I’ll get to this chart in a moment, but first, I want to chat with you about a very important topic; stock valuation. It has struck me lately, regardless the company I look at, there is always an “expert” ready to tell me it’s overvalued. As an example, I recently bought shares of Texas Instruments (TXN) and wrote about it on Seeking Alpha. In this article, I used the Dividend Discount Model (DDM) and calculated a fair value at $113.25 while shares currently trade at in the low $90’s. This implies there is 20% margin of safety on this trade. This is based on my calculation and I’m not a gifted stock guru. I’m just an investor giving additional explanation about his latest move. I’m well aware that Morning Star values TXN at $78 and CFRA values it at $81.40. So… who am I to tell highly paid CFA’s that they are wrong? In fact, I’m nobody… but the best part, is that they are nobody too!

The Market is Overvalued – Been There, Done That

One of the reasons I decided to work in the financial industry is that I find investors behaviors fascinating. If you listen to anybody, the market is always on a verge of a crash. And when we are in the middle of the storm; this time is different and there won’t be a strong come back. In other words; this is always a bad timing to invest. There are also those so-called “I told you so” that are calling for the Black Swan for years and when it happens, well… they claim they have been right! This reminds me of gamblers in a casino who always bet on “red”… they are always right… at one point!

I’ve been doing some studies across many investing articles. Everybody is unanimous; the market will fall big time (many say by 50%). Take a look at some of my favorite quotes from reputable sites:

“Of course, with stocks at all-time highs, some seem to have nowhere to go but down.”

- Business Insider

“At ValuEngine.com we show that 77.8% of all stocks are overvalued, 45.2% by 20% or more. All 16 sectors are overvalued; consumer staples by 17.6%, retail-wholesale by 26.4% and utilities by 9.8%.”

- Forbes

“The market has jumped nearly 30%. This means the stock market’s rally has been based solely on people paying more money for the same amount of earnings — this is known as “P/E multiple expansion.”

- Motley Fool

“There are three basic reasons I keep warning you that I think future stock performance will be lousy:

Stocks are very expensive.

Corporate profit margins are still near record highs.

The Fed is now tightening.”

- Business Insider

Yeah… that is quite scary. But I forgot to mention something; those quotes are taken from articles dated 2013 and 2014.

Source: Ycharts

But a few journalists could have been wrong…

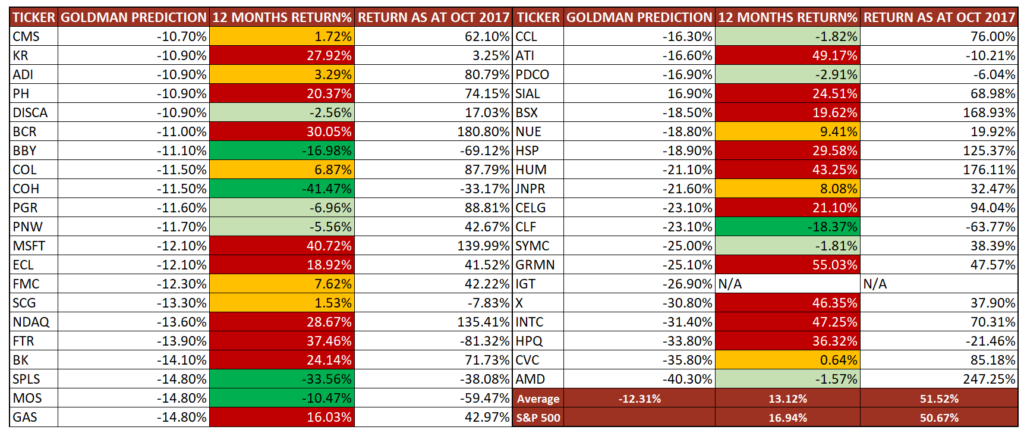

If you read those articles, you will notice some are nuanced and don’t necessarily call for panic. However, they were all wrong in the first place. I went a little bit further and look at the work of “real analysts”. You know, those who get paid hundreds of thousands (when it’s not millions) to make strong analysis? I’ve picked an article from Business Insider highlighting the top 40 overpriced stocks back in 2013 according to Goldman. Since I have lots of time in hand, I decided to take a closer look to the 40 companies with a double-digit downside according to a team of CFA’s and other experts valuation method. Unfortunately, IGT didn’t show proper data on the NYSE back in 2013 and I took it off the list. Then, you have 39 stocks in the following chart.

