Have you taken a look at my best 2019 dividend stock picks yet?

I have a tradition going on this blog (and now it’s at DSR) since 2012. During the month of November and December, I go on a long research journey to identify dividend stocks that show great short-term potential. The idea is to beat the market with these top picks for the next 12 months. I select my top 20 US stocks and top 10 Canadian holdings. DSR members get the list during December so they can get ready and pull the trigger before the New Year starts. Throughout the year, I post a few updates and share a few of those picks among my readers. So, here are some of my best 2019 dividend stock picks.

“You can decide to hide, and let your money sit in a cash account. The money will sleep well and so will you. It will also not work for you. It will not produce anything.”

Or…

“You can decide to seek out great companies instead. Dividend growers usually get out of a bear market faster than the rest of stocks.”

-DSR Premium December newsletter

I believe in transparency, do you?

I always thought that the financial world lacked of transparency. We read articles written by many financial journalists, many gurus (and clowns), many financial experts, many CFA’s, many bloggers, and they are all about giving us their wisdom and claim they “found the formula” to make money on the stock market. Unfortunately, most of them hide behind their theory and provide little to no transparency. I try to set myself apart from this group by being as transparent as I can (you can read my monthly portfolio review here).

This “best stock pick” tradition I started in 2012 is quite risky for my reputation. After all, the whole point of doing this is to show that my investing methodology could work even on a short-term basis. Since I invest for the long term, I don’t really mind what’s happening in my portfolio in the next 12 months. I’m well aware that short-term returns are meaningless and are closer to casino plays than investing.

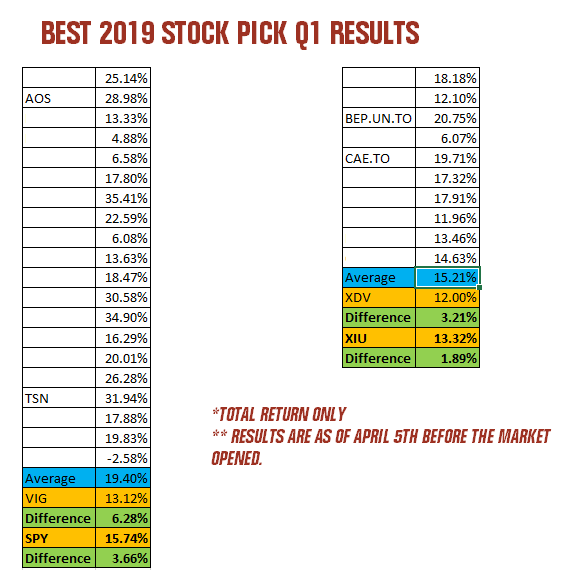

For this reason, I handpicked dividend growers that show short-term growth opportunity, but could also be great candidate in my portfolio for the next 10 years. Therefore, the short-term results are interesting, but keeping those growers for several years is the whole idea. Nevertheless, here are my Best 2019 Dividend Stock Results for this first quarter:

As you can see, my US average is a lot better than both my benchmark (Vanguard Dividend Appreciation ETF (VIG)) and the market (SPDR® S&P 500 ETF (SPY)). I crushed both by 6.28% and 3.66% respectively.

My Canadian average is not too, either. I beat my benchmark (iShares Canadian Select Dividend ETF (XDV.TO)) and the TSX (iShares S&P/TSX 60 ETF (XIU.TO)) by 3.21% and 1.89% respectively.

I know results could fluctuate a lot before we reach December 31st, but I’ll take the win with a smile for the first quarter!

Are you ready to learn more about AOS, TSN, BEP.UN.TO and CAE.TO?

But first, the process to find those gems

Wouldn’t it be nice if one could just pull out a stock screener with a few filters and select any stock from that list to be the best 2019 dividend holdings? Yeah…. I dreamt of that a while ago, and I’m not going to post my magic formula here… because it doesn’t exist!

