I remember my days as a financial planner. When I worked with my clients on their retirement plans, the easiest part was withdrawals. Why? Because we were taking care of their money. In private banking, we offered an “all-inclusive” service where we would manage how, when, and where to withdraw the money to make sure our clients enjoyed their retirement.

The reality is significantly different if you manage your own portfolio. The advantage is that you are not limited by your financial advisor’s set of products, and you don’t have to pay fees. Therefore, there are good opportunities for your returns to be better. Unfortunately, once you get to be retired, you don’t benefit from the “all-inclusive” service where someone manages the mechanics behind each withdrawal.

Even if you don’t have someone taking care of your withdrawals, it doesn’t have to be complicated. This article is all about making your retiree’s life easy. The goal here is that you have more time to spend with your family, laughing, traveling, or eating out. We don’t want you to spend your weekends in front of your computer designing budgets and orchestrating withdrawals.

I’ll go with how I intend to manage my portfolio once I retire. I’ll cover the how, when, and where to withdraw money from a portfolio.

But first, a few words about taxes.

Withdrawal and Taxes

Considering that each situation is different and that I have Canadian, American, and even European readers, I will not discuss tax implications. You already know that I’ will advise you to seek professional advice on tax issues.

I believe one should perform tax optimization after he/she has set his/her investing strategy (global asset allocation, risk tolerance, types of investments). It’s good to save a few bucks in taxes, but not at the expense of the bigger picture. In other words, I don’t think it’s a crime to pay withholding taxes on dividends paid if it enables you to have a more diversified and better-performing portfolio.

However, when it’s time to retire, the order and timing of withdrawals could greatly affect your budget. You can’t control your portfolio performance, but you can control a great part of the taxes you will pay (or save) at retirement. Therefore, crunching numbers with a tax expert will likely make a big difference in your lifestyle. Make sure to make your appointment, develop a plan, and thereby avoid potential costly mistakes.

How About Inflation Protection?

I have received many questions about inflation lately. It’s understandable considering the amount of “advertisement” for the “Flations of the Apocalypse” (namely In, Stag and Hyper). Gold believers will not miss an opportunity to tell you about how much cash the FED has printed in the past twelve months. Bitcoin fans will explain that the only viable currency is digital. Finally, some go as far as comparing Canada with Zimbabwe or Venezuela and today’s U.S. with 1990’s Japan. In other words, many are calling for a massive currency value drop creating hyperinflation. This is a lot of noise that you don’t need in your life.

If you book your entire weekend to try to understand what is happening between the creation of money (stimulus bills in the U.S., support in Canada, etc.), gold prices and the rise of Bitcoin, you will have lost a great opportunity to take a walk outside and enjoy spring. Here’s my confession: I regularly read articles about those topics because it’s my job (and it’s my interest). Each time I read something that makes me think “hum…this makes sense”, I read another piece telling me the complete opposite and this article also makes sense.

Conclusion: I’m not smart enough to tell you if we are going to get into hyperinflation or not. There are multiple forces driving currencies and prices both up and down at the same time. Then, what is the smart thing to do?

How to protect your portfolio against inflation

If you search for ways to protect your portfolio from inflation, you will likely end-up on pro gold / precious metals or pro bitcoin articles. In fact, there isn’t a bullet proof methodology to protect your money against inflation. Not even gold. Did you know that since its peak price in the 80’s, gold has never fully recovered when considering inflation? I just found this gem written by Morning Star showing how gold is far from a good hedge against inflation.

