The second half of 2018 has been challenging for many investors. For the first time in several years, both the TSX and S&P 500 finished in negative territories. While some screamed for a bear market, I’m not too convinced about the strength of that bear. After all, the S&P 500 hit -19.8% at closing on December 24th (from its peak) to bounce back during the following session. Today, we barely talk about a double-digit loss.

Source: Ycharts

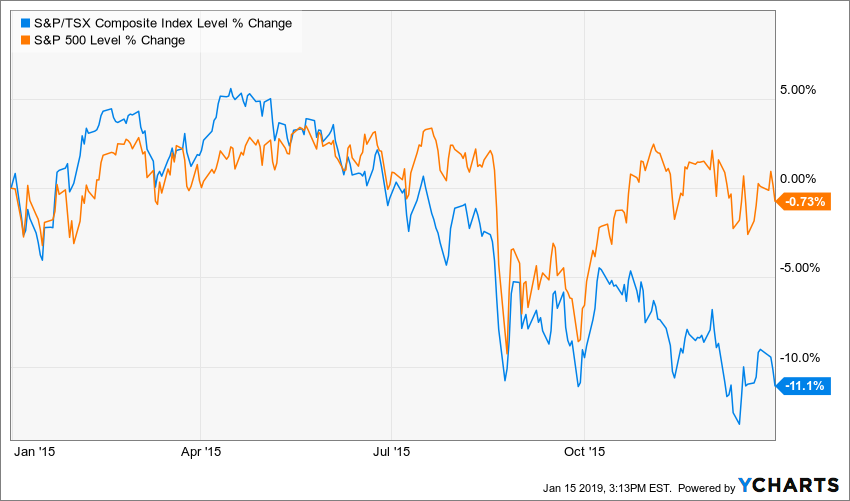

Oh, wait! Did I just write that it was the first time in several years? I guess investors may have a very very very short memory… The drop wasn’t as brutal in 2015, but nobody seems to remember that this year also finished in negative territories:

source: Ycharts

While the damage done on the US market was minimal, Canadian investors took a double-digit hit. In other words, it’s the second time in 3 years Canadian investors took a hit on their portfolio. I guess that even before we start with the lessons from 2018, Canadian investors should learn to diversify with more US stocks! I’ve made sure to keep slightly over 50% of my portfolio in US stocks for several years now and never regretted it. There is often one or both countries contributing to my return.

Nonetheless, I think 2018 brought everybody back down to earth and forced them to revise their investing strategy. Investing money hasn’t changed that much over the past decades. Most fundamental learnings are valid today, but the investor is probably the living specie with the longest and shortest memory capacities. I’ve had a great discussion on twitter (you can follow me @TheDividendGuy) yesterday about what 2018 thought us. Here’s what 2018 brought back to the table:

Lesson #1 Dividend Cuts & Bad Earnings Happen in Real Life

There are dividend cuts every year; this is no news. The list of “classic” dividend payers which failed their shareholders in 2018 was quite long:

- General Electric (GE) -92%

- Owen & Minors (OMI) -71%

- Buckeye Partners (BPL) -41%

- L Brands (LB) -50%

- Adient (ADNT) – suspended

- Anheuser-Busch InBev (BUD) -50%

- Artis REIT(AX.UN.TO) -50%

- Corus Entertainment (CJR.B.TO) -79%

- AltaGas (ALA.TO) -56%

Each dividend cut brought shares down with it. This is probably why we have read so many negative comments and articles about investing in 2018. Many investors suffered. I haven’t suffered a dividend cut in several years now (and my DSR portfolios have never seen one). I’ve recently described my rules to avoid dividend cuts. And if you ever suffer a dividend cut, rule #1 is to sell your shares. Rule #2 is to make sure your sell order was processed.

My take: It’s just the beginning

There are lots of companies that have been riding this bull market without carefully managing their money. Investors were complaisant, banks overlooked shaky balance sheets and central banks allowed cheap loans for over a decade. Today we wake up with a bunch of “not so great” companies telling their shareholders the party is over.

