Each month, we issue The Mike’s Buy List for our DSR members. They get our best ideas for both U.S. and Canadian dividend stocks. The first Friday of each month, they receive our top 10 growth and top 10 retirement (yield over 4%+) investment ideas.

With more earnings reports coming in, we have seen a few winners emerging from the buy list and we believe there is still money to be made with those picks. Today, we’ll cover two growth stocks and I’ll share two companies to consider for your retirement next time.

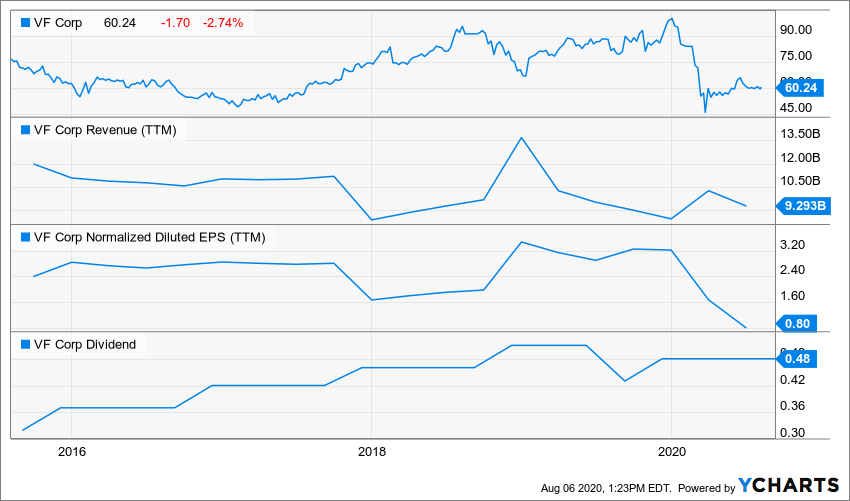

VF Corporation (VFC)

What’s the story?

Once again, analysts were expecting catastrophic numbers and they were right. VFC, however, did better than expected. With sales down 53%, their major brands like Vans (-52%) and The North Face (-45%) are representative of what is going on. Revenue segment wise: active -54%, outdoor -44%, work -19%. Direct-to-consumer revenue -37%, digital revenue +78%. Management is looking toward the future with 75% of stores open in North America and 90% in Europe, the Middle East and Africa. Management now expects digital sales to represent more than 25% of its business in 2021.

VF ended the first quarter of fiscal 2021 with inventories up 2 percent and approximately $2.8 billion of cash and short-term investments in addition to $2.23 billion remaining under VF’s revolving credit facility. The company suspended its share repurchase program, but kept its dividend intact.

Business Model

VF designs, produces, and distributes branded apparel and accessories. Its largest apparel categories include action sports, outdoor, and workwear. Its portfolio of about 20 brands includes Vans, The North Face, Timberland, and Dickies. VF markets its products in the Americas, Europe, and Asia-Pacific through wholesale to retailers, e-commerce, and branded stores owned by the company and partners. The company has grown through multiple acquisitions and dates back to 1899. While VFC has a growth-by-acquisition strategy, it is not afraid to sell brands not fitting its vision anymore.

Investment Thesis

How does a glove and mitten manufacturer become a world leading outdoor and action sports apparel company with over $12 billion in sales? We are talking about active brand portfolio management. In a world where fashion evolves at a rapid pace and where brand power means pricing power, VF Corporation cracked the code. In May 2019, VFC spun off its jeans brands into Kontoor (KTB). Kontoor Brands house the Wrangler, Lee and Rock & Republic denim brands. The company has built a serious brand with an incredible growth potential with Vans. We also like its focus on e-commerce and branded stores to avoid dependence on third-party retailers. It enables VF to control its brands and its message. The company will go through a rough period (2020 and 2021), but we expect the company to pursue further acquisitions at cheaper prices.

Potential Risks

VF showed it can manage its brand portfolio, but the fashion industry evolves fast. So far, management successfully maintained its brand power and expanded margin, but this could turn quickly. While the company is reducing its dependence on third-party retailers, many mass stores are selling VF product. The brick and mortar retail industry isn’t doing so well, and it could affect VF sales down the road. This phenomenon will accelerate amid the COVID-19 impact on the economy. Management expects to see sales down by ~50% in June 2020. This will be a difficult period, but VF manages strong brands that will survive. Shareholders must remain patient.

Dividend Growth Perspective

We believe the “new VF” (after it spins off its denim brands) will be in a good position to keep its dividend streak alive. VF still has plenty of room for future dividend growth. Expect high single digit raise for the next 10 years. While both companies intend to pay dividend, we will mostly stick with VFC as it shows better growth perspective.

