In September 2017, I received slightly over $100K as a result of the commuted value of my pension plan. I decided to invest 100% of this money into dividend growth stocks. Each month, I publish my results. I don’t do this to brag, I do this to show you it’s possible to build a portfolio during an all-time high market. The market will crash… eventually. In the meantime, I’d rather cash some juicy dividends!

Going to Vietnam

This is the first article I write while I’m traveling through Vietnam. I’ll be covering the stock market with a 12-hour time zone difference for the entire month of January. You can tell that life is hard…

More seriously, this got me thinking about a crucial concept for many investors: timing. When you think about it, each day, I will go to bed about one hour after the market opens. For a full month, I’ll always be one day late on the news. I will miss any big announcements and I’ll only be able to trade on them the day after… way too late to do anything.

But that doesn’t bother me at all. I have no intention of trading during that month in Vietnam. You know why? Because I follow my investing strategy no matter what happens.

You may argue: “But Mike, what if BlackRock posts disastrous results while you are away and the stock tank 20%?”.

- Will the dividend be cut I January? I highly doubt so since management increased it each year since 2010.

Between November and December 2019, all my holdings were carefully reviewed to make sure each company meets my investment thesis. I will do the same process in February-March once all companies declared their Q4 2019 earnings. In the meantime, I can enjoy my trip without looking at my portfolio a second.

Acting on recent fluctuations is never a good idea

When I’ll review my holdings, I will not see if they went up or down while I was away. This is irrelevant. It would be important if I was about to liquidate a good part of my portfolio for a specific project. Since this money is for my retirement (if I ever retire!), I don’t have to worry about any of this.

If I was retired, what would matter to me is the likelihood of a dividend cut in my portfolio. A bad quarter would not crush management’s dividend growth policy. Therefore, there is nothing to worry about short-term fluctuation.

Short-term price fluctuations are simply noise that will cloud your judgment. What matters is how much your portfolio generates dividends quarter after quarter. Hint; this number should always increase!

Numbers are as at January 3rd, 2020 (after the bell):

Canadian portfolio (CAD)

|

Company Name |

Ticker | Market Value |

| Alimentation Couche-Tard | ATD.B.TO | $7,205.08

|

| Andrew Peller | ADW.A.TO | $4,971.70 |

| National Bank | NA.TO | $5,729.60 |

| Royal Bank | RY.TO | $6,213.00 |

| CAE | CAE.TO | $6,902.00 |

| Enbridge | ENB.TO | $8,301.16 |

| Fortis | FTS.TO | $5,319.27 |

| Intertape Polymer | ITP.TO | $4,986.00 |

| Lassonde Industries | LAS.A.TO | $3,235.89 |

| Magna International | MG.TO | $5,044.20 |

| Sylogist | SYZ.V | $1,960.15 |

| Cash | $954.36 | |

| Total | $60,882.41 |

My account shows a variation of +$374.73 (+0.62%) since the last income report.

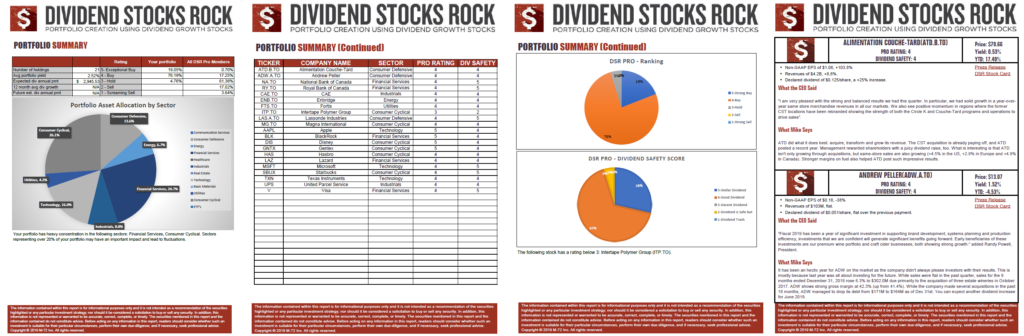

I’m slowly building cash in my Canadian account and I’m contemplating the possibility of adding ore shares of Sylogist to my portfolio. This is a new addition and I only have what some would call “a half position”. Most of my holdings weigh about 10% of my portfolio value while SYZ.V is only about 3%. I could improve by using dividend payment sitting in cash. I intend to keep all my other holdings for now. Many of my companies were highlighted by my DSR service as top picks for 2020:

Andrew Peller, Royal Bank and Fortis for best holdings overall.

Enbridge and Intertape Polymer of best retirement stocks.

CAE and Alimentation Couche-Tard for fast-growing stocks in 2020.

