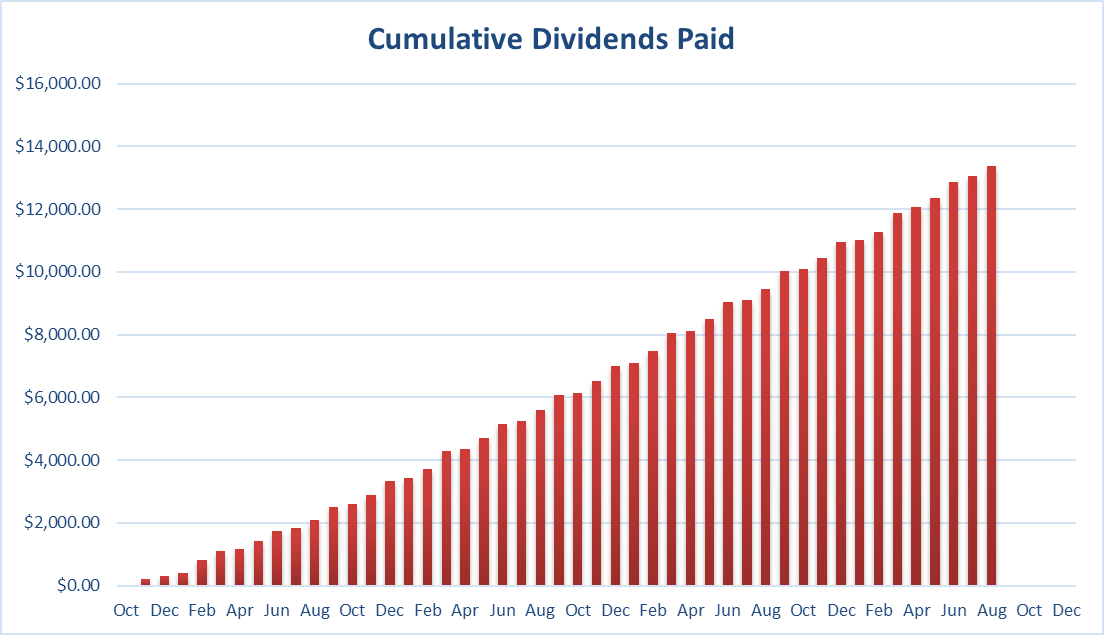

In September of 2017, I received slightly over $100K from my former employer which represented the commuted value of my pension plan. I decided to invest 100% of this money in dividend growth stocks.

Each month, I publish my results on those investments. I don’t do this to brag. I do this to show my readers that it is possible to build a lasting portfolio during all sorts of market conditions. The market will inevitably go down, as it did last year. But I continued to enjoy cashing consistent and growing dividends despite that negative market action! And, most importantly, I stayed fully invested in the market and have enjoyed the market recovery in 2020 that has continued into this new year of 2021.

As you know, I also take the opportunity during my monthly income report to add some relevant market commentary. This time, we’ll see how I doubled my money in 4 years!

Performance in Review

Let’s start with the numbers as of September 3rd 2021 (before market open):

Original amount invested in September 2017 (no capital added): $108,760.02.

- Portfolio value: $219,703.83

- Dividends paid: $3,913.50 (TTM)

- Average yield: 1.78%

- 2020 performance: +20.3%

- SPY=18.17%, XIU.TO = 5.27%

- Dividend growth: +7.7%

Total return since inception (Sep 2017- Sept 2021): 102%

Annualized return (since September 2017 – 48 months): 19.22%

SPDR® S&P 500 ETF Trust (SPY) annualized return (since Sept 2017): 18.43% (total return 96.73%)

iShares S&P/TSX 60 ETF (XIU.TO) annualized return (since Sept 2017): 12.10% (total return 57.91%)

