As you might have read about it here, I do live webinars and certainly have fun doing so. I have been surprised by the positive interest attendees had towards many of my stock picks. This is how I came to the idea of sharing here some of my “Video of the Week”, during wich I go through a company recent news or results and explain why I believe it is currently a good or a bad pick for a dividend investor.

Investors looking for a safe consumer defensive stock during tougher market times will be served with Pepsi (PEP), part of the consumer defensive sector. Having 90% of its brands as #1 or #2 in their sector, this Dividend Aristocrat is there to stay. Its recent healthier products are also interesting moves for the future!

Video

If you enjoy the videos format and want more of them, subscribe to my YouTube channel!

Verbatim

00:00 Mike Heroux: Hey, fellow investors, this is Mike Heroux from Dividend Stocks Rocks. I hope you’re doing well today. At the time of recording this video, we are, October 11th. It’s been two days, the market is not going very well. Mostly because investors are concerned about commercial trade wars, about interest rates rising, inflation, the oil market booming, which take away money out of consumer pockets on top of inflation and everything. And the fact that most consumers in most countries, continued over the past decade to just spend money with, regardless of their debt level. So a lot of investors right now are concerned at, what we’re heading towards right now is the perfect cocktail for a market crash. But you know what, we could have had this discussion three years ago and found a dozen reason why the market would crash in 2015, and yet it didn’t happen. So I’m not talking about the fact that the stock market is going to go bullish for another 5 years. I’m not telling you that we’re heading towards a crash in the next three months, either. I’m just telling you that if you are concerned, I might have a really good idea for you.

01:18 MH: How about investing in PepsiCo. Ticker PEP, I mean, this company is obviously well known among investors and among consumers. Pepsi had about 50 % of its revenue coming from its beverage business. And the other assets coming from its salty business, so it’s snack business. Ninety % of them are number one or number two in term of brand recognition and brand leadership. So we’re talking about a company that is well established, not only in America but across the world. With, over 40 % of the revenue coming outside the United States. So if you’re looking for a safer pick, if you’re looking for a company that is among consumer staples which also known as consumer defensive, which means that it will do well no matter what happens on the economy because people eat and people drink, obviously. I think that Pepsi could be a very good pick. This year, the company has not been doing well, so far on the market, it’s down about 10 %. It might be even lower after this video because the market is not very, very good right now.

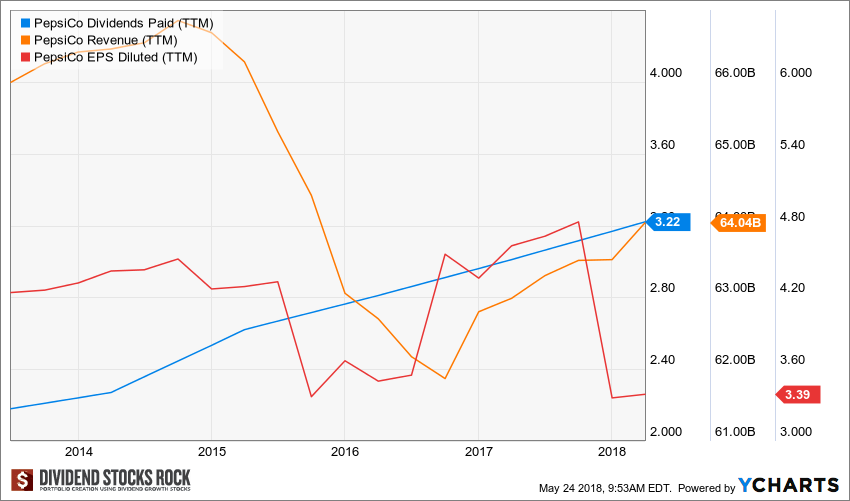

02:34 MH: But when you think about it, Pepsi reported their latest quarter last week at the beginning of October, showing organic growth of five %. So this means that while Pepsi is hitting currency headwinds and they might not sell as many bottles as they wish, or as many snacks as they wish, in term of total sales. The thing is, when you look at organic revenues were up five % which is pretty good. In Latin America, it has been facing strong currency headwinds but in currency neutral, sales are up 10 %. So this company is still doing well. People will, as I’ve said, continue to eat and drink. And most importantly, Pepsi shows 46 consecutive years with a dividend increase. What’s the latest dividend increase? It was 15 % up this year in 2018. So if you think that management is concerned about the market or about the economy, this is a strong and bold move to increase, double digit DER dividend payment. We’re talking about a stock that will soon become a dividend king which means that it will soon reach 50 consecutive years with a dividend race. We’re talking about a yield over three % right now. And a dividend increase of eight % analyzed rate over the past five years. So, something that is very, very interesting for income seeking investor in term of value add DSR we think that Pepsi had the potential to reach over $140.

04:20 MH: Not gonna happen if the market crashes, obviously. But the good news is, it will continue to grow in terms of revenue and earnings and your dividend payment will continue to grow, even if 2019 is the worst year of the past decade. That won’t matter, you will still get paid to wait. So, I believe Pepsi is on the good track. I think that they’re moving part of their business towards healthier and better for people, snacks and beverages. Like using Gatorade and Tropicana and better snacks. Obviously, there’s a lot of marketing into it, but they have moved like 50 % of their product offering as better health products. Think they’re following the trend over there as well. So keep on track with Pepsi. Right now seems a good time to buy according to our model, but keep in mind that you cannot take that as a financial advisor by ourselves, a recommendation. I strongly suggest that you dig into deeper into the financial quarters that just been published actually two weeks ago. So look into it, do your own research. Don’t take that as a buy and sell recommendation. And you can not sue me if you’re buying Pepsi and it crashes, but you won’t have to pay me a dime if you’re making some money down the road.

05:50 MH: So I hope that you have enjoyed this video. Don’t forget to subscribe to my YouTube channel I’m doing this stock pick on a weekly basis and if you wanna get more information, more stock reports and more news, head over to my blog, thedividendguyblog.com and register to my news letter over there. So see you next week for another stock pick. Cheers.

Image source: pixabay

The post Video of the Week: Pepsi, a Safe Play Through the Waves appeared first on The Dividend Guy Blog.