You can read about how I managed my portfolio as a Canadian (e.g. mixing both CDN and US investments): Investing the Canadian Way – Tricks I use to Boost My Returns. I discuss my sector allocation, how I manage currency fluctuations and my favorite sectors.

Numbers are as at January 3rd, 2020 (after the bell):

U.S. portfolio (USD)

| Company Name | Ticker | Market Value |

| Apple | AAPL | $9,310.85 |

| BlackRock | BLK | $7,125.72 |

| Disney | DIS | $6,669.00 |

| Garrett Motion | GTX | $29.55 |

| Gentex | GNTX | $6,923.10 |

| Hasbro | HAS | $4,845.18 |

| Lazard | LAZ | $4,157.52 |

| Microsoft | MSFT | $9,637.20 |

| Resideo Tech | REZI | $60.85 |

| Starbucks | SBUX | $7,594.75 |

| Texas Instruments | TXN | $6,478.50 |

| United Parcel Services | UPS | $4,321.23 |

| Visa | V | $9,556.00 |

| Cash | $698.53 | |

| Total | $77,407.98 |

The US total value account shows a variation of $3,741.22 (+5%) since the last income report.

I must admit that the success of my pension portfolio has been tied to my performance with the US market. While my performance in the Canadian market has been very good (still beating the market since September 2017), my US stocks have stolen the show with +11.27% in 2017 (Sept to Dec), 7.47% in 2018 and… 34.50% in 2019.

What I’m particularly proud of is the return achieved in 2018. It is one thing to ride a bull market (as they say: bull markets make geniuses everywhere!), but it is another to avoid double-digit market drops. To be fair, I must also declare that the USD to CAD jumped in value by 9% in 2018. Therefore, my return would have been -1.53% in neutral currency. However, I don’t mention that the same currency factor hurt my portfolio by 5% in 2019. As you can see, this comes and go ?.

Similar to my Canadian holdings, I show many US companies that were highlighted by Dividend Stocks Rock for 2020:

Hasbro for best holdings overall.

Enbridge and Intertape Polymer of best retirement stocks.

Microsoft, Disney, and Visa for fast-growing stocks in 2020.

Unfortunately, none of my holdings cut the best retirement stocks for 2020, but you can read the article anyway ?

My entire portfolio quarterly updated!

Each quarter, we run an exclusive report for Dividend Stocks Rock (DSR) members called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF giving all the information about all my holdings. Results have been updated as of December 2020.

Download my portfolio Q4 2019 report.

Dividend income: $483.14 CAD (+14.7%)

*I usually post my dividend income chart here, but I have forgotten to copy my data from my desktop (silly me!). It will be there for my January update! Still, it’s another good month with a double-digit dividend growth compared to last year!

Here is the dividend growth detailed. The growth is compared to December 2018 (not a necessarily a recent dividend increase):

- Fortis: $47.27 +6%

- Enbridge: $118.85 + 10%

- Magna Intl: $33.45 +9.4%

- Sylogist: $19.70 (new)

- Lassonde: $12.50 -26.5%

- Alimentation Couche-Tard: $10.75 +25%

- Intertape Polymer: $58.26 +4%

- CAE: $22.00 +20%

- Visa: $15.00 +20%

- UPS: $35.52 +5.5%

- Microsoft: $30.60 +10.9%

- BlackRock: $46.20 (new)

Canadian Holdings payouts: $317.78 CAD

- Fortis: $47.27

- Enbridge: $118.85

- Magna Intl: $33.45

- Sylogist: $19.70

- Lassonde: $12.50

- Alimentation Couche-Tard: $10.75

- Intertape Polymer: $58.26

- CAE: $22.00

U.S. Holding payouts: $127.32 USD

- Visa: $15.00

- UPS: $35.52

- Microsoft: $30.60

- BlackRock: $46.20

Total payouts: $483.14 CAD

*I used a USD/CAD conversion rate of 1.2988

Since I started this portfolio in September 2017, I have received a total of $6,506.18 CAD in dividend. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added int his account (it’s a LIRA). Therefore, all dividend growth is coming from stocks and not from additional capital.

Final thoughts

During my trip, I will not make any transactions as mentioned earlier. However, I will sell my few shares of Garrett Motion (GTX) and Resideo Technologies (REZI) as they were a result of a spin-off of Honeywell (HON), which I sold to buy BlackRock about a year ago. I will use the proceeds along with my dividends to buy more shares of Sylogist upon my return.

What about you? Are you planning any trades for January?

Read: 3 Red Flags Telling You It’s a Bad Dividend Stock

The post December Dividend Income Report – Going to Vietnam Edition appeared first on The Dividend Guy Blog.