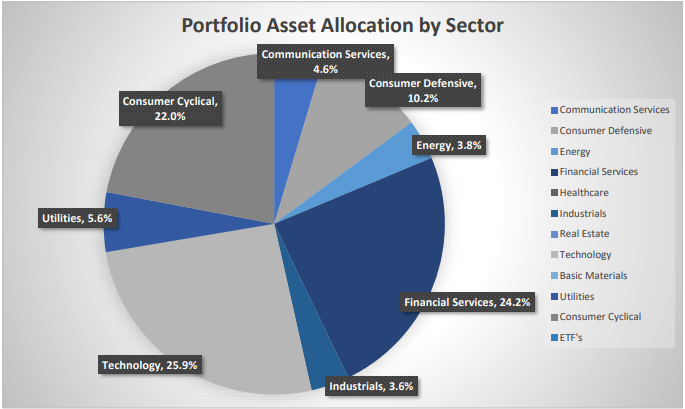

Sector allocation calculated by DSR PRO.

How to Double Your Money in 4 Years

Wow! That was quite a ride! In June 2016, I locked the door and jumped in my RV with my wife and three kids. After working for over a decade in the financial industry, I took a pause from private banking and decided to live my life more fully. In the corporate world language, “I took 26 years’ worth of vacation upfront”.

I came back to Canada in July of 2017. I officially quit my job and received a nice cheque for my pension plan value. The pension plan offered me the choice between having a $1,228.17 monthly pension cheque at the age of 65 or self-manage my LIRA valued at $108,760.02. I obviously took the latter. I received the cheque sometime in September 2017 and started investing that money over the following 3-4 months. By October of 2017 I had 75% of the money invested, and I completed my portfolio with late trades in December.

4 years later, I show a total portfolio value of $219,703.83 which is 102% more than the original amount. Again, I’m not writing this piece to brag. I report this update to show you that dividend growth investing works beautifully. I didn’t only beat the market, but my portfolio took a smaller hit during the market crashes. In 2018, my pension portfolio ended in positive territory and last year, the portfolio performed better than the market with a smaller drop in value and a much stronger recovery.

Why my dividend growth portfolio did better during market crashes?

The answer is quite simple: it’s related to factor investing. As per BlackRock’s definition, “Factors are the foundation of investing – broad, persistent drivers of returns across asset classes. Understand how factors work to better capture their potential for excess return and reduced risk, just as leading investors have done for decades.”

You guessed it as my main factor is dividend growth. By selecting dividend growers (regardless of their yield), I selected companies that:

- Are well-positioned in their market (1st or 2nd positions),

- Count multiple growth vectors (brand recognition, technology edge, R&D, unrivaled economies of scale, etc.),

- Have a robust balance sheet (debt is under control, access to more liquidity for growth, etc.),

- Are making money (strong cash flow generation, earnings growth, and healthy margins).

Now, how such companies could fail during a recession? They are likely the ones that will get stronger while others are struggling. In the past 18 months, we have seen multiple companies gaining market share, buying out competitors, offering new products. Those companies made a powerful comeback on the market and will continue to share the wealth with their shareholders for years to come.

Two other factors that helped me smooth market drops were my exposure to US stocks (currency went up big time during crashes) and the fact that I received dividends. While stock prices plummeted, dividend payments rarely stop coming in. This brings some peace of mind when you look at your portfolio weathering the storm.

Why my dividend growth portfolio doubled in 4 years?

To double your money within 4 years, one must get close to a 20% annualized return. Let me be forthright: such a return streak is unsustainable, and you should never write a financial plan that includes double-digit returns. As I mentioned at the beginning of this newsletter, the S&P 500 reported an annualized return of 18.43% and the TSX was at 12.10%. Therefore, the first step to double your money in 4 years is clearly to stay invested during bull markets. If I had only followed the market with a 50-50 asset allocation, I would have generated an annualized return of around 15% ((18.43 + 12.10)/2). That’s more than acceptable, but why did my portfolio grab an additional 4% each year?

The second reason my portfolio did so well is also in line with factor investing. As strong companies will do well during market crashes, they will likely do even better when the wind is pushing them to go faster. Therefore, dividend growers did an amazing job over the past 4 years.

Third, there is a lot of your stock return that will be explained by the sectors you invest in. I typically favor three sectors: technology, consumer cyclical and financial services. Lucky for me, all three performed exceptionally.