I’ve compiled their predictions, added the stock return 12 months after the article was written and add the stock return as at October 6th 2017. Since several stocks in this list don’t pay dividend, I discard this data and simply focus on stock value. Results are classified in 4 different colors:

- RED: They were dead wrong; the stock went up by double-digit growth rate (19 out of 39 = 48.7%)

- ORANGE: They were wrong; the stock went up by single digit growth rate (8 out of 39 = 20.5%)

- LIGHT GREEN: They were somewhat right; the stock went down by a single digit (7 out of 39 = 17.9%)

- DARK GREEN: They were right on spot; the stock went down by double-digit (5 out of 39 = 12.8%)

Here are the results:

Here are some funny facts about those predictions:

- This “portfolio” almost beat the S&P 500 following the next 12 months

- It did beat the S&P 500 as of October 6th 2017

- 18 out of 39 picks (46%) beat the market in the following 12 months

- Goldman analysts were wrong 69% of the time

- Their most overpriced stock (AMD) is also the one who skyrocketed the most (+247.25%)

I know, it’s easy to bash on selection that didn’t work out. Some will even tell me that sooner or later, those companies will drop like rocks. But my point is quite simple; valuation doesn’t matter; the market goes wherever it wants.

If CFA’s and other experts were wrong 69% of the time with their valuation, who are we to claim we have a better method?

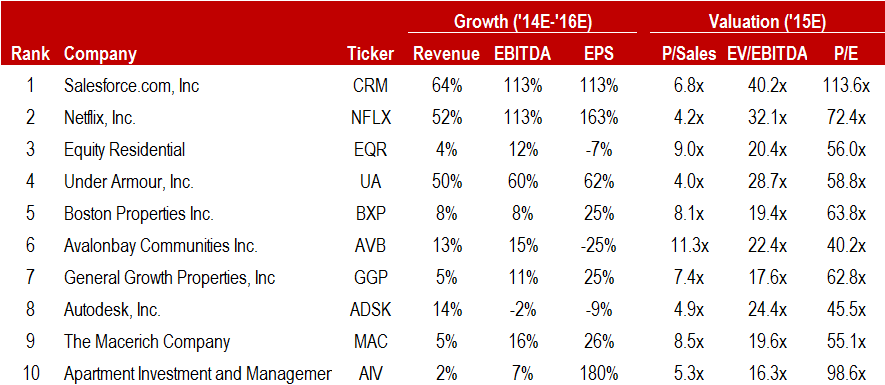

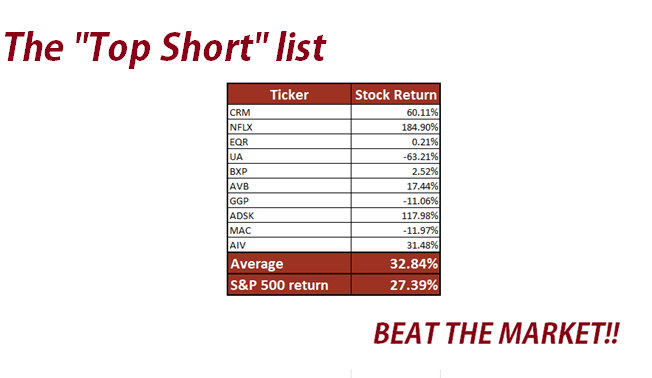

Sophisticated Valuation Methods Aren’t Better

During this research on the web, I’ve found a very interesting article about stocks that are not only overpriced, but that should be on a short list. This means you should sell those stocks on the market and buy them back once the price dropped. I don’t mean to bash on the author, but he mentions this list was based on a sophisticated quantitative model: “Apus Investments’ Quant Model (“AIQ Model”) uses a proprietary system to identify stocks that are extreme outliers in their valuation relative to the mean of index constituents.” When you read the article, you think it makes sense. It is well written with explanations. Here’s the list:

And here are the results:

Darn! The short list did BETTER than the S&P 500. I guess the worst part of this list is the only “good” idea was shorting UA. Two picks could have completely destroyed your portfolio (imaging shorting NFLX???).

