- The Canadian Market is a lot more than just banks and energy stocks.

- There are many great dividend-paying stocks in other sectors, notably in consumer, cyclical and defensive stocks.

- I’m sharing three good ideas along with their investment thesis.

Last week, I wrote an article about some struggles faced by Canadian investors. One of the most common challenges for Canadians is diversifying their portfolio by venturing outside of their borders. After a few classics, it could become difficult to find growth or high-yielding stocks. Additionally, I feel there aren’t enough articles covering Canadian dividend stocks. It’s hard to get detailed opinions on many “Canadian dividend underdogs.” Here are some of my favorites:

Always Buying More Wine

If you have been following my blog for a while, you will know that there are two things that I enjoy equally in life (besides my family, of course):

1. Getting paid by companies in which I hold shares.

2. Drinking wine with my wife and friends.

Well, I found the perfect match with this winemaker that has a thirst for acquisitions. Andrew Peller (ADW.A.TO), founded in 1961, has become one of the most respected Canadian winemakers, owning wineries in British Columbia, Ontario and Nova Scotia. ADW not only produces its own wine, but also markets it along with other products. The company owns several brands, including Peller Estates, Trius, Hillebrand, Thirty Bench, Sandhill, Copper Moon, Kalona Vineyards Artist Series VQA Wines, and Red Rooster. Currently, they own an estimated 10.2% share of their total wine market and a 37% share of domestic wines.

The Reason Why I Like It

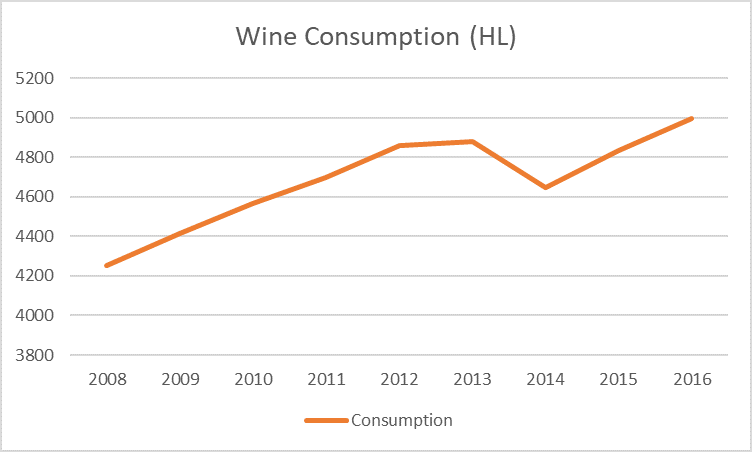

The wine market has been quite stable in Canada over the past few years. By using stats from the International Organisation of Vine and Wine (OIV), you can see that Canadian wine consumption is increasing, but not at a flabbergasting rate:

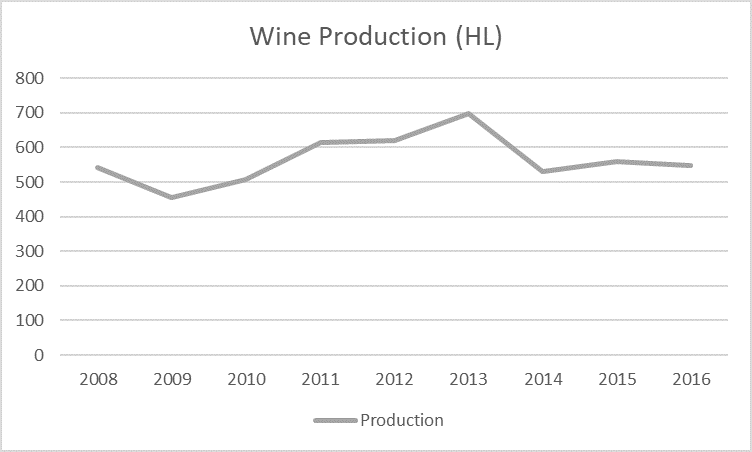

The first figure shows about a 17% increase in wine consumption over eight years. However, changes in wine production over the course of eight years, shown in the second figure, show stagnation in the current market.

In other words, there hasn’t been much growth.

So, Mike, why are you so excited by Andrew Peller?

This situation offers a “larger-players-take-all” situation. This is where Andrew Peller kicks in with their 10% market share in the Canadian industry. As a larger player in a highly fragmented market, ADW has the size and balance sheet to grow through acquisitions. $200 million in acquisition later (17 transactions since 1995), Andrew Peller has built a solid expertise in acquiring and integrating new brands. The company enjoys strong brand recognition and customer relationships. The winemaker is also using its marketing expertise to diversify the products by offering premium craft beers and whiskies (Wayne Gretzky’s brand).

The company pays a small yield (~1.50%), but shows a dividend annualized growth rate of ~9% over the past five years. ADW maintains a low payout ratio as management carefully manages its cash flow. The company is then able to keep growing through acquisitions while raising its payouts with a high single-digit to low teens growth rate.

Duct Taped to My Portfolio

If there is one thing that is as reliable as a strong dividend stock, it’s probably duct tape. While I was travelling throughout Central America, I would tell my kids that there was nothing a roll of duct tape couldn’t fix. I guess this is why I like Intertape Polymer Group (ITP.TO) so much.