I do use a stock screener with a few filters, however, but that’s just the very beginning of my research process. Since I prefer to dive deep inside each company before I make a decision, I’m not too picky with my filters. In general, I use something like this:

- Dividend yield between 2% and 5%

- 5 years revenue growth positive

- 5 years normalized EPS growth positive

- 5 years dividend growth positive

- Include PE ratio, payout ratio and cash payout ratio (no filter)

- I use Ycharts for all my data research

This filter helps me to get companies meeting my dividend triangle:

First, the company must make revenue. Without revenues, there is nothing, right? Then, those revenues must grow year after year to ensure the company’s sustainability.

Second, the company must be able to generate earnings from those revenues. Then again, if you are looking for dividend payment growth in the future, you need to see rising earnings as well.

Third, the company must pay an increasing dividend. If management is not on board with this policy, I quickly lose interest in the stock.

This list usually goes down to about 100 to 200 stocks (depending on how I adjust my screeners). Those are obviously not strong picks for the upcoming year. Then, I prioritize dividend growth metrics (I sometimes add 3-year and 1-year dividend growth metrics to make sure it’s stable) to start digging this list. Following my 7 dividend investing principles, I start to build my list for the upcoming year:

- Principle #1: High Dividend Yield Doesn’t Equal High Returns

- Principle #2: Focus on Dividend Growth

- Principle #3: Find Sustainable Dividend Growth Stocks

- Principle #4: A Strong Dividend Triangle Ensures Future Growth

- Principle #5: Buy When You Have Money in Hand – At the Right Valuation

- Principle #6: The Rationale Used to Buy is Also Used to Sell

- Principle #7: Think Core, Think Growth

If you were courageous enough to read my entire 7 dividend investing principles, you know that creating my Best 2019 dividend stock book isn’t something I do during a Sunday morning with *only* one cup of coffee. I need a whole carafe and several Sundays ?.

Now, let’s take a look at 4 stocks that have done very well since the beginning of the year.

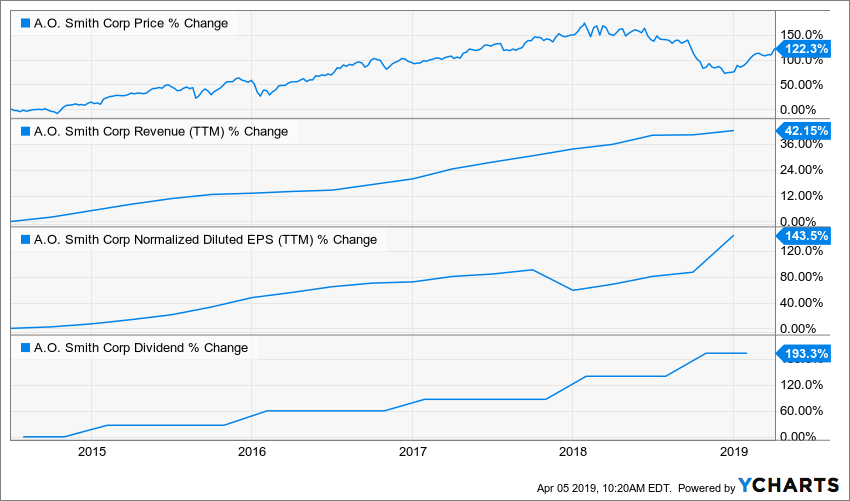

A.O. SMITH (AOS)

Business Model & Recent Comments

A. O. Smith is among the world leaders in the manufacture of residential and commercial water heaters and boilers. It offers products featuring the best-known brands in North America, China, and India, such as AO Smith, American Water Heaters and Aquasana. The company claims to have nearly 40% of the market share for the residential market in the U.S. The company founded in 1874 now employs about 16,100 workers in eight countries and operates sales and distribution in more than 60 countries around the world.

During their latest quarter, AOS posted double-digit EPS growth and a juicy dividend increase (+22%). Unfortunately, sales fell short in China, and the market is now actively discarding this stock from their portfolio. AOS continues its new partnership with Lowe’s and have now placed their water treatment systems in 1,700 Lowes stores. While management must address its absence of recent revenue growth, we were pleased with AOS’s cash flow improvement. The company generated $289M from their operations vs $150M last year.