The technology sector is spreading its wings. The world can’t get enough from their smartphones, all devices speak to each other, and communication and productivity have been supported by new technologies. They generate strong cash flows, and they show double-digit growth potential for years to come.

The consumer cyclical sector always does well when consumers are happy. We live in a world where there are lots of jobs (read boomers are retiring leaving more jobs than we can fill), low-interest rates (you can borrow without getting squeezed) and e-commerce is exploding. Those who can adapt will be set for years to come.

The financial services led by Canadian banks have done incredibly well. Canadian banks are a no-brainer. Investing in the largest asset manager (BlackRock) should go accordingly. The quest for a comfortable retirement is an incredibly strong trend in the industry.

If I had decided to invest massively in the energy sector in 2017, I would have had a very hard time. Sectors you choose (make sure you understand each industry) will be a strong determinant in how much you make each year from the market.

Finally, the most important point: I’ve stuck to my strategy, and I’ve stayed invested. It’s like being a General Manager of a sports team; most of the best trades are the ones you will never make. I don’t go too fast in buying or selling stocks and I make sure I take my time to secure perspective on what is happening. If a stock drops by 20%, I don’t necessarily do anything. I simply look back at my investment thesis, I verify the fundamentals and I determine if the short-term fluctuation is due to market panic or because there is a major shift within the company business model or environment.

Let’s look at my CDN portfolio. Numbers are as of September 3rd, 2021 (before the bell):

Canadian Portfolio (CAD)

| Company Name | Ticker | Market Value |

| Algonquin Power & Utilities | AQN.TO | 6,668.13 |

| Alimentation Couche-Tard | ATD.B.TO | 18,395.16 |

| Andrew Peller | ADW.A.TO | 5,162.66 |

| National Bank | NA.TO | 7,884.80 |

| Royal Bank | RY.TO | 7,779.00 |

| Brookfield Renewable | BEPC.TO | 1,245.20 |

| CAE | CAE.TO | 7,726.00 |

| Enbridge | ENB.TO | 8,043.56 |

| Fortis | FTS.TO | 5,746.95 |

| Intertape Polymer | ITP.TO | 9,156.00 |

| Magna International | MG.TO | 7,070.00 |

| Sylogist | SYZ.TO | 4,607.85 |

| Cash | 368.09 | |

| Total | $89,854.10 |

My account shows a variation of +$1,216.13 (+1.37%) since the last income report on August 2nd. This month, many Canadian banks reported their earnings. I got some great news and some… well not so great! Here is the latest news.

Algonquin keeps investing for the future

Algonquin reported a strong quarter beating both EPS and revenue growth expectations. Results were supported by the 1,400 MW of renewable energy projects placed in service since August 2020 and the contributions from AQN’s recent acquisitions. AQN keeps investing in its business with a massive CAPEX plan. In the second quarter of 2021, the Regulated Services Group successfully completed the construction and acquisition of all wind facilities related to its inaugural ‘greening the fleet’ initiative (600 MWs of new wind energy generation). AQN also closed on the acquisition of a 51% interest in the West Raymond Wind Facility (240 MWs).

Alimentation Couche-Tard continued their good results

Couche-Tard did better than expected as total revenue surged by 40%. Most of it came from fuel sales increase (+63%) as merchandise and services revenue was up only 5.4%. Merchandise categories most impacted by COVID-19, such as food, continue to show a positive trend and, on a 2-year basis, convenience activities performed well in their global network. Fuel margins continue to be higher than pre-pandemic levels, while fuel volumes continue to be challenged by work from home trends and changes in local restrictions. ATD now has a share repurchase program allowing it to buy back 4% of its shares. It used $299M to buy shares last quarter.

I’m losing patience with Andrew Peller

Sales were down 6% vs 2020 and management explained favorable conditions in 2020 that pushed sales higher. However, 2021 sales are still lower compared to 2019 ($95M in June 2019 vs $92.4M in 2021). Earnings plummeted due to revenue declines in high margin trade channels, increased distribution costs, higher imported wine costs, and increased co-packing costs related to the Company’s new and growing refreshment beverage categories. Management expects margins to strengthen over the long term as the Company’s businesses return to more normal operations as the pandemic eases. At least, the dividend was increased by 10%. Let’s wait a little longer for this one to more fully play out.