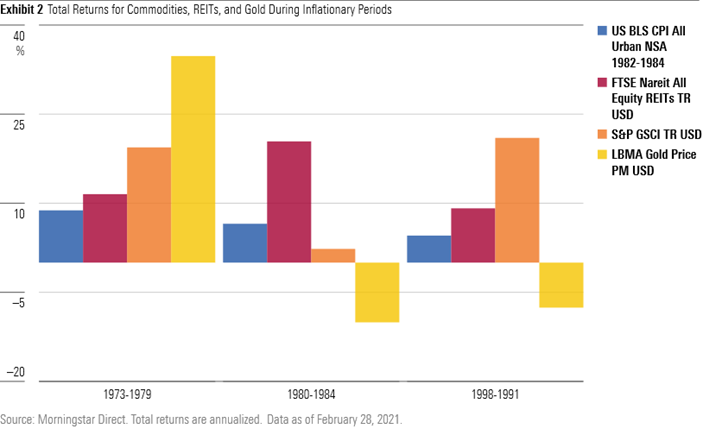

Below, you will see a graph showing you how commodities (blue), Real Estate (red), equities (orange), and gold (yellow) did over the last three critical inflationary periods. Shocker: gold is the worst hedge of them all! It worked tremendously well during an episode of stagflation (inflation mixed with a recession) but appeared to be a dud for regular inflationary periods.

The article suggests commodities having the best correlation (e.g., protection) with inflation. However, you must be ready for a wild ride as it is also the most volatile asset class. Real Estate usually does well as landlords tend to pass the inflationary pressure to their tenants. Finally, there isn’t much correlation between stocks and inflation. However, long-term returns from equities tend to be superior to all asset classes. I guess this is how you can protect your portfolio against inflation, right?

I know a way to not worry about inflation though. It’s called dividend growth investing. By selecting companies with the ability to increase their dividends year after year, you protect your retirement income from inflation. In 2020, my portfolio dividend payments increased by 7.7%. That’s more than enough to cover inflation.

If I don’t know what inflation will look like in the future, I also know that capitalism isn’t about to disappear. Great companies making great products or services will continue to expand and pay dividends. If you want to fight inflation, I believe this is a classic “offense is the best defense” situation. Gold has failed many investors, Bitcoin has proven one thing and one thing only (it’s highly volatile), but great dividend growers have always performed well over the long term. I’ll bet my retirement on that too!

It is a simple answer to a complicated question. Sometimes, keeping things simple is the best strategy. Now, let’s simplify the withdrawal mechanics!

Cash, Dividends, Selling Shares and Portfolio Allocation

In this section, we’ll elaborate a simple, but effective, plan to make sure you always have enough money to enjoy your retirement. I will tell you what I intend to do once I retire. It may or may not fit with your situation, but this will give you a good starting point.

As previously discussed in the last retirement article, I intend to have between 12 and 24 months worth of my retirement budget in cash on day 1 of my “new life”. The key here is to have enough cash, so I never panic when the market drops and that I’m never forced to sell stocks at a bad time.

With this cushion in mind, I expect to combine my dividend payments with small withdrawals from this cash account. To make the example fun, let’s put numbers into this exercise.

Imagine I retire at 65 with $1,000,000 generating 2% in dividends (my current average yield). Now, let’s imagine I need the classic 4% from that $1M (or $40K/year). This means that between two and four years before retirement, I would have let the 2% dividend pile up in cash to create my reserve. I don’t want to be forced to sell stocks at 65 during the 33rd pandemic wave crushing the stock market ?.

Therefore, at the age of 65 I would have a portfolio of $1M generating $20K in dividends and I would also have $40K in cash. I would review my financial situation every 6 months to determine if it’s the right time to sell some shares or not.

During the first six months of retirement, I would have spent about $20K. Half of it will come from my dividend portfolio and the other half from the cash account. Therefore, my cash account would decrease to $30K. If after 6 months the market is still good (e.g. no crash happening), I would sell a few shares to increase my cash account back to $40K.

If the market is in “crash mode”, I can easily wait another 6 months and see where the market is at that time. At this point, my cash account would decrease to 20K and my portfolio would still be generating the same $20,000 in dividends. In fact, chances are it will be generating a little bit more than that since my portfolio is focused on dividend growth stocks.

A market crash doesn’t drop the value of your portfolio permanently. Most crashes will happen over a few months to a year and then the market will start to recover. If the market is still in bad shape after 1 year of bearish returns, I still have the luxury to do nothing and wait another 6-months using the same technique. Ultimately this strategy would give me up to two years without having to touch my portfolio.