Investment Thesis

Besides being a leader in its market, AOS shows several growth vectors. The company has used its strong North American position to expand into emerging markets where water heaters & boilers are growing in demand. AOS also sells reverse osmosis water treatment products. As technology evolves, reverse osmosis seems like the efficient and preferred way to treat heavy metals in water. China, India and water treatment segments (36% of sales) are their fastest growing opportunities.

Potential Risks

Some headwinds are coming ahead. The rise of raw material costs (such as steel) is affecting AOS’s profitability. Margins are thin in the “rest of the world” segment, showing roughly a 10% difference with North America. This has been a recurrent problem in recent years, and it means AOS’s earnings might not grow as fast as they have in the past. The whole “tariffs war” between the U.S. and China will definitely hurt AOS as sales are already slower in China.

Dividend Growth Perspective

AOS has increased its dividend for the past 12 consecutive years. It shows great dividend growth, but a low yield. The company is clearly focusing on R&D and growing its markets. With a payout ratio under 40%, the money is not going toward shareholders. Management thinks it can offer stronger share value appreciation for shareholders as opposed to a generous dividend yield. After reviewing its growth vectors, I tend to agree.

Valuation

Dividend Growth Rate Years 1-10: 8.00% Terminal Dividend Growth Rate: 6.00%

| Intrinsic Value | Discount Rate (Horizontal) | ||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $66.53 | $44.07 | $32.85 |

| 10% Premium | $60.98 | $40.40 | $30.11 |

| Intrinsic Value | $55.44 | $36.72 | $27.38 |

| 10% Discount | $49.90 | $33.05 | $24.64 |

| 20% Discount | $44.35 | $29.38 | $21.90 |

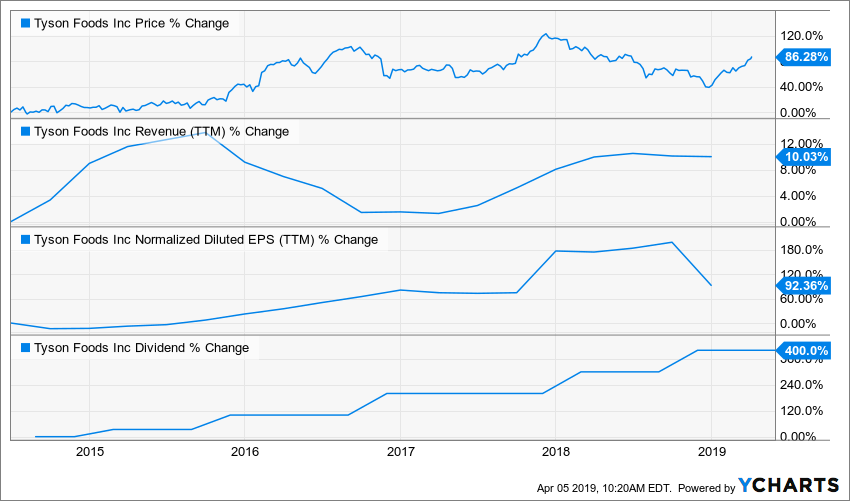

TYSON FOODS (TSN)

Business Model & Recent Comments

Founded in 1935, Tyson Foods is one of the largest protein food companies and is the U.S.’s largest chicken producer. From Arkansas, it now shows nearly $40 billion in protein food sales. TSN’s chickens are antibiotic-free and the company puts quality food (at least for a part of it!) on top of its priorities. TSN is highly focused on domestic U.S. sales with roughly 90% of its revenue coming from the U.S.

For their latest quarter, TSN posted another quarter with double-digit EPS growth, but disappointed the market with weak revenue growth and outlook. Tyson expects full-year revenue of $41B vs. $41.5B consensus, and full-year EPS of $5.75 to $6.10 vs. $6.21 consensus. Pork and Chicken prices hurt TSN’s business during this quarter while the beef segment didn’t save the day with only 3.4% volume growth. TSN counts on prepared food to boost its revenue going forward.