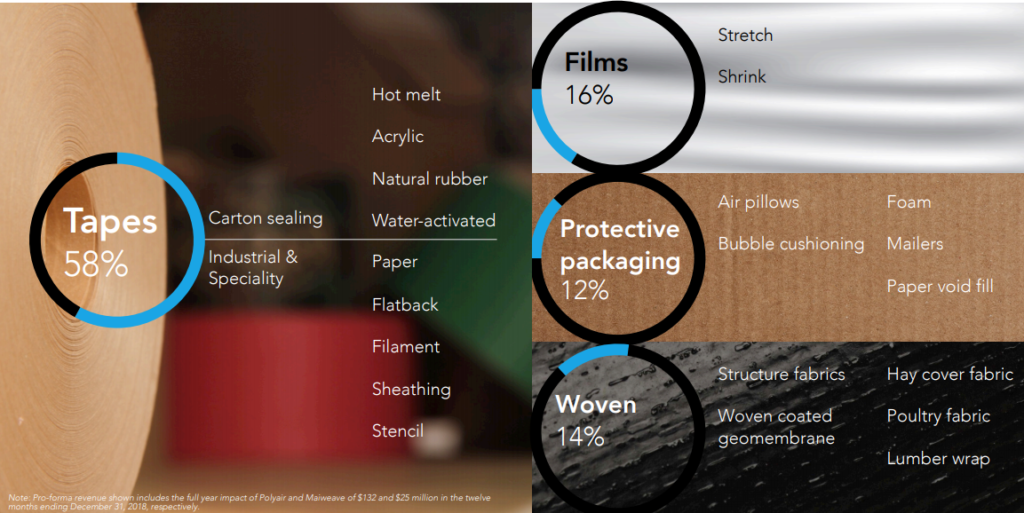

Intertape Polymer Group manufactures and sells a variety of paper and film-based, pressure-sensitive, and water-activated tapes, as well as polyethylene and specialized polyolefin films, woven coated fabrics, and complementary packaging systems for industrial and retail use. ITP employs approximately 3,400 employees with operations in 27 locations, including 20 manufacturing facilities in North America, two in Asia, and one in Europe.

The Reason Why I Like It

With the rise of online shopping, the packaging industry should benefit from this tailwind. ITP expects to reach $1.5 billion in sales by 2022. Intertape is number one and number two in its main market in North America and shows international expansion opportunities. Management also expects to grow by acquisition to expand its current line of products, consolidate its activities, and open additional doors in international markets. In August 2018, the company completed the acquisition of Polyair Inter Pack for $146 million. This was a strategic move to expand ITP product offering while opening doors to create cross-selling opportunities to PIP’s clients.

ITP pays its dividend in USD (currently $0.14USD/share) and the company shows solid payout ratios. This is why Canadian investors will feel that the dividend shows considerable fluctuation. The dividend hasn’t increased since late 2016, but the company has used its cash for acquisitions to increase its revenue. In the meantime, you can enjoy a solid ~4.2% yield that is paid in USD (it’s great if you spend your winter in Florida!)

Built for Distance

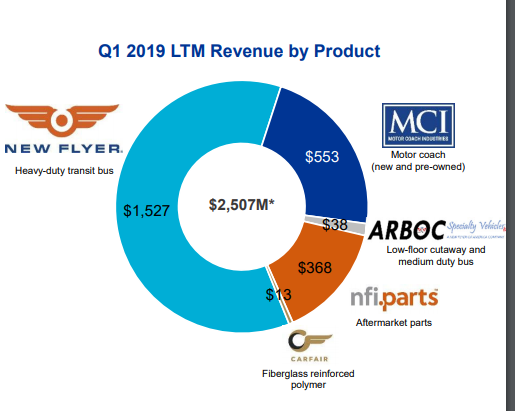

My last stock pick comes as a gift as shares plummeted not too long ago; however, the dividend is going the distance. Founded in 1930, New Flyers (now NFI Group) (NFI.TO) is the number one bus original equipment manufacturer (OEM) and parts supplier in North America. The company fabricates, manufactures, distributes, and operates service centers in the U.S and Canada. New Flyer is using technology to offer evolved solutions such as drive systems, including clean diesel, natural gas, diesel-electric hybrid, trolley electric, battery electric and fuel cell electric. The company now counts 6,000 workers across 31 facilities.

The Reason Why I Like It

NFI is a classic “growth by acquisition” business where investors count on management’s next move to generate additional growth. Most recently, the world’s biggest manufacturer of double deck buses and leading British bus and coach builder, Alexander Dennis Limited (ADL), was acquired by NFI Group for around $405 million. The company sees immediate synergies and will also enable NFI to expand its activities offshore. There is additional growth to be captured in this market as bus transportation continues to grow. As the largest player on the playground, NFI enjoys strong brand recognition and constant sales.

Shares dropped in 2018 and NFI now offers ~4% yield and was recommended in my DSR buy list in May 2019 (for ~15% gain since then). As any automobile/truck company, NFI evolves through cycles. It is currently trading at interesting value and you will get paid to wait.

Final Thoughts

Those three companies are great examples of Canadian dividend-growers you can use to improve your portfolio. I currently hold shares of ADW and ITP, but I didn’t pull the trigger on NFI (because all of my money was already invested…. can’t catch them all!).

If you enjoyed this article, I have seven other Canadian picks for your portfolio here.

Disclaimer: I hold ADW.A.TO and ITP.TO in my dividend portfolio.

The post Three Canadian Companies We Rarely Talk About (But Should be in Your Portfolio) appeared first on The Dividend Guy Blog.