National Bank is just my favorite bank, but I think you knew that.

NA reported another strong quarter and beat earnings expectations. The growth was driven by increases in total revenues across all the business segments and by lower provisions for credit losses. Property and Casualty Insurance (P&C) segment revenue was up 10% mostly due to growth in loan and deposit volumes that was strong enough to compensate for weaker interest rates. Wealth Management revenue grew by 21% and was driven by growth in fee-based revenues. Financial Markets net income grew by 21% driven by favorable markets. The Net income for the US & International segment surged by 85%, mostly due to a decrease in provisions for credit losses for Credigy. We now just wait for the inevitable dividend increase!

Royal Bank is one of the strongest Canadian banks

RY came in strong this quarter with EPS up 35%. Earnings growth was supported by higher results in Personal & Commercial Banking, Capital Markets, Wealth Management, and Insurance. These results were partially offset by lower earnings in Investor & Treasury Services. P&C saw its net income surged by 55%, mostly driven by smaller provisions for credit losses and strong volume growth of 9% (+10% in deposits and +8% in loans). Like NA, RY’s Wealth Management net income surged 31% on higher average fee-based client assets. Insurance net income was up 8%, Investor and Treasury services were up 16% and Capital markets increased 19%.

Brookfield Renewable is ahead of expectations

Brookfield Renewable reported a good quarter with FFO per unit up by 23% and beat revenue growth expectations at +8%. Results were supported by a high level of asset availability and acquisitions. BEP signed 28 agreements for approximately 800 GWh of renewable generation with corporate off-takers across all major industries. It is also working on 7,500 megawatts of development projects through construction and advanced stage permitting. The company is always ready for more projects and acquisitions with almost $3.3B of available liquidity. You can now add this one to your portfolio with a 3% yield as a major bonus!

CAE’s future is looking bright

CAE is emerging from the effects of the pandemic, but results weren’t positive enough to make the market smile. Revenue is up 37% vs last year, but CAE still lags vs its 2019 numbers (down 9% vs 2019). Management is quite optimistic for 2022 as CAE has inked many deals and continues to work on acquisition integration. During the quarter, Civil signed training solutions contracts valued at $338.1M, including contracts for five full-flight simulators (FFSs) sales. Civil also made progress in the Advanced Air Mobility market with its being selected by Jaunt Air Mobility. CAE has also announced a $1B five-year research and development program. The money will be invested in new technology development, immersive solutions, and AI.

Enbridge has plenty of cash flowing in

Enbridge reported solid results with distributable cash flow per share up by 4.1%. This leads to a DCF payout ratio of 67.3% for this quarter. Management is confident for the following quarters and reaffirmed their guidance to generate 5-7% distributable cash flow growth through 2023. This means more dividend increases for the future. Construction of the final leg of the U.S. Line 3 Replacement Project is progressing on schedule with an expected fourth-quarter in-service date. This is great news considering everything that has happened around Line 5 since the beginning of the year. ENB continues to progress with the Tunnel Project for Line 5.

Fortis is boring, but it is on track!

FTS reported a small earnings decrease this quarter. The decrease was mainly due to a lower US-to-Canadian dollar exchange rate, resulting in a $24 million unfavorable variance compared to the same period in 2020. Fortis achieved a 15% reduction in Scope 1 emissions in 2020 compared to 2019, equivalent to taking 400,000 vehicles off the road in one year. The 2021 $3.8 billion capital plan is on track with $1.7 billion invested during the first six months. Higher forecast capital expenditures for the year are expected to offset the impact of lower foreign exchange rates.

Intertape Polymer raised its dividend!

Intertape reported impressive revenue growth this quarter. Sales were up 41%, due to organic growth in a certain film, woven, and tape products, including continued strength in products with significant e-commerce end-market exposure such as water-activated tape and dispensing machines. Earnings were down slightly (-4%) due to the weaker USD, a one-time gain from 2020, and an increase in finance costs mainly due to the 2018 Senior Unsecured Notes Redemption Charges. Management increased its 2021 guidance with stronger revenues and earnings expectations. Finally, ITP increased its dividend by 7.9%!