Investment Thesis

While most food packaging companies’ sales are stagnating, TSN is booming by selling what consumers want: more good quality protein. In fact, 54% of people look to add “Good sources of protein” to their diet. The demand for natural food increases and TSN can answer this strong trend. The interest in protein in Asian countries is rising and as the company only exports 10% of its food, Tyson expects to get a piece of that market. TSN should be able to increase its international segment with its quality and strong-brand portfolio. 2018 has been a difficult year for TSN as pork and beef suffered from lower prices. This price drop could be a great opportunity. TSN reminds us of what happened to Hormel Foods (HRL) not too long ago.

Potential Risks

Tyson doesn’t face many headwinds. However, the low cattle price affects the beef business. With roughly 40% of its sales, TSN’s beef business isn’t as profitable. Like Hormel Foods with turkey, TSN has a hard time generating strong margins (about 5%) from this segment. Low selling prices make consumers happy but leave little in Tyson’s pocket. It’s great that Tyson produces chicken without antibiotics. I’m all about health food. However, animal diseases can be serious. Cal-Maine cut its dividend due to the avian flu.

Dividend Growth Perspective

TSN has raised its payout for only 6 consecutive years, and its current yield is not very attractive. However, their growth pace is impressive. During the past 5 years, the dividend surged by 500%. Both payout and cash payout ratios are under 25%. The company counts on many growth vectors. Therefore, there is significant room for future increases. You can expect double-digit dividend growth for at least a decade.

Valuation

Dividend Growth Rate Years 1-10: 10.00% Terminal Dividend Growth Rate: 6.00%

| Intrinsic Value | Discount Rate (Horizontal) | ||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $134.55 | $88.62 | $65.70 |

| 10% Premium | $123.34 | $81.23 | $60.23 |

| Intrinsic Value | $112.13 | $73.85 | $54.75 |

| 10% Discount | $100.91 | $66.46 | $49.28 |

| 20% Discount | $89.70 | $59.08 | $43.80 |

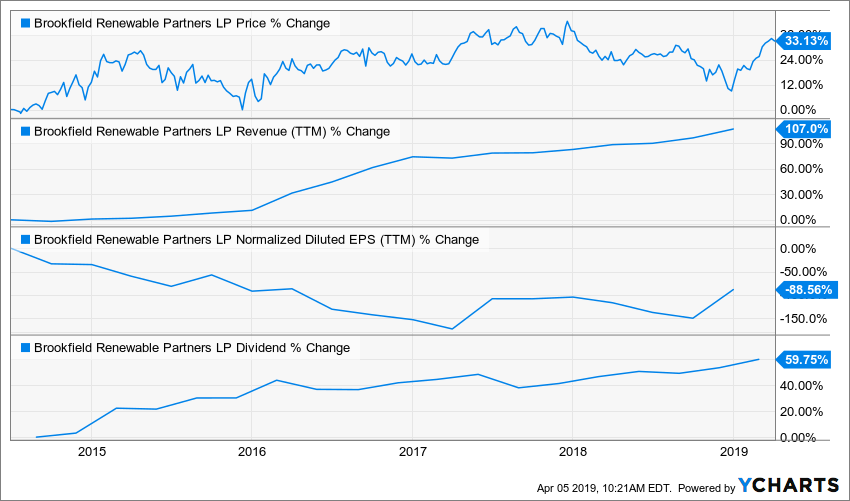

BROOKFIELD RENEWABLE PARTNERS (BEP.UN.TO / BEP)

Business Model & Recent Comments

The company is a rare pure play in the renewable energy sector. With over 2,000 employees, $27 billion in power assets and $285B in AUM, BEP is one of the largest players in this industry. The company manages over 264 facilities across 7 countries. About 90% of its power generation comes from hydroelectricity. Their goal is to “acquire renewable power assets and businesses at below intrinsic value, finance them on an investment grade basis, and optimize cash flow and value utilizing our depths of operating expertise,” says CEO Sachin Shah.

