76 |

| Alimentation Couche-Tard | ATD.B.TO | 17,285.85 |

| Andrew Peller | ADW.A.TO | 4,969.28 |

| National Bank | NA.TO | 8,344.80 |

| Royal Bank | RY.TO | 7,930.20 |

| Brookfield Renewable | BEPC.TO | 2,187.36 |

| CAE | CAE.TO | 7,716.00 |

| Enbridge | ENB.TO | 8,409.03 |

| Fortis | FTS.TO | 5,494.50 |

| Intertape Polymer | ITP.TO | 8,931.00 |

| Magna International | MG.TO | 7,278.60 |

| Sylogist | SYZ.TO | 4,799.67 |

| Cash | 121.21 | |

| Total | $89,515.26 |

My account shows a variation of +$2,984.75 (+3.45%) since the last income report on October 6th. The portfolio is pretty much following market trends. In fact, XIU.TO went up 5.55% during the same period. I’ll review my CDN holdings in December as most of them will have the time to report their earnings (especially banks!). You will notice the increase in my BEPC.TO position as I used my dividend to buy 20 more shares.

Here’s my US portfolio now. Numbers are as of November 3rd, 2021 (at market close):

U.S. Portfolio (USD)

| Company Name | Ticker | Market Value |

| Apple | AAPL | 14,543.04 |

| BlackRock | BLK | 13,323.80 |

| Disney | DIS | 7,653.60 |

| Gentex | GNTX | 8,589.25 |

| Lazard | LAZ | 4,967.40 |

| Microsoft | MSFT | 20,040.00 |

| Starbucks | SBUX | 9,571.85 |

| Texas Instruments | TXN | 9,459.50 |

| VF Corporation | VFC | 6,025.59 |

| Visa | V | 10,405.00 |

| Cash | 28.20 | |

| Total | $104,607.23 | |

The US total value account shows a variation of +$5,082.96 (+5.11%) since the last income report on October 6th. Similarly, to the Canadian market, the S&P 500 was also on a roll this month. Many companies reported their earnings. Here’s a quick summary:

Apple disappoints with double-digit growth

When a company disappoints the market with EPS up 70% and revenue up 29%, you can say that we have become greedy. The real problem comes from supply chain disruption. Earlier this month, the company announced it will cut shipments of its iPhone 13 by 10 million units by the end up the year due to shortages in communication chips from some of its suppliers. In other words, sales are not going to grow as fast as expected in the coming quarter. However, this is a short-term problem, and we are long-term investors. On the bright side, Services recorded its largest quarter, with sales of $18.3 billion, up from $14.5 billion in the year-ago period.

BlackRock to the moon

BlackRock reported another amazing quarter with double-digit growth everywhere. EPS was up 19%, and revenue was up 16% reflecting strong organic growth. There was a 13% growth in technology services revenue despite lower performance fees. The company also delivered its 10th consecutive quarter of active equity inflows and client demand for ESG remains strong, with $31B of inflows across BLK’s sustainable active and index strategies. BLK now has close to $10 trillion (you read that right) in assets under management. It will be nice to see its stock price cross the $1,000 mark.

Gentex suffers from supply chain disruptions

GNTX reported Q3 2021 Net sales of $399.6 million, representing a 700-basis point outperformance compared to the quarter-over-quarter reduction in light vehicle production in the Company’s primary markets. Gross margin was 35.3%, compared to a gross margin of 39.7% for the third quarter of 2020. The gross margin was primarily impacted by the lower sales levels stemming from the 23% quarter over quarter decline in light vehicle production in the Company’s primary regions. However, the gross margin was also impacted by lower-than-expected price reductions on raw materials, increases in freight, and other supply chain related costs.

Lazard did well, but skipped its dividend increase (again)

Lazard reported a strong quarter with revenue up 23% and assets under management up 19%. The company said Financial Advisory operating revenue was a record $381M, 24% higher than the Q3 2020. As there are currently many mergers & acquisitions, you can expect this segment to continue to thrive in the coming quarter. Unfortunately, the company did not increase its dividend once again. The DSR dividend safety score will be downgraded to “2” meaning that it’s not considered a dividend grower anymore. I guess it’s almost good news for me as I have many financial stocks in my portfolio. I’ll seriously consider selling LAZ as it doesn’t fit my dividend growth investing guidelines.

Microsoft is killing it (what’s new?)

Microsoft crushed expectations and reported double-digit growth everywhere: Revenue in Productivity and Business Processes was $15.0 billion and increased 22%, Intelligent Cloud was $17.0 billion and increased 31%, and More Personal Computing was $13.3 billion and increased 12%. Azure and MSFT’s cloud services grew by 50%. Microsoft also pleased investors by providing stronger revenue guidance than expected for its next quarter. Total revenue should come to $50.15B-$51.05B vs. the consensus of $48.92B. And, did I tell you about the 11% dividend increase?

Starbucks is clearly getting out of the pandemic

Earnings almost doubled, revenue was up 31%, and guidance was increased. Executives said that adjusted EPS will be up “at least 10%” from the $3.10 mark in FY21 or $3.41+ vs. consensus of $3.71. Performance accelerated throughout the quarter and the company expects continued growth as urban U.S. stores have reached sales at or above pre-pandemic levels. Another item of good news is management has announced it will return $20B to shareholders in the next three years through share repurchases and dividends.

Texas Instruments is another victim of the chip shortage

TXN reported a strong quarter with double-digit revenue growth (+22%). Results were supported by strong demand in industrial, automotive, and personal electronics. Analog revenue grew 24% and Embedded Processing grew 13% from the same quarter a year ago. TXN’s fourth quarter outlook is for revenue in the range of $4.22 billion to $4.58 billion and earnings per share between $1.83 and $2.07. The stock dropped on earnings day on short-term fear around chip shortage. It will affect results over the coming quarters, but TXN remains a solid business. This may create a good buying opportunity for this classic growth company.