Magna International will be affected by the chip shortage

Magna International reported solid growth, but that was mostly related to the lockdown that happened in 2020. The second quarter of 2020 included unprecedented industry-wide production suspensions due to the COVID-19 pandemic, while the second quarter of 2021 included the production disruptions due to the ongoing global semiconductor chip shortage, making the quarters difficult to compare. Unfortunately, the chip shortage will continue to have an impact on Magna’s results for the rest of the year. However, the company raised the FY2021 total Sales outlook to $40.2B – $41.8B from the previous projection of $38B – $39.5B.

Sylogist was a major disappointment

Sylogist dropped a bomb of disappointment this quarter. Earnings dropped by 50% and revenue lagged as well. The earnings decrease was due mainly to the employee bonus accrual, increased general and administrative expenses and lower revenues. This was combined with an increase in amortization of intangible and Right of Use (“ROU”) assets due to the intangible assets assumed in the MAS acquisition. Management mentioned covid slowed down the talk for new contracts, but the deal pipeline is getting better now. SYZ ended the quarter with $22M in cash and $56M available on their line of credit. SYZ expects sales to return to growth mode for Q4.

I received many emails from worried readers about the stock, so I’ve decided to create a video to answer your questions and deep dive into Sylogist’s quarter.

Here’s my US portfolio now. Numbers are as of September 3rd, 2021 (before the bell):

U.S. Portfolio (USD)

| Company Name | Ticker | Market Value |

| Apple | AAPL | 14,750.40 |

| BlackRock | BLK | 13,309.38 |

| Disney | DIS | 8,183.70 |

| Gentex | GNTX | 7,301.45 |

| Lazard | LAZ | 4,973.52 |

| Microsoft | MSFT | 18,069.00 |

| Starbucks | SBUX | 9,976.45 |

| Texas Instruments | TXN | 9,470.50 |

| VF Corporation | VFC | 6,142.23 |

| Visa | V | 11,209.00 |

| Cash | 203.13 | |

| Total | $103,588.76 | |

The US total value account shows a variation of $1,897.78 (+1.87%) since the last income report on August 2nd. Overall, the U.S. market continues to roll on down the highway. Each month is a new record, and we simply ride the wave. At some point, stocks will take a hit and the market will crash. I don’t really mind as I’m comfortable with my holdings right now. They will continue to pay me well during a bear market.

My Entire Portfolio Updated for Q2 2021

Each quarter, we run an exclusive report for Dividend Stocks Rock (DSR) members who subscribe to our very special additional service called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF showing all the information about all my holdings. Results have been updated as of June 2021.

Download my portfolio Q2 2021 report.