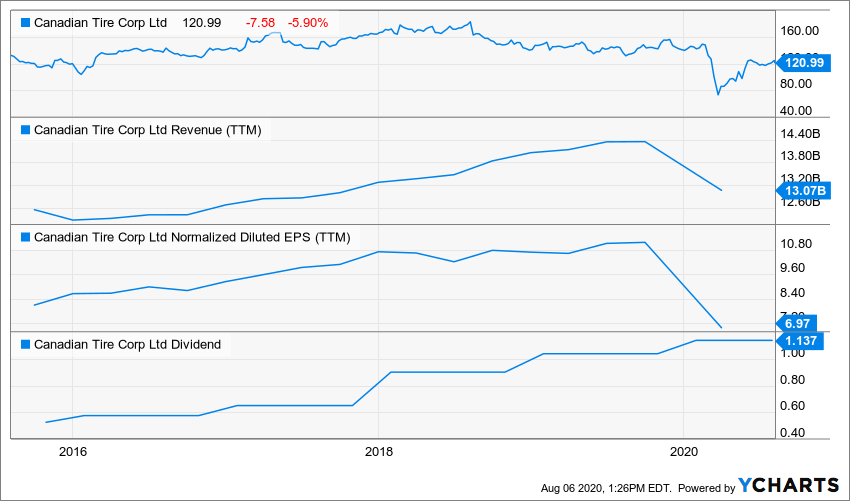

Canadian Tire (CTC.A.TO)

What’s the story?

Canadian Tire stores posted strong sales growth (+9.3%) while 80% of its total store network operating under closures and restrictions for much of the quarter. Digital sales surged by 400%. eCommerce demand peaked in April and May during store closures. In June, new heightened levels relative to pre-COVID activity were established. This tells you how people think about Canadian Tire even when they can’t go to the physical store. Overall revenue was down double-digit (-14%) because of store closures at SportChek, Mark’s and Helly Hansen.

Unfortunately, CTC declared a loss this quarter as the company spent $41.2M ($0.50 EPS) of additional operating expenses related to the COVID-19 (most of it going to enhanced security in their stores and increasing their employees paychecks.). Another $27.9M ($0.36 EPS) was generated by impairment costs related to Musto sailing brand and select SportChek stores. The company maintained its dividend for the quarter. You can sleep well.

Business Model

Canadian Tire sells home goods, sporting equipment, apparel, footwear, automotive parts and accessories, and vehicle fuel through a roughly 1,750-store network of company, dealer, and franchisee-operated locations across Canada. Aside from their namesake banner, stores operate primarily under the Mark’s, SportChek, Party City, Atmosphere, and PartSource monikers. The company acquired Helly Hansen, a Norwegian sportswear and workwear brand, in 2018. The firm also operates and holds majority ownership of a financing arm (Canadian Tire Financial Services; 20% owned by Scotiabank) and a REIT (CT REIT; Canadian Tire owns about 70%).

Investment Thesis

We think CTC enjoys unique brand recognition and has built a solid bond with Canadians. Through its private labels (MotoMaster, MasterCraft, etc.) it can compete against online retailers. The company is going to have a difficult year in 2020 amid the pandemic. On the other hand, this has pushed CTC to improve its ecommerce site since digital sales surged during the first half of 2020. As people will likely spend more time at home for their vacation, camping and sports gears should increase. Through its wide network, CTC is able to improve its online sale (with in-store pickups).

Potential Risks

One of the biggest risks for Canadian Tire is online shopping. Having exclusive products and a strong retail network is helping, but there is little that CTC could offer in-store or online that another Amazon of this world can’t compete with. CTC continues to be heavy in the old school & classic marketing methods (flyers, catalogs, etc.). While this seems to work for now, it could catch up to the company because baby boomers are aging. The temporary closure of many of its branded stores (SportChek, Mark’s and Helly Hansen) hurt sales in 2020. Finally, CTC is also financing a part of its customers through credit card purchases. This could blow back in their face in the event of a recession.

Dividend Growth Perspective

Canadian Tire has been successfully increasing its dividend since 2011. Since then, CTC’s stock price dropped in early 2020 which makes the stock yield very interesting. With its low payout ratio, CTC has enough room to stick to a generous course with shareholders. Due to its presence in the Canadian economy, CTC enjoys a steady cash flow growing quarterly. Shareholders can expect a high single-digit to double-digit dividend growth going forward.

Protect Your Portfolio Against Bears

I’m not the typical investor. I don’t pretend that my strategy is the best one and that anybody else should apply it to his/her portfolio. But, I like to share my thoughts on the matter and hope it will help you refine your strategy at the same time. There are three main “rules” I use when it comes to building a strong level of protection for my portfolio. I’ve shared them in my last income report. Hint: Offense is the best defense!

The post Two Dividend Growth Winners from My Monthly Buy List appeared first on The Dividend Guy Blog.