VF Corporation is buying back shares

VFC reported that Q2FY2022 Revenue from continuing operations increased 23% to $3.2B YoY. Active segment revenue increased 16% including an 8% increase in Vans® brand revenue and an 8% revenue growth contribution from acquisitions. Gross margin increased 290 basis points to 53.7%, primarily driven by reduced promotional activity. Inventories were up 2% compared with the same period last year. During the quarter, VF returned approximately $192M of cash to shareholders through dividends. VF is reinstating its share repurchase program, under which it is authorized to repurchase up to $2.8B of its common stock.

Visa generously rewards shareholders

Visa’s Q4 results point to recovery from the pandemic as payments volume, cross-border volume and processed transactions all increased from fiscal Q3 levels when indexed to 2019. Payments volume rose 17% Y/Y in constant dollars with cross-border volume up 38%, and processed transactions up 21%. Cross-border volume excluding transactions within Europe, which drive our international transaction revenues, increased 46% on a constant-dollar basis for the three months ended September 30, 2021. Total cross-border volume on a constant-dollar basis increased 38% in the quarter. Visa also increased its dividend by 17%.

My Entire Portfolio Updated for Q3 2021

Each quarter, we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of September 2021.

Download my portfolio Q3 2021 report.

Download my portfolio Q3 2021 report.

Dividend Income: $206.15 CAD (+201% vs September 2020)

It’s about time I recorded a stronger month for dividend payments. Since I’ve done some transactions, the order when I receive dividends has changed. While August and September were slower for the same reasons, October has now become a better dividend month with the addition of Algonquin’s dividend!

There is also the dividend paid by Intertape Polymer that landed in my account on October 1st instead of September last year. Finally, the exchange rate continues to impact negatively my total dividends received in CAD as the USD was up to $1.30 CAD last year vs $1.24 this year.

Here’s the detail of my dividend payments.

Dividend growth (over the past 12 months):

- Intertape Polymer: +10.6% (was paid in September last year)

- Andrew Peller: +14.3%

- Algonquin: new

- Gentex: +0%

- Conversion: -6.7%

Canadian Holding payouts: $171.22 CAD

- Intertape Polymer: $64.46

- Andrew Peller: $36.04

- Algonquin: $70.72

U.S. Holding payouts: $28.20 USD

- Gentex: $28.20

Total payouts: $206.15 CAD

*I used a USD/CAD conversion rate of 1.2387

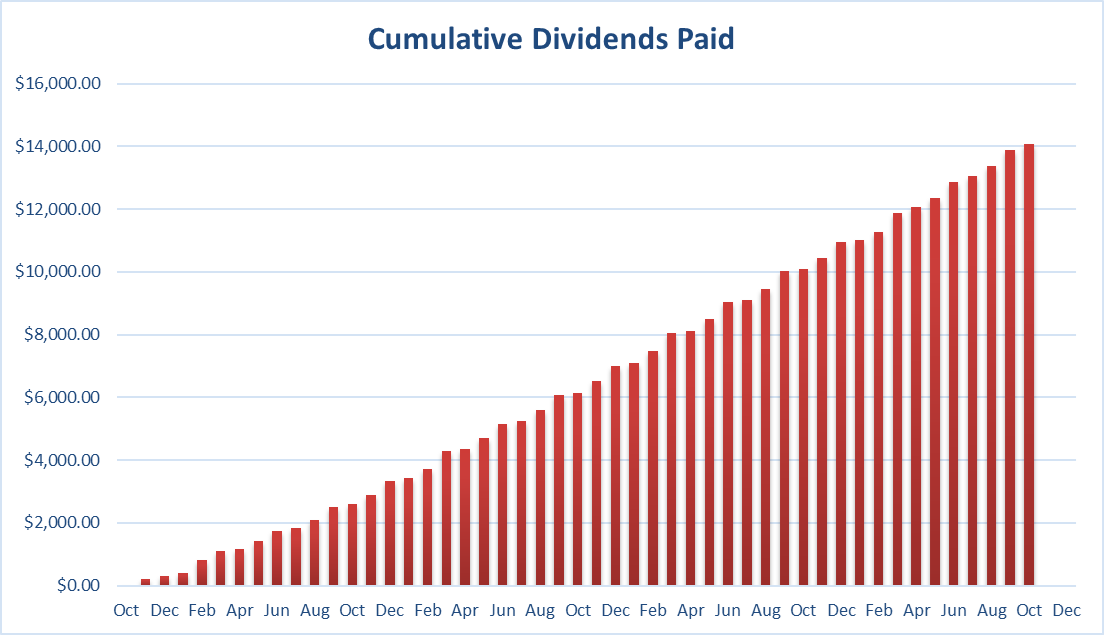

Since I started this portfolio in September 2017, I have received a total of $14,077.39 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added into this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital.

Final Thoughts

I have now two companies on my “potential sell list”. I’ll wait to see what happens with Andrew Peller’s latest quarter to decide if I keep this laggard in my portfolio. I’ll dig into the transcript as I want to see some acquisitions pipeline or any other growth vectors. Then, I’ll give myself a few weeks to consider selling Lazard. The company is in good shape, but the lack of dividend growth over the past two years has left me with a sour taste in my mouth. It could have been worse as I’m still showing a total return of 40% on this trade, but it could have been a lot better too! All that is to say that you never really rest when you manage your own portfolio!

And talking about Andrew Peller, here’s a video I did this week to explain why I kept it so far.

Cheers,

Mike.

The post Why I’m Considering Selling Lazard – October Income Report appeared first on The Dividend Guy Blog.