In September 2017, I received slightly over $100K as a result of the commuted value of my pension plan. I decided to invest 100% of this money into dividend growth stocks. Each month, I publish my results. I don’t do this to brag, I do this to show you it’s possible to build a portfolio during an all-time high market. The market will crash… eventually. In the meantime, I would rather cash some juicy dividends!

Portfolio holdings

Numbers are as at August 31st 2018:

Canadian portfolio (CAD)

| Company Name | Ticker | Market Value |

| Alimentation Couche-Tard | ATD.B.TO | $5,430.90

|

| Andrew Peller | ADW.A.TO | $7,050.85 |

| National Bank | NA.TO | $5,210.39 |

| Royal Bank | RY.TO | $6,286.80 |

| CAE | CAE.TO | $5,228.00 |

| Enbridge | ENB.TO | $7,262.71 |

| Fortis | FTS.TO | $4,226.30 |

| Intertape Polymer | ITP.TO | $5,573.99 |

| Lassonde Industries | LAS.A.TO | $5,019.00 |

| Magna International | MG.TO | $5,062.39 |

| Cash | $451.15 | |

| Total | $56,802.48 |

August was an exciting month as I had some cash in hand to trade. Before going on vacation, I sold my shares of Canopy Growth (WEED.TO) and Shopify (SHOP.TO) with a healthy profit. I ended-up with roughly $15K in cash and decided to split it in 3 holdings. The first one was Intertape Polymer (last month) and I just added two more candidate to my portfolio:

Trade: Bought 80 shares of National Bank (NA.TO) @ $64.13

The smallest of the big six (often forgotten) shows many growth vectors. First, the bank has created its private banking brand serving high net worth clients (Private Banking 1859) almost 10 years ago and it still shows double-digit revenue growth to this date. The growth in the banking industry will be found in this sub-sector as many business owners and baby boomers are millionaires and looking for advice to manage their estate.

Secondly, National Bank has a strong capital market segment. While this is a more volatile source of income, this division has usually posted high single-digit to double-digit growth over the past decade as well. Capital markets usually make money when there is more volatility. This is exactly what we have experienced since the latest crash. Therefore, NA is in the right position to enjoy the ride.

Finally, I like how National Bank has its loan portfolio concentrated in Quebec. This is a large province that hasn’t shown its housing price going crazy like other major markets (Toronto, Calgary, Vancouver, etc). Therefore, if a bubble burst in the housing market, NA will not suffer too much from it.

Trade: Bought 200 shares of CAE (CAE.TO) @ $25.85

CAE is a world leader in simulation and training for the civil aviation and defense markets. The company has a global presence employing 8,000 people at 100+ sites in 30 countries. CAE is a leader in three business segments: Civil Aviation Training Solutions (58%) (commercial/business aviation, training equipment), Defense and Security (38%) (virtual and live training), and Healthcare (4%) (patient simulation and training solutions).

CAE has developed a close relationship with many of its clients. The switching cost for them is relatively high as CAE clearly understands their needs and can improve/modify its training/simulation solutions to evolve with its customer. This creates a high recurring volume of business. With over 160 locations across 35 countries, CAE can meet any international clients’ demands. The company has shown steady growth over the past 5 years, and a record backlog in 2018. As the economy continues to grow, demand for commercial and business aviation will remain strong. Therefore, more training will be required.

Numbers are as at August 31st 2018:

U.S. portfolio (USD)

| Company Name | Ticker | Market Value |

| Apple | AAPL | $6,975.93 |

| Disney | DIS | $5,036.39 |

| Gentex | GNTX | $5,522.50 |

| Hasbro | HAS | $4,590.34 |

| Honeywell | HON | $5,102.39 |

| Lazard | LAZ | $4,865.40 |

| Microsoft | MSFT | $6,717.00 |

| Starbucks | SBUX | $4,513.50 |

| Texas Instruments | TXN | $5,629.00 |

| United Parcel Services | UPS | $4,545.45 |

| Visa | V | $7,337.00 |

| Cash | $571.68 | |

| Total | $61,406.58 |

Besides looking my US portfolio growing by another $2K , I didn’t do much in August. I’m currently following all earnings and taking some time to review each company I hold. So far, I like what I see and I don’t have any reasons to sell anything. The beauty of dividend growth investing is to wait and cash your dividend!

