The stock market is trading at its highest level ever; valuation multiples are increasing, it almost smells like food burning in the oven if you ask the “Swan Fans”. I get the following question from my readers almost daily of late:

“I’ve an important sum of money sleeping in my cash account and I’m concerned about the current market. When is the right time to invest?”

Here’s my straight to the point answer:

The best time to invest was yesterday;

If you didn’t do it yesterday, then it’s today;

But the worst time to invest is definitely tomorrow.

The real problem is often not when to buy, but why you didn’t buy in the first place. And most of the time the answer you get is; oh, I bought already, but I got out X months ago thinking the market would crash. Well… no hurray for you, the market didn’t crash.

Never Get Out in the First Place

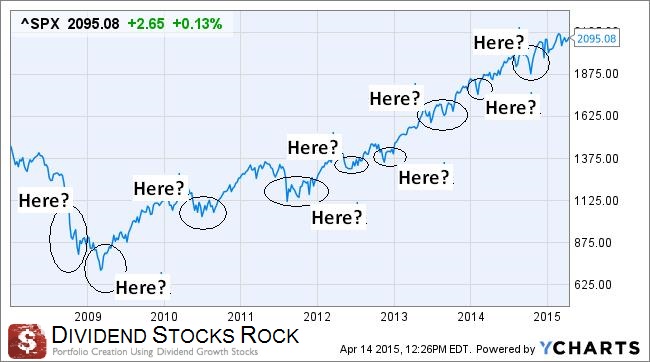

If there is one thing I’ve learned from investing through the past 12 years is that you can only make money on the stock market if you are in for the long term. If you get in and get out like you are playing hide & seek, you are pretty much playing roulette at the casino game and not investing. In fact, the market goes up and down so many times, it’s impossible to always be right. Because when you get out, you also have to get in at the right time in order to make money. I’ve pulled out the graph of the S&P 500 since January 2008 just to show you how many times one could get in or out:

The best move when you look at the graph was to sell your holdings on January 1st 2008 and then re-enter the market somewhere in March 2009 and then weather a series of ins and outs. But then, if you just passed by 2008 and entered the market in 2009, what do you do when the market looks like this in 2010?

Between April 22nd 2010 and July 1st, the S&P 500 lost 15%. It didn’t look that big on the previous chart, huh? But when you are in the middle of the mist, do you keep moving forward or do you sell? And the obvious question when you simply slide dates on a historic graph is this:

From July 1st 2010 until the end of the year, the market bounced back by 22%. I’ll save you from another graph, but what you need to remember is this:

While the market tumbled by 15% from April 22nd 2010 to July 1st 2010, it did +4.05% from Aprils 22nd to December 31st 2010.

And I exclude dividend payments in the process! I think this is the most important argument when you think of selling your holdings: by selling your holdings, you say “adios” to many dividend payments on top of potential stock appreciation.

As a dividend investor, I’ve developed the 7 investing principles I use to succeed. Investing principle #5 is “Buy when you have money in hand”. I think the previous graphs show why I’ve included this principle in my investment process.

But You Did, So What’s Left to do?

All right, what is done is done and it is certainly not the right time to bang your head on the wall. It’s time to get back to work and make another watch list. The market has gone up; it doesn’t mean everything is overpriced…. And it doesn’t mean you should buy everything on the street either. Where can you start? I have a few options for you:

#1 Best 2015 Dividend Stocks eBook

At the beginning of each year, I make a list of 20 US and 10 CDN dividend stocks that I believe will do well during the next 12 months. My latest list beat both benchmarks (US and Canadian) after the first quarter. You can read more about my performance here.

#2 Mike’s Buy List

Since I keep getting asked which stocks to buy at the right moment, I decided to build my own “buy list” that is based on my 7 dividend investing principles. These are companies that either trade at a discount or show a great future potential. You can read more about how I build this list that I follow monthly for my Dividend Stocks Rock members.

#3 DSR Real-Time Portfolios

My members benefit from a total of 12 real-time portfolios that are built according to 4 different sizes, two different investing profile (conservative and growth) and two countries (US and Canadian). This is also a good place to start if you are looking to build a portfolio. You can see our performance here.

I think you’ve got the idea overall; start investing today because you will keep missing opportunities if you don’t.

The Market is high… really?

