I often have the feeling we forget about industrials. There is nothing sexy about them. There is nothing to create hype on the stock market. Even worst, this sector is not seen as a high yielding one. Still, the fact that many companies operate through cycles, there are always a few industrials for sale.

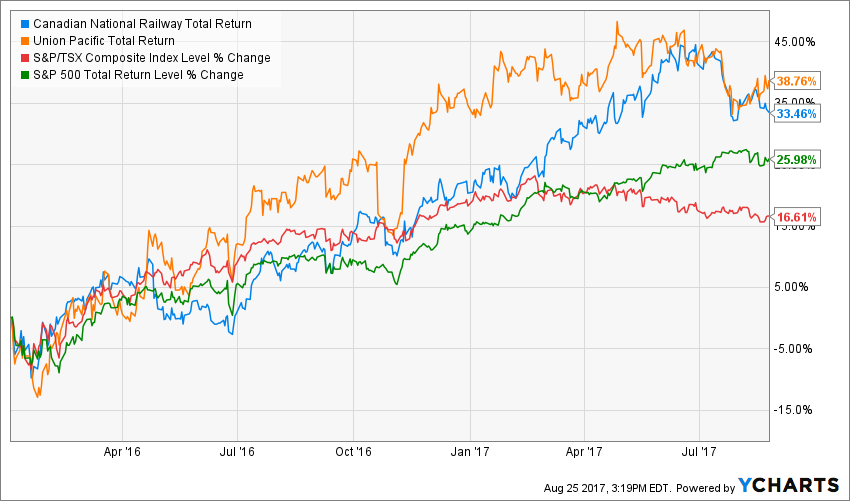

During 2016, I’ve covered many railroads and suggested Canadian National Railway (CNR.TO) and Union Pacific (UNP) to be strong buys. They both did very well over the past 20 months compared to the market:

Source: Ycharts

As industrials are often forgotten, there are always a few hidden gems to pick from. The best part is that once you have picked some, you can easily forget them in your portfolio and wait a few years before you take a second look at them. Those companies are often too big and too strong in their field to be threatened by another competitor.

One of those gems is possibly Aecon (ARE.TO). The company made news at the end of August as the company confirmed it has engaged BMO Capital Markets and TD Securities to look into a possible sale of the company. Shares jumped 20% upon that news (please note that they don’t have a buyer yet). Should you trade based on the news or wait to see what is happening? Let’s dig deeper.

