Do I need a million dollars to retire? I bet you’ll need more than that!

In my previous article, I discussed how the concept of retirement has evolved over time. I ended my article with the small combination of factors that will influence how you will live the rest of your life. There are many myths about the magical number you’ll need to attain before you can claim to the world you can retire in peace. One of the most common is reaching the symbolic million-dollar mark to retire. Do you need a million dollars to retire? Let’s crunch a bunch of numbers to see!

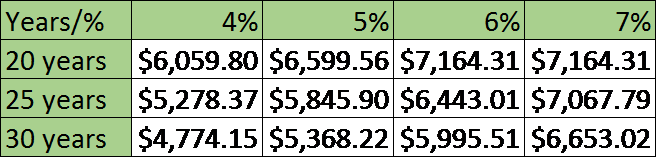

The first table I produced was based on having $1,000,000 the day you retire and then see how many years you can last depending on your investment return. I’ve run 3 scenarios 20 years, 25 years and 30 years (assuming you retire at 65, this leads you to 95… fair enough!). And then, I used 4 different investment return; from 4% to 7% (let’s be honest, 7% annualized return for the next 30 years is more like hunting unicorns).

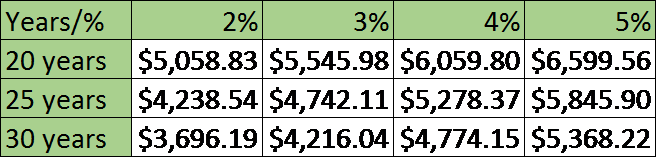

From this chart, you can conclude that even if you invest at 4% and live 30 years on your nest egg, you can still withdraw a whopping $57,289.80 per year. That’s pretty neat, isn’t it? It is… but I forgot to invite a special guest to my retirement party; its name is Big Bad Inflation Dude. To make it simple, I’ve used a 2% inflation rate and reduced my investment return by the latter. Therefore, when you invest at a 4% investment return, really only net 2% (assuming the 4% was net of fees obviously!). Here where the numbers drag us:

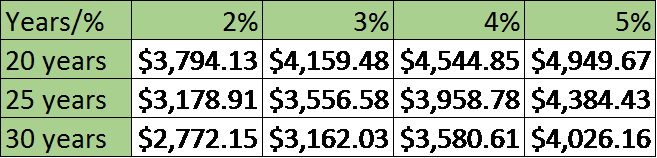

Still, $44,354.28 is a decent amount of money to live on. Considering you worked very hard and you had paid down all your debts, this is more than enough to live happily. Unfortunately, While I was reviewing my calculation, I noticed there was another guest I forgot to put on the list, his name is Mr. Tax Party Pooper. Now, I can’t really get into the specific of taxes as the cut you will give to the government will depends on various factors (e.g. the type of account you invest in, the type of revenue you generate and where you live). However, I ran the calculation with a 25% tax rate to give you an idea of how much will be deposited in your account if you retire with a million dollar in hand.

It is interesting how I went from making $57,000 and now I am down to $33,265.80 net of inflation and taxes? I’m pretty sure that many of us can live with $2,772,15 per month. At retirement, we should have slowed our lifestyle and already paid down our debts. Therefore, this sounds like a good budget to retire on. However, this is assuming you want to retire at the age of 65… if you aim at early retirement as mentioned in my previous article, then the math doesn’t work out even if you reach a million dollar earlier.

In the end, the million-dollar retirement plan still work, but you will not live like a “millionaire” per se…And this is if you can reach this milestone.

How’s reaching the million dollar working out for you?

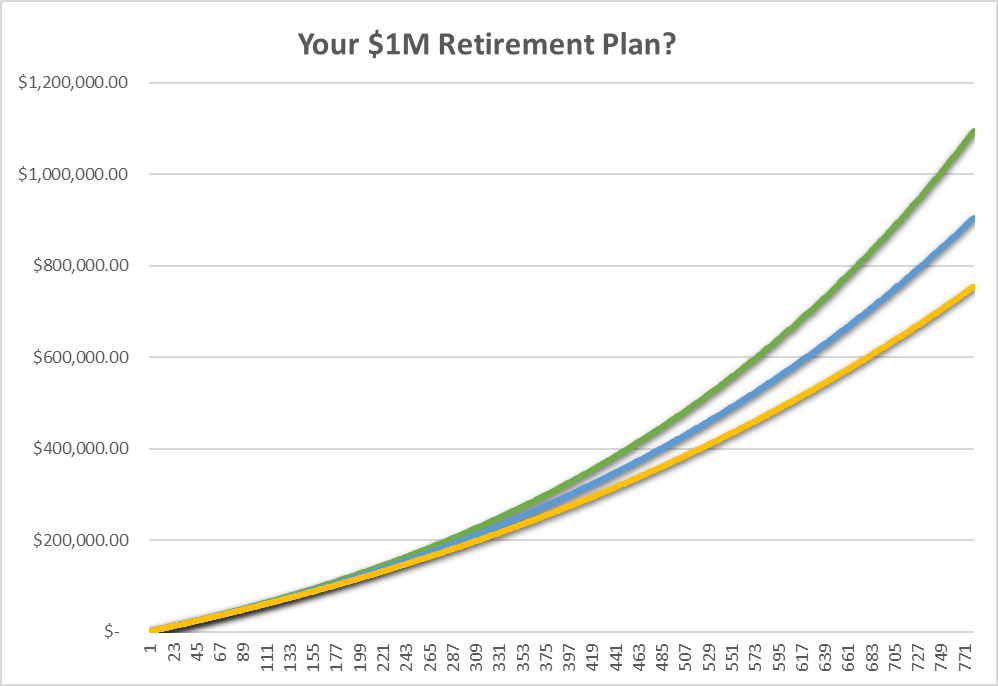

Reaching a million dollar is not that easy. It requires discipline and commitment. I ran a few scenarios to illustrate my point. Assume you are a budgeting ninja and manage to save $500 on each pay check you earn, you will need to save over 30 years at an investment return of 6% to break the million-dollar mark. To be exact, this would bring you to $1,093.893.50. If you are unlucky and achieve a 5% return, your nest egg would melt by almost $200K at $903,561.85 and, finally, at a 4% investment return, you only finish at $754,201.97.

Depending on your income level and lifestyle, saving $500 every two weeks may or may not be easy. It’s like having a second mortgage to pay off. But this is the price to pay if you want to reach this mark!

How you can make it easier and still become a millionaire

This is probably what I like most about financial planning: there are millions of possibilities to explore! Your goals and ways used to achieve them could be quite different from your neighbor’s. There are many small tweaks you can use to make it to a million without eating ramen noodles everyday!

The first one is to use the power of compounding interest to your advantage. Did you know that if you start saving only 5 years earlier for a total 35 years instead of 30 in your retirement plan, you would only need to save $325 every two weeks to reach the million-dollar mark? Therefore, if you start at the age of 30 to save $325 on your pay check, you will become millionaire by the age of 65.

The best part is that if you start saving at a young age, chances are you will be able to increase your savings through each pay raise and promotion. Therefore, instead of becoming millionaire by 65, you may reach your milestone in your 50s.

Finally, you can count on multiple sources of income at retirement so you don’t have to reach a million dollars in your portfolio. There are various ways you can build additional sources of income over time. You can consider buying a small rental property, have a side gig when you retire or simply work part time instead of completely quit your job. The next article in this series will explore these possibilities to make your retirement goal easier to reach!