Summary

#1 In 2017, we read many millionaire Bitcoin stories.

#2 Cryptocurrencies are not just the flavor of the month anymore. They now part of the financial world.

#3 Ways to trade cryptocurrencies are now entering classic stock markets.

In order to fully benefit from the upcoming year and boost your return, I’ve identified three investing themes that will play a major role on the market. I’ve already discussed the first theme not too long ago:

01 Amazon against the world

02 Interest rate increases

03 Bitcoins frenzy

The best part is you can benefit from each situation and still minimize your risk. Today, I will explain you how you can benefit from the cryptocurrency industry. Nope, this is not another “how to buy Bitcoins and become rich” article.

Author’s creation

Theme 03: Bitcoins Frenzy

Do you remember the last time you invested in something and it posted over 1000% return in a single year? Yeah… unless you bought a few “dot coms” you probably don’t have many stories like that. Well, this is exactly what is happening with Bitcoin right now:

Source: Ycharts

In my intro, I wrote that this wasn’t a “how to buy Bitcoins and become rich article”. Well, this is also not a “run! Bitcoins is a bubble!” article either. In fact, I don’t claim to be an expert in cryptocurrency. For that, I will let my fellow SA author Paulo Santos educate you about Bitcoin with his in-depth 7 articles series on the topic. Here, I will simply relate a few facts about Bitcoins:

#1 The blockchain concept is revolutionary and all financial actors are interested by new technology.

#2 The concept of cryptocurrency is here to stay. You can’t go back.

#3 Your brother-in-law is very annoying with the $10,000 investment he made in Bitcoins back in April 2017…

First things first: ignore the noise

The way that Bitcoin value goes up and down gives me the unique reason I need to let this type of investment to others. In the end, there will probably be a handful of winners compared to the tons of people that will be losing money in such a roller coaster ride. Therefore, my first reflex was to find a way to benefit from this phenomenon without having to suffer from such fluctuations. If blockchain technology has found a way to improve financial transactions, there will be one group of people that will ultimately benefit from this… stock market investors! And what best way to invest in them besides going after CME Group (CME)?

CME Group is the largest derivatives marketplace and operates the Chicago Mercantile Exchange Inc. (CME), Board of Trade of the City of Chicago, Inc. (CBOT), New York Mercantile Exchange, Inc. (NYMEX) and Commodity Exchange, Inc. (COMEX) exchanges. In other words, if you want to trade options and futures, chances are you are going to use one of the CME platforms.

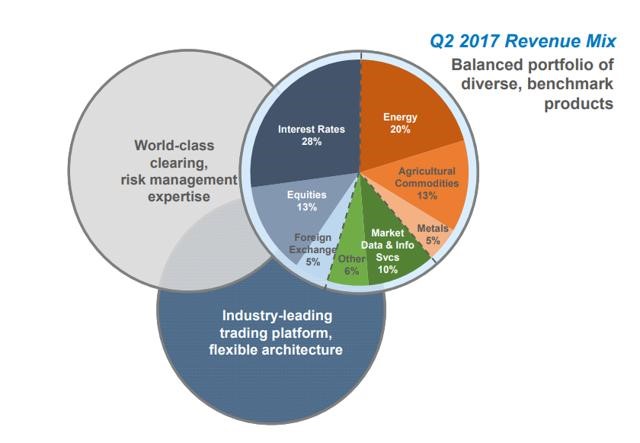

Source: CME Q2 2017 investor presentation

CME also introduced the first derivative products enabling investors to literally trade the Bitcoin in a regulated trading platform. The interest in derivative investment products has been growing a lot as of late and the introduction of cryptocurrency products will only fuel the fire. This is a great way to benefit from the Bitcoin rush with no concern if it goes up or down. CME will make money off it.

Now, couple this phenomenon with rising interest rates. Interest rate products represent about 30% of CME revenue at the moment. The more movement there is from the FED, the more the need for hedging strategies will arise. Isn’t that the perfect storm?

