Earlier this week, I announced that I sold my position in Black Diamond. While their dividend wasn’t at risk, management decided to cut it by 38% to improve the company’s cash flow for the future. While I can appreciate why management took this decision, it goes against my 7 investing principles. This is not without any regret, but I’ve pulled the trigger on BDI.TO and quickly replaced the company by a stronger dividend payer.

I Bought 42 Shares of Canadian National Railway (CNR.TO) at $77.35

Canadian National Railway owns and operates the largest railway in Canada and also operates in the USA. The company’s transportation activities are well diversified among 7 different industries:

Petroleum & chemicals, metals & minerals, forest products, coal, grain & fertilizers, intermodal and automotive.

In other words; whatever needs transportation across a long distance, CNR has the knowledge and the capacity to do so.

I must admit CNR didn’t blink on my dashboard for a while because its dividend yield is relatively low. At a 1.62% yield, we can’t talk about a “strong” dividend payer. However, after digging further, I realize how strong the company’s fundamentals are. The company shows incredibly strong metrics:

5 year revenue growth of 11.22% CAGR

5 year EPS growth of 14.64% CAGR

5 years dividend growth of 15.40% CAGR

Very low payout ratio of 27.39%

So for those who will tell me CNR dividend yield is too low, imagine that if you had bought it 5 years ago, your dividend yield based on your cost of purchase would be 3.60% today:

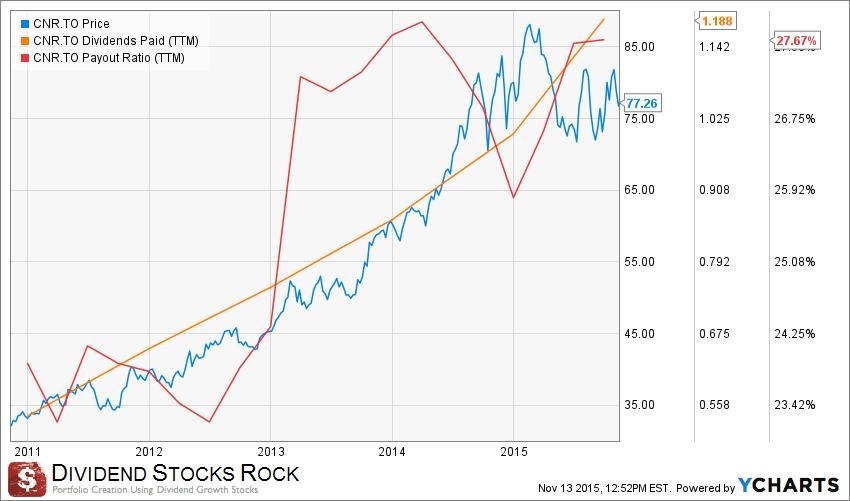

Such strong dividend growth rate usually comes at the expense of a higher payout ratio. As you can see, the company has maintained its payout ratio between 23% and 28% for the past 5 years.

I like the business structure as the company is built to generate a consistent cash flow:

The management team makes sure to use a good part of this cash flow to maintain and improve their railways (their biggest expense) at the same time as rewarding shareholders with generous dividend payments.

CNR has a very strong economic moat as railways are virtually impossible to replicate. Therefore, you can count on increasing cash flow coming in each year. Plus, there isn’t any better way to transport most commodities than by train.

Valuation

In order to determine CNR’s stock valuation, I use a double stage dividend discount model. This helps me attribute a fair value to the company considering its dividend growth capacity.

Since CNR evolves in a fairly stable and predictable market, I will use a discount rate of 9%. As for dividend growth, I use a 10% rate for the first 10 years and reduce it to 7% to be more conservative. The 10% dividend growth for the first 10 years seems aggressive at first, but considering the company increased it by 15% CAGR over the past 5 years, I think that using 10% for the first 10 years is a fair assessment:

According to my calculation, I bought the company with a 10% margin of safety (meaning the company’s intrinsic value should be around $85). This is a very good purchase considering the current market. In light of my analysis, I could say that the CNR dividend yield is low due to the strong interest from shareholders for such a well-managed company.

This holding will be part of my “core portfolio” and I intend to hold it for several years… if not forever!