Business Model

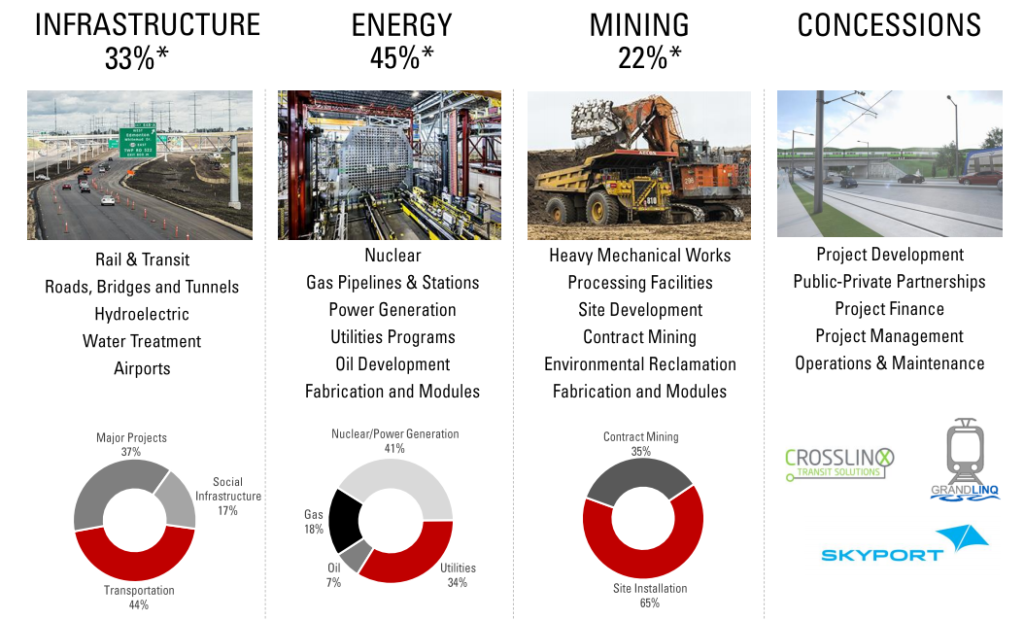

Aecon provides construction and infrastructure development services to private and public sector customers throughout Canada (roughly 50%-50%). It also provides services to the energy and mining sectors, as well.

Source: ARE Q2 2017 presentation

As you can see in the graph above, it has been quite a bumpy ride in term of earnings over the past 10 years. However, the future looks bright for Aecon as the Liberal government has the firm intention to boost infrastructure spending by $35 billion. On August 25th, the stock surged as ARE hired an adviser to explore a potential sale of the company (source Bloomberg).

I guess it’s good timing for everybody since both revenues and EPS were going down this year. Before the news, the stock was also down 25%. This makes me a little bit worried about the sudden jump. I don’t like buying stocks based on thin air…

It’s a good thing I dug deeper to find out that revenues were affected by the sale of Quito Airport Concession in 2015 (impacting results up to June 30th 2016) and EPS were hit by a onetime restructuring expense. The latter has probably be done to make the company valuable for potential buyers. After adjustments, EPS would still be lower than 2016, but it would be more acceptable. You can imagine this is only normal since the bulk of the company’s projects are in both the mining and energy sectors.

Investment Thesis

Macroeconomics is a strong tailwind that Aecon will benefit from in the upcoming years. The need for new infrastructure in Canada is obvious. “Aecon is currently pursuing projects at the bidding or qualification stage and have total capital costs in excess of C$25 billion,” ARE founder John Beck said then. “We are very positive on the impact this level of investment and pipeline of projects will have on Aecon’s growth and margin profile.”

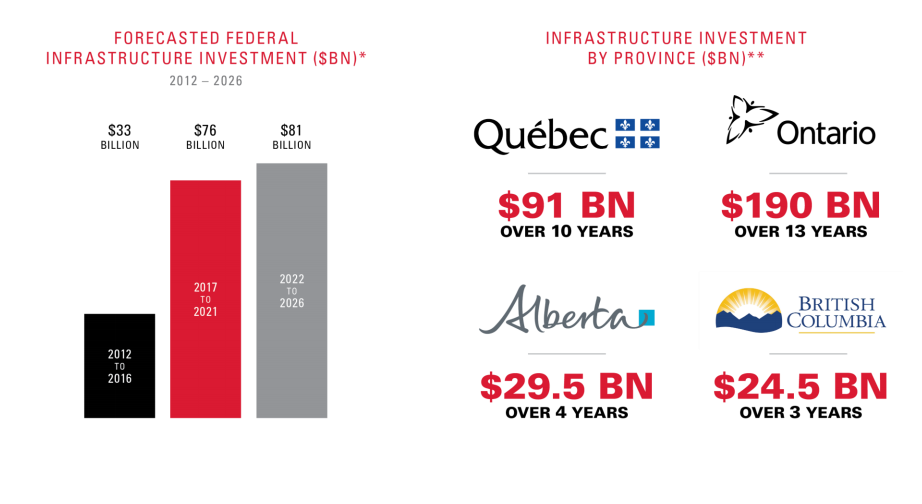

While both mining and energy sectors are down, infrastructure spending may help ARE to grow in the upcoming years. We are talking about billions to be spent for the next decade:

Source: ARE Q2 2017 presentation

In the energy sector, we also see some improvements. The Ontarian government is also expected to spend $12.6 billion to refurbish its nuclear energy network. There are several pipeline projects on the table (TransCanada Energy East and TransCanada Keystone XL to name a few). Then again, energy and mining industries are cyclical. It’s always a good thing to buy companies related to those fields during the down cycle.