Can You Protect Your Cash Account for More than Two Years?

A two-year break will be enough to cover many bear markets, but not all of them. Therefore, it’s preferable to have two-years worth of retirement budget to cover about four years of bear market. If you don’t want to have ~$80K sitting in a cash account as per my example, there is something else you can do.

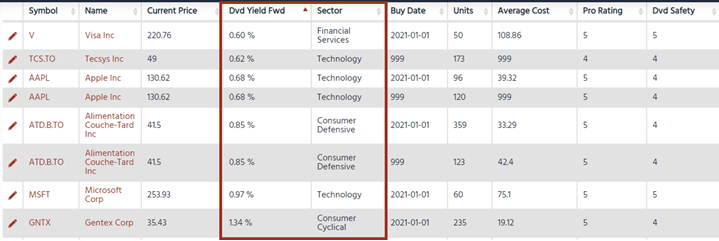

It’s always possible to take a few chances with your portfolio and improve your yield. Let’s be honest, a 2% yield isn’t much. It’s quite easy to transform your dividend yield from 2% to a 3-3.5% level. By using my DSR PRO portfolio builder, I can sort my holdings by yield and identify which company “hurts” my yield:

I can then identify each sector where I must find replacements and use the stock screener with filters such as:

- PRO rating* minimum 4

- Dividend safety score* minimum 4

- Dividend yield minimum 3%

*I’ve explained both the PRO Rating and the Dividend Safety Score on my YouTube channel. Click on each ranking title to view them.

I could then sell some Visa, Tecsys, Apple, Alimentation Couch-Tard and buy more Royal Bank, Sylogist, Broadcom and Coca-Cola.

Another technique I could use is to look at my sector allocation. I have a strong concentration in technology and consumer cyclical. I could sell some stocks in those sectors and replace them with companies in sectors with higher yields such as REITs and Utilities.

Therefore, I would end-up with two valid scenarios (you can pick the one you like best):

- Portfolio yield of 2% and a larger cash reserve (more like 18 to 24 months)

- Portfolio yield of 3%-4% and a cash reserve of about 12 months.

Since I’ve always focused more on growth than on income, I would likely pick the scenario #1. However, this would expose my retirement plan to more volatility in the case of a severe market crash. Scenario #2 would allow your portfolio to recover fully from pretty much any bear markets while you enjoy a stronger current income coming from your portfolio.

At this point, it’s a personal choice between growth and income. I see both possibilities as good choices (if you don’t jump from one to another repetitively!).

Which stocks to sell?

If I must sell stocks to create my own dividend, I will likely do everything to keep my sector allocation intact. I would then identify if I must rebalance my portfolio first and sell overweighted stocks. If sector allocation is well diversified, then I would sell a few shares of each position to maintain the allocation as is. It may trigger a few more transaction fees, but that’s the point of not selling more than twice a year (or, ideally, once a year).

To summarize

Here’s an easy plan to follow for your retirement withdrawals:

- Select between a low yield portfolio with a larger cash reserve or a higher yield (3-4%) and about 12 months of cash reserve.

- Write down a tax optimization plan with a tax expert.

- Sell overweight stocks to rebalance your portfolio, then sell a little bit of all positions to maintain your sector allocation.

- Enjoy your retirement!

Final Thought

When I made the decision to travel for one year with my family, I had this sentiment of urgency to act. While we worked on this project for 18 months before leaving, I was very aware that many kinds of catastrophes could hit our family. I feared an external event would take my dream away. In the end, it was the most amazing experience of my life.

When you retire, you may experience a similar feeling. The fear that an external event could destroy your retirement dream is frightening. But in most cases, it’s just our brain playing tricks with us. If you have a robust plan, you simply must follow it, and everything will be fine. Keep in mind that full market cycles take between 5 and 10 years on average. Therefore, even in retirement, you are down for a least 2 full cycles.

Cheers,

Mike.

The post Retirement and the Withdrawal Mechanics appeared first on The Dividend Guy Blog.