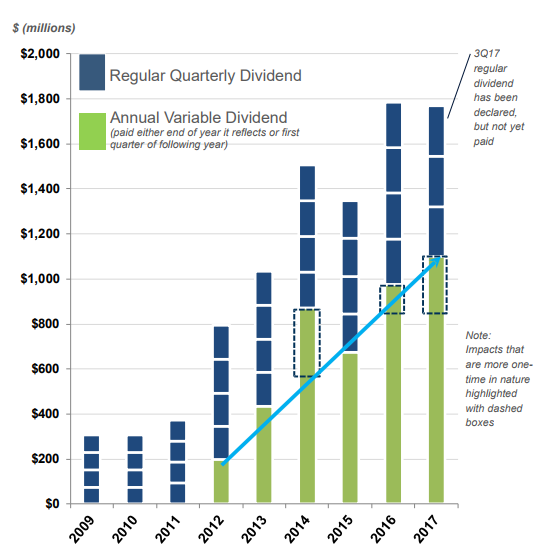

On top of that, CME is paying a decent dividend to make you wait. CME yield is nearly 2% (1.82% as at January 3rd) and they also reward shareholders with a special dividend based on financial performances.

Source: CME Q2 2017 investor presentation

Electronic currency? Play electronic payments!

Another way to enjoy the Bitcoin rides without having to wonder if you are driving toward a wall or not is to look into which companies will facilitate those transactions in the real world. Because it all comes down to this: no matter how much your electronic wallet is worth, what matters is if you can use this money in the “real world”.

Visa (V) enables Bitcoins owners to pay with their card and make real purchases.

Source: Bitpay

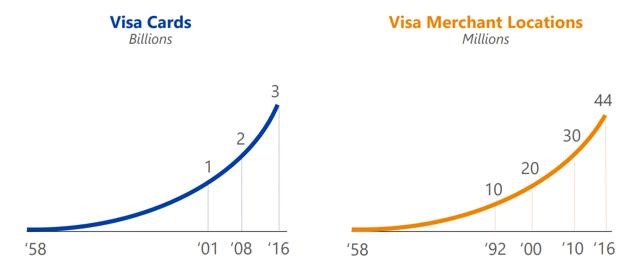

This techno stock is riding the natural shift from cash to electronic payment like no others. Visa dominates the market with over 3 billion cards across the world:

Source: V investors day presentation

V has also been the first electronic payment processor to introduce Bitcoins to its cardholder. With such a wide network and important client base, Visa is among the best candidate to offer an easy way to translate electronic money into real cash.

Visa will continue to thrive in the upcoming years due to the natural shift of cash toward electronic payment. The rise of the Bitcoins and ecommerce platforms such as Amazon (AMZN) is only adding to this strong tailwind. Visa started its business as a means to facilitate purchases. It has now transformed into a means to facilitate any kind of money movement. By ensuring money transfer security and validating usage of this money, Visa is working with governments and businesses for their transaction needs.

I know that Mastercard (MA) is also working on the project and they let you pay with blockchain, but not with Bitcoin, yet. But to be honest, I think both companies will benefit from the cryptocurrency frenzy.

Final Thought

I would lying if I wrote that I don’t regret investing in Bitcoins. After all, we all like making a quick buck, right? But I never considered seriously an investment in cryptocurrency simply because I don’t believe in investing in anything that doesn’t produce revenue and profit. Gold, oil, Bitcoins… this is all the same stuff. They all have value only if someone is willing to pay more for it. If you leave your 5 Bitcoins in your electronic wallet on your electronic shelf for 10 years, there will nothing more and nothing less but your 5 coins.

I’m currently fully invested in dividend growth stocks and I don’t intend to change my strategy. In the end, even if I’m wrong, my stocks will continue to pay me for waiting. Instead of betting on where the market will finish in 2018, I bet that all my holdings will not only maintain but increase their dividend payouts. This is the kind of prediction I can make. What about you?

Seriously, if you made it this far, it’s because you liked what you read. Don’t be a stranger; leave a comment and tell me what you think! I’m asking you one more thing; click on “follow” button (it’s orange, you can’t miss it!) and you will get notified each time I write a great piece like this one.

The post 2018 Main Themes & How to Play Them Part III appeared first on The Dividend Guy Blog.