Many people tell me the market is high… read overpriced. I tend to agree that there is a general buzz of optimism. Both JP Morgan (JPM) and BlackRock (BLK) CEO wrote letters to their shareholders earlier in April saying companies in general were too generous to investors. Both CEOs are afraid that many public companies are too focused on their stock repurchase programs and dividend increases. I saw this trend over the past 2-3 years as many companies proudly report how many billions they have returned to investors each year. This contributes to inflating some stock prices and Swan Fans are jumping on the bandwagon. Here’s what I’ve shared with my DSR members at the beginning of April:

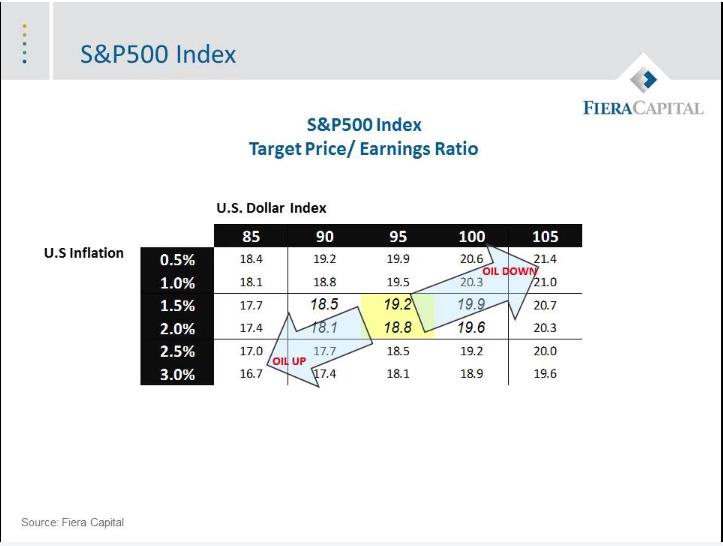

I found this very interesting chart on Fiera Capital’s website:

You can find the rest of the explanation on the Fiera Capital website.

This explains why the S&P 500 PE ratio is historically valued considering inflation in the US and the US dollar index. As inflation rises, a smaller multiple is used. As the dollar value increases, a higher multiplier is used. Currently the PE stands in an acceptable zone of 18.8 to 19.2. Now, let’s take a look at the overall S&P 500 metrics.

As you can see, the S&P 500 P/E ratio (green line) hasn’t moved that much since its drop in 2010. We can see a stable uptrend since 2012 which almost matches the earnings uptrend as well. The current P/E ratio stands at 18.6 and we should be in a zone of 18.8-19.2 according to Fiera Capital’s research. This tells me we are not overpriced… but we are not undervalued either. This is why it becomes crucial to buy the right companies at the right price. Buying stocks on hype could hurt your portfolio for several years.

Now clearly, this is how I would do it if I were you

I think I’ve thrown enough financial theory, historical proof and real-life examples that you should seriously think to start buying stocks if you are sitting on cash. Plus, keep in mind that each month you are out of the market, you also miss out on the dividend checks!

If I had let’s say 50K or 100K sitting in my cash account earning a mediocre 1% interest rate, I would do the following in this order:

#1 Make a watch list

I would run my stock screener and start by identifying a potential 20 interesting stocks at the moment. I would not go higher than 20, probably even closer to 15 if possible. I believe the market will continue to be good but that’s not a reason to buy everything that is on the market.

#2 Determine the best value

I would put the 15-20 stocks in order from the most interesting stock (showing the best growth potential) to the least. Then, I would build a virtual portfolio according to sector (don’t pick your top 3 selections if they are in the same industry!).

#3 Start buying each month

If you’ve been waiting on the sidelines for the past 12-18 months, it’s not another month that would burn you. Try to inject your money into the market over a period of 3-4 months. This is enough time for you to correctly analyze each company on your list and feel comfortable buying them. Doing everything in a rush may push you to make bad transaction while waiting another 12 months to invest all your money will definitely increase the chance of doubting your decision to the point of not taking one.

#4 Revise quarterly

This is what I do to manage my existing holdings. After each earnings season, I review my positions and checkout the latest financial statements. This gives me an idea where the company is going and if the stock deserves to be part of my book or not.

Did I tell you to buy right away?

To finish up, if there is one piece of advice I have for you is to never leave money on the sideline. You are better off being paid to wait by receiving dividend payments than trying to find the perfect moment to leave the market and to come back later before it’s too late. What do you think? Are you going to invest now?