Management is currently raising capital through asset sales and debt. BEP has a plan to generate net proceeds of $850M and increase their total available liquidity to $2.3B. The hydroelectric segment contributed $104 million to FFO, the wind segment contributed $29 million to FFO, and the solar, storage and other segments contributed $42 million of FFO. The company will be ready to finance additional projects going forward.

Investment Thesis

The future of energy will be found across hydroelectric, solar, and wind power, and 80% of BEP’s portfolio is focused on hydroelectric power. The company has power plants across North America, South America, Europe, and Asia. BEP enjoys large scale capital and expertise to manage its projects across the world. Management aims at a 5-9% annual distribution increase for years to come. At the current price, BEP shows a strong upside potential along with a healthy dividend. What’s not to like?

Potential Risks

This kind of company grows mostly through leverage, so the debt level is always an issue. BEP shows nearly $11 billion in long-term debt. As interest rates rise, it will impact future profitability. The market’s appetite for additional debt may be limited in the future. BEP deals with large numbers as it is a capital-intensive industry. One mistake and the dividend growth policy may be in danger.

Dividend Growth Perspective

BEP shows a great dividend profile. The company maintains their liquidity (currently $1.7B) for future projects. Management was smart to benefit from a strong market to raise additional funding. After some variations, management was able to bring back their FFO payout ratio in line with their target (70%, was 74% during the summer of 2018). Shareholders can expect mid-single digit dividend growth rate going forward.

Valuation

Dividend Growth Rate Years 1-10: 6.00% Terminal Dividend Growth Rate: 5.00%

| Intrinsic Value | Discount Rate (Horizontal) | ||

| Margin of Safety | 9.00% | 10.00% | 11.00% |

| 20% Premium | $66.94 | $53.40 | $44.37 |

| 10% Premium | $61.36 | $48.95 | $40.68 |

| Intrinsic Value | $55.79 | $44.50* | $36.98 |

| 10% Discount | $50.21 | $40.05 | $33.28 |

| 20% Discount | $44.63 | $35.60 | $29.58 |

*Price is in USD

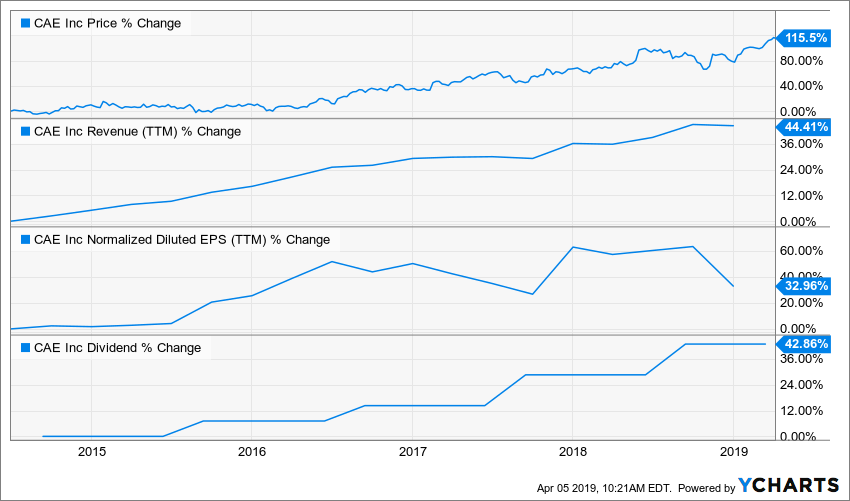

CAE (CAE.TO)

Business Model & Recent Comments

CAE is a world leader in simulation and training for the civil aviation and defense markets. The company has a global presence employing 8,000 people at 100+ sites in 30 countries. CAE is a leader in three business segments: Civil Aviation Training Solutions (58%) (commercial/business aviation, training equipment), Defense and Security (38%) (virtual and live training), Healthcare (4%) (patient simulation and training solutions).