I don’t mean to be pessimistic. In fact, my portfolio is 98% invested in the market at all times. I’m an eternal bull as I always look to 20 years from now (you can do it too, unless you are older than 80!). I also believe there was a free party for many companies in the past decade, and the time to stop the music and look at who’s standing has arrived. Will it be through a massive bear market or a succession of corrections in a volatile market? I have no clue. But bad companies are going to pop-up and show their weakness as credit gets more expensive and harder to get. Make sure you have efficient tools to detect rotten apples in your portfolio.

Lesson #2 Pain Generates a Strong Emotional Response

I did some research and I couldn’t find empiric evidence on that, but I’m pretty sure I read something like the strength of negative (pain/fear) feelings overpower positive (joy/confidence) feelings. I’m not saying negative feelings win over positives ones. I’m saying you will hurt more if you lose $100 than if you find $100 on the floor. On the stock market, the loss of 5% of your portfolio hurts more than a gain of 5%.

This is why so many people started panicking when the market dropped in the second half of the year. When investors looked at their portfolios and it was all red for a few days in a row, they immediately thought of 2008. It’s like they forgot to look at their 3yr or 5yr total return (that was still green). In fact, most investors were losing paper profit, but not real cash. Still, pain generates a strong emotional response. My trick to beat the bear is the same as if you encounter one in real life: ignore it and walk away.

My take: Ignore the Pain

When I visited Yellowstone National Park a few years ago, my three children were quite anxious about camping in “bear country”. We thought it would be a good idea to attend one of the Ranger trainings about being “bear aware”. The best advice we got from it: Don’t panic: just slowly back away.

Going into a series of transactions will just “rattle” the bear in your portfolio. However, if you simply put your statement on your desk and wait for a few weeks (sometimes a month, hahaha!), you will realize the bear is slowly fading away. Major market corrections take between 18 to 24 months to recover. Are you in a hurry with your portfolio? Just ignore the pain and keep investing according to your strategy. Oh, you don’t have a defined investing strategy? This is where your problem is.

Lesson #3 Your Investment Strategy Must Worth Something

I worked over a decade in the financial industry taking good care of my clients’ portfolio. A series of market corrections and the 2008 bear market taught me something; those who lose the most are the ones jumping from one strategy to another (or simply not having a well-defined investing plan period). Almost all my clients followed their investment plan in 2008. Do you know how many of them were complaining in early 2009? All of them. Do you know how many were complaining in 2012? None of them… and they were all very happy.

It took me several years of investing, reading and experiencing on the market to define, optimize and put down to work my investing strategies. But now that I’ve established my 7 dividend growth investing principles, I’m sticking to them religiously. I don’t really mind if the market is up or down. I don’t mind if a central bank raised its interest rate or if there is a commercial war. I don’t mind the market. I don’t mind the noise. All I mind is if companies in my portfolio follow my investing rules. If they do, they are keepers. If not, I sell them.

My take: Write it down

A few weeks ago, I wrote an article about investing in 2019 and beyond. Most of this article was pure common sense. Yet, it is very important to write down why you invest and how you invest. Then again, it’s all related to emotion. When you are about to panic, get back to your investing strategy and read it. Then, look at your financial plan and portfolio and make sure everything still makes sense.

When company shares surge on the market, do you panic? Do you sell them thinking the only option for those is to go down again? No, you keep them, and you smile. When shares go down, you should do the same. Getting paid to wait (e.g. dividends) is definitely helping!

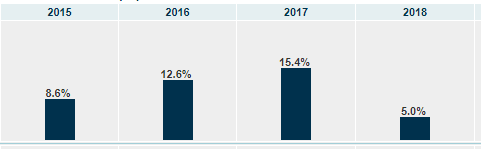

Final Lesson: Dividend Growth Investing Kicks A$$

On top of those great lessons, 2018 also confirmed something I’ve been advocating for a while: dividend growth investing ROCKS! As you can see, my 2018 was not as great as my previous years, but a 5% total return for a 100% equity portfolio (invested in US and CDN stocks) is not that bad!

Source: my brokerage account (includes all my accounts together: RRSP, RESP and Locked-in RRSPs).

Even if my portfolios had shown a total return of -5% in 2018, I would continue to advocate that dividend growth investing is a strong strategy. The point here is to invest for the next 10+ years, not for the next 10 months. We will all hit speed bumps during our investing journey. The key is to stay the course and stick to our itinerary!

The post 3+1 Lessons From 2018 – A Guide to Beat the Bear appeared first on The Dividend Guy Blog.