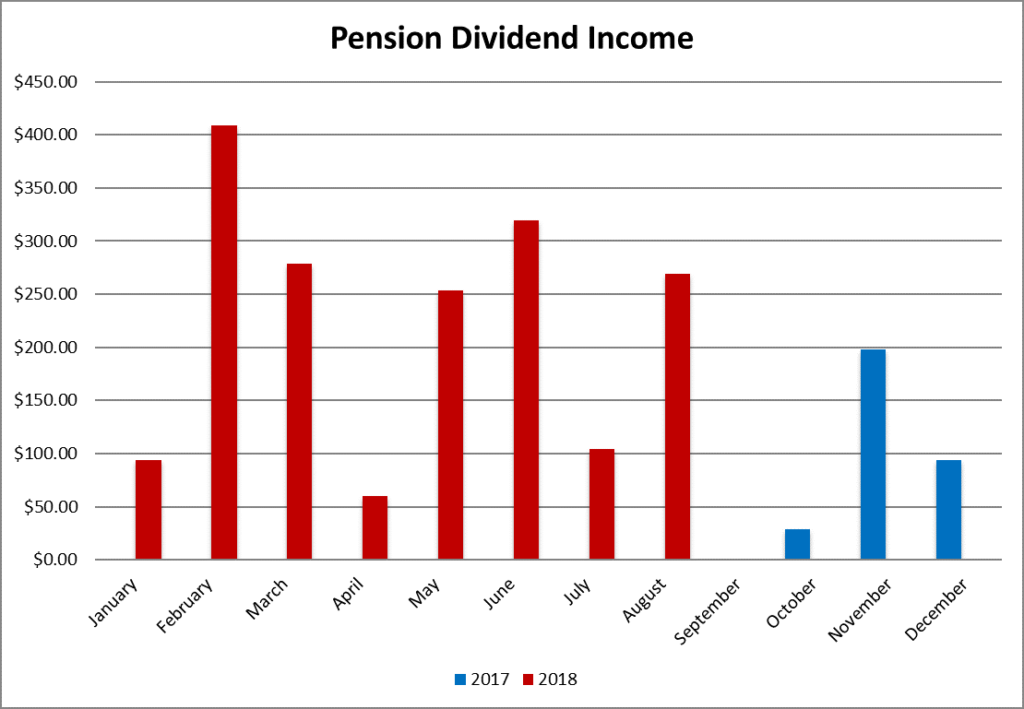

Dividend income: $269.42 CAD

Now this graph starts to get exciting! I’ve made my first purchases in September 2017 and received my first dividends the following month. This means that starting in October, I’ll be able to compare my dividend growth from one year to another. Obviously, my first “quarter” of comparison (Oct to Dec) will look very nice as my money wasn’t all invested in 2017. Still, it will give me a good idea of how much to expect going forward.

Let’s take a look at which company paid me this month:

Canadian Holdings payouts: $65 CAD

- Alimentation Couche-Tard: $8.60

- Royal Bank: $56.40

U.S. Holding payouts: $157.55 USD

- Texas Instruments: $31.00

- Hasbro: $28.98

- Apple: $22.63

- Lazard: $44.34

- Starbucks: $30.60

Total payouts: $104.03CAD

*I used a USD/CAD conversion rate of 1.2975

Since I started this portfolio in September 2017, I have received a total of $2,106.76 in dividend.

Oh yeah! I’ve crushed the $2,000 mark in 11 months! This means that I’ll be close to be earning $200/month on average for my first full year. While this doesn’t pay for my mortgage yet, it’s a great start!

Final thoughts

Last week, I’ve hosted a great webinar presenting my investing methodology that lead to this portfolio. I’ve walked through my investment process, including the tools I’ve used and the reasoning behind my stock picks. While you can’t get the live experience, you can still register to the webinar and watch the replay for free. Click here to check it out!

The post August Dividend Income Report appeared first on The Dividend Guy Blog.