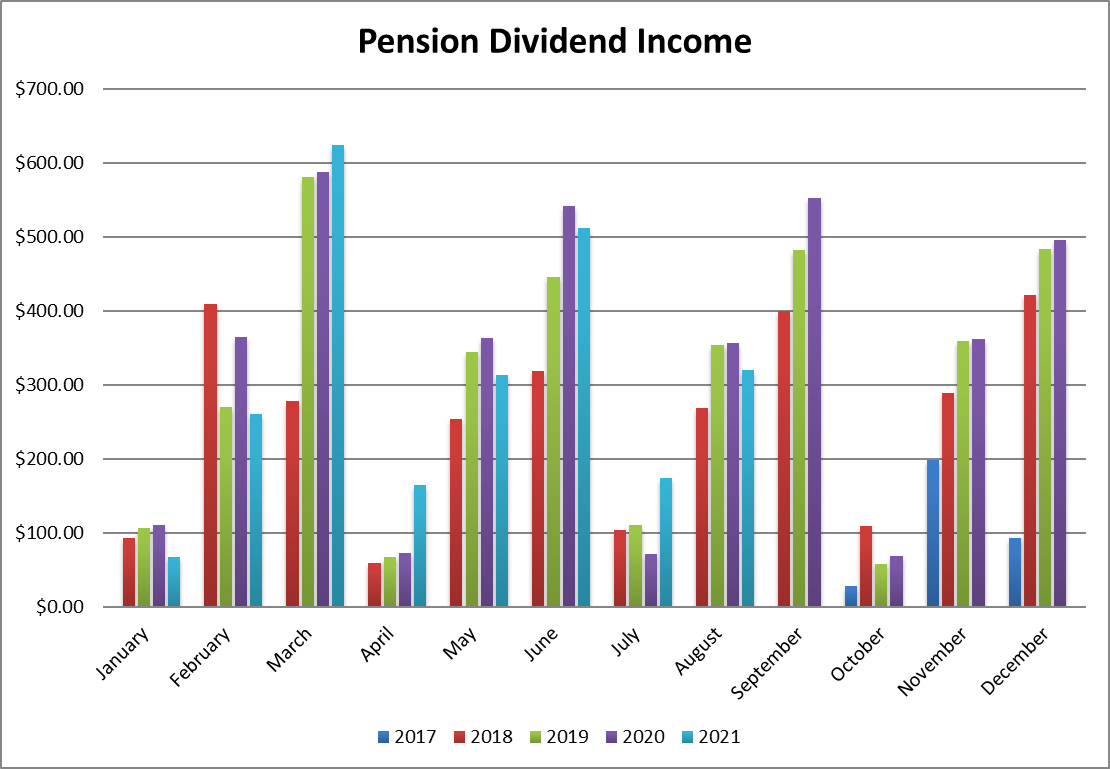

Dividend Income: $320.04 CAD (-10.1% vs August 2020)

This month’s total dividends are weaker vs August 2020, mainly for two reasons. #1 Last year, I had Hasbro (HAS) in my portfolio which paid $31.28 USD (or $41.04 CAD using last year’s conversion rate). #2 The US vs CAD conversion rate has changed a lot from $1.3122 last year to $1.2535 this year. Therefore, I’m losing 6% on all my USD dividends vs last year. It’s a good thing I have a USD account and keep that money in its original currency.

Canadian banks can’t increase their dividend yet, therefore, National Bank and Royal Bank are not allowed to write more generous checks. I have Lazard on my watch list lately as the company has not increased its dividend since 2019. I understand that 2020 was a unique situation, but if the company doesn’t increase its dividend soon, I’ll get rid of it and move on. After all, 2021 has been a flourishing year for asset managers and Lazard benefited from strong merger & acquisition activities. It’s time they pay back shareholders for their patience.

Here’s the detail of my dividend payments.

Dividend growth (over the past 12 months):

- National Bank: 0% (Thank you Office of the Superintendent of Financial Institutions (OSFI)!)

- Royal Bank: 0% (Thank you OSFI!)

- Texas Instruments: +13.33%

- Apple: +7.3%

- Lazard: 0% (red flag!)

- Starbucks: +9.8%

Canadian Holding payouts: $121.60 CAD

- National Bank: $56.80

- Royal Bank: $64.80

U.S. Holding payouts: $158.31 USD

- Texas Instruments: $51.00

- Apple: $21.12

- Lazard: $47.94

- Starbucks: $38.25

Total payouts: $320.04 CAD

*I used a USD/CAD conversion rate of 1.2535

Since I started this portfolio in September 2017, I have received a total of $13,372.56 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added into this account other than retained and/or reinvested dividends. Therefore, all dividend growth is coming from the stocks and not from any additional capital.

Final Thoughts

Investing for the long term doesn’t mean that you can’t or won’t adjust your portfolio periodically. Unfortunately, what is true today may be completely different in a year from now. Overall, most of my companies have stuck to my investment thesis and that explains why my portfolio has doubled in value over the past 4 years. However, I have two laggards in my portfolio. Andrew Peller keeps disappointing with mediocre growth, but it has been saved so far for its steady dividend growth policy. Lazard has been performing well (especially since the latest run) but failed to meet dividend triangle minimum requirements (consistent dividend increases). I’ve learned to not jump the gun too quickly, but both companies are definitely on the top of my watch list right now and our patience is running a bit thin.

Cheers,

Mike.

The post From 108K to 219K in 4 Years: 102% Total Return in 4 years – August Dividend Income Report appeared first on The Dividend Guy Blog.