The tale of a potential sale will just add some excitement to this newly named Canadian Dividend Aristocrat.

Potential Risks

As shares jumped by over 20% in a single day upon the sale potential, the risk of seeing this gain fade is real. Infrastructure construction projects are capital intensive and there are often unexpected expenses. A project that goes sideways can drop a company’s earnings in a heartbeat.

Aecon’s revenues and earnings haven’t followed a straight uptrend and the company went through many bumpy rides. There is potential, but don’t expect a smooth ride with this one.

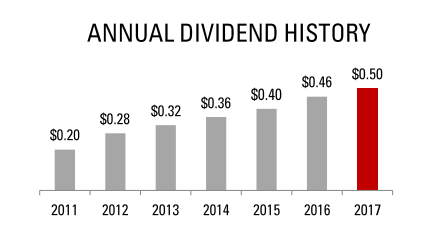

Dividend Growth Perspective

The company has recently joined the elite group of Canadian Dividend Aristocrats. They should be able to maintain its 8%-9% dividend growth rate for a while as the project pipeline seems to increase steadily. Between 2011 and 2017, the dividends more than doubled.

Source: ARE Q2 2017 presentation

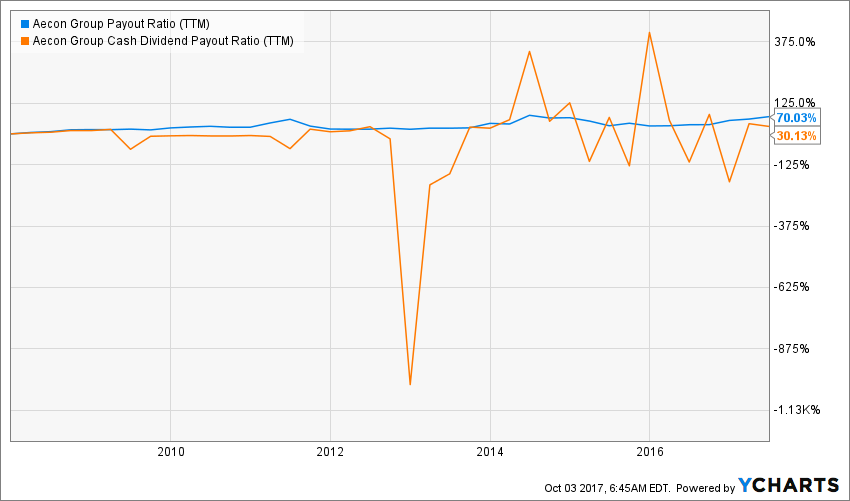

As Aecon]s business is capital intensive, I didn’t expect to find such low payout ratios. Management definitely has a company in good standing and benefits form lots of room for future increase.

Source: Ycharts

Valuation upside -8%

When I looked at how the market valued ARE over the past 10 years, I couldn’t see any trends:

Source: Ycharts

For this reason, I decided to ignore the PE valuation and focus on the DDM. I’ve used a double stage dividend discount model to determine ARE value. I’ve followed management guideline with an 8.5% dividend growth rate for the first 10 years and reduced it to 6% afterward. Unfortunately, Aecon seems fully valued at this price:

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $0.50 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 8.50% | |||

| Enter Expected Terminal Dividend Growth Rate: | 6.00% | |||

| Enter Discount Rate: | 10.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 9.00% | 10.00% | 11.00% | |

| 20% Premium | $26.10 | $19.43 | $15.43 | |

| 10% Premium | $23.92 | $17.81 | $14.15 | |

| Intrinsic Value | $21.75 | $16.19 | $12.86 | |

| 10% Discount | $19.57 | $14.57 | $11.58 | |

| 20% Discount | $17.40 | $12.95 | $10.29 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

Final Thoughts

Overall, I think ARE could be a great addition to an already diversified portfolio. This is a strong company with solid dividend perspectives. On the other side, the valuation isn’t perfect due to the recent share price surge. Based on the dividend potential, Aecon seems a good fit for any dividend growth investors.

Disclaimer: long CNR.TO, UNP