Lately, CAE impressed the market with double-digit growth for both EPS and revenue. The company also more than doubled its free cash flow (from $63.5M to $137.7M). CAE shows order intake of $985.9M for a record $8.7B backlog. CAE also announced an agreement to acquire Bombardier Business Aircraft Training (BAT) for $645M. The acquisition will also serve to expand CAE’s position in the largest and fastest growing segment of the business aviation training market, involving medium- and large-cabin business jets.

Investment Thesis

CAE has developed a close relationship with many of its customers. The switching cost for them is relatively high as CAE clearly understands their needs and can improve/modify its training/simulation solutions to evolve with its customers. This creates a high recurring volume of business. With over 160 locations across 35 countries, CAE can meet any international clients’ demands. The company has shown steady growth over the past 5 years, and a record backlog in 2018. As the economy continues to grow, demand for commercial and business aviation will remain strong. Therefore, more training will be required.

Potential Risks

A recession could be a big hit for CAE. While its order book is currently filled, its clients may consider they don’t need as much training in the future and hold on this expense during challenging periods. CAE is also dependent to a lesser extent on military spending. If governments slow down their spending, CAE will also feel the cold air in the room.

Dividend Growth Perspective

From its past metrics, CAE is not a high yielding stock, but it is surely about dividend growth. The dividend payment nearly doubled in the past 5 years, and shareholders can expect additional strong hikes in the upcoming years. Considering numerous growth vectors, CAE should be able to maintain a double-digit dividend growth rate for the next decade.

Valuation

Dividend Growth Rate Years 1-10: 12.00% Terminal Dividend Growth Rate: 7.00%

| Intrinsic Value | Discount Rate (Horizontal) | ||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $79.78 | $39.28 | $25.81 |

| 10% Premium | $73.13 | $36.01 | $23.66 |

| Intrinsic Value | $66.48 | $32.73 | $21.51 |

| 10% Discount | $59.84 | $29.46 | $19.36 |

| 20% Discount | $53.19 | $26.19 | $17.20 |

You want more? How About getting your portfolio fit for summer?

If you want to learn more about how I select those companies or how to improve your own portfolio, I recently wrote an article about getting your portfolio ready for summer. As we sometimes forget to get in good physical shape, we also tend to forget our financial shape. Before summer hits and you go on vacation, it’s time to make sure your portfolio is in good shape. If you are willing to go the extra mile to have a beach body, you might as well go for your beach money! Here’s how to do it;

First, you must make sure you start with a clean portfolio (e.g. getting rid of all rotten apples in your basket). Then, you identify how you will build it up to make it in great shape again (picking up healthier food!). Finally, there are tricks to build a solid investment process to make sure your portfolio doesn’t get fat anymore. It’s all about healthy investing habits!

I’ll be hosting a webinar discussing these topics shortly. You can register for free here:

Register here (email required)

Topic: Portfolio Fitness: Clean your portfolios, Improve your returns, Avoid bad decisions.

Date: Thursday, April 11th at 1pm EDT

Description:

This webinar is for investors who wish to get their portfolio back in good shape. You either lost money during the last market correction or panicked and went cash.

How to you deploy your money now to benefit from the current market?

How do you decide if you should sell some of your holdings?

How can you avoid bad stocks and make sure yours will thrive in the upcoming years?

These are the kind of questions I’ll be answering.

You must register with Webinar Ninja to attend (if you did it in the past, no new registration is required). This is completely free and the webinar is free also. Webinar Ninja is the platform we use to run all our webinars. It works well and provides an optimal experience for everyone.

The presentation is about 35 minutes.

There will be a Q&A session of about 25-30 minutes.

The webinar works on Google Chrome or Safari from a laptop or computer. (not compatible with smartphones or tablets)

If you can’t make it on time, there will be a full replay available, but you must register to access it.

Register here (email required)

disclaimer: I hold shares of TSN, AOS, CAE and BEP in our DividendStocksRock portfolios.

The post Best 2019 Dividend Stocks Revisited Q1 Update [4 of my picks included] appeared first on The Dividend Guy Blog.