Your Valuation Should Be a Small part of Your Investment Process

I get it; we all want to find those magic hidden gem. I always feel good when I buy stocks that go up like crazy after I found an “undervalued” pick. But I’m no genius; I focus on strong companies. Sometimes, the market decides they were undervalued and push their stocks through the roof. Some other time, my picks go sideways for a while before showing some returns. And, rarely, but it happens, my investment thesis was wrong and the stock is down.

Valuation should only be a small part of your investment process. I have 7 dividend growth investing principles and only one refers to valuation. Most of them focus on fundamentals leading to dividend growth. You know why? Because dividend growth matters more than you think.

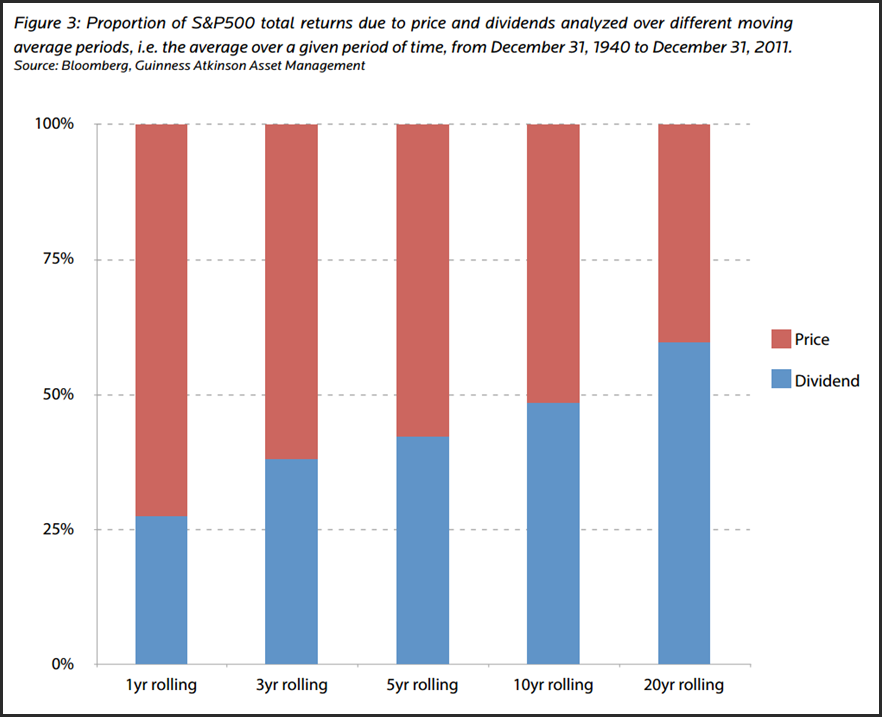

Dividends are responsible for over 50% of the market’s return

I’ve published this many times (notably here); dividends are a very important part of market’s total return. Here’s another graph showing you how dividends are important:

Source: Guru Focus

What this graph doesn’t tell you is that when the stock market is down; you are still cashing dividends. Today you have an important decision to make. Will you continue to be afraid of a big sell off on the market or will you continue investing in strong dividend growers?

Comments I read when I told you I was going to invest 100K in the current stock market was exactly the same feeling expressed in the articles mentioned in this posts. Many are convinced the stock market is overpriced and is about to collapse. Yeah well, it’s been since 2013 experts are telling the stock market is going to crash. Those who listened back then missed a growth opportunity of 75% plus dividend…

And even if the stock market goes down by 40% in 2018, your dividend won’t be cut by this much. In fact, chances are it will continue to increase. But instead of focusing on valuation, why don’t you focus on strong companies that won’t let you down? Here’s a great place to start with.