In September 2017, I received slightly over $100K as a result of the commuted value of my pension plan. I decided to invest 100% of this money into dividend growth stocks. Each month, I publish my results. I don’t do this to brag, I do this to show you it’s possible to build a portfolio during an all-time high market. The market will crash… eventually. In the meantime, I rather cash some juicy dividends!

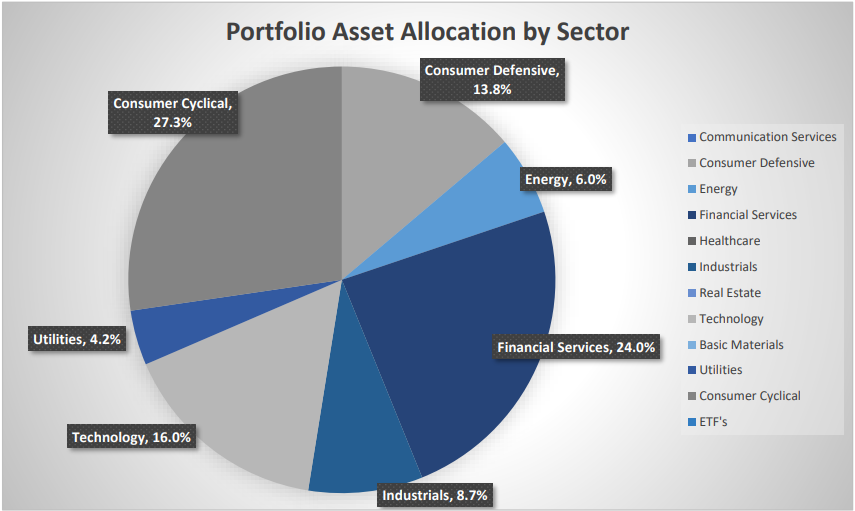

The Importance of Diversification

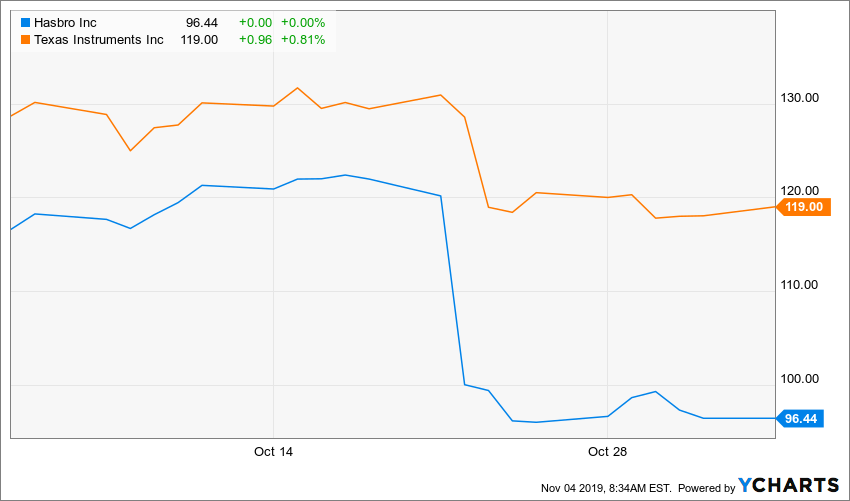

This has been a very interesting month for my US portion. The last two weeks of October was filled with numerous earnings releases for Q3. For some, it seems the market was desperately waiting for a good reason to sell and cash some profit. This is how two of my holdings lost roughly $1,500 combined (Hasbro (HAS) -18% and Texas Instruments (TXN) -8%). This is a steep drop for such a small period. Most of the drop happened on earnings day:

Source: Ycharts

The Joy of Diversification

On a ~150K portfolio, a 1.5K drop represents only 1% of the portfolio value. Therefore, while two of my companies are getting killed by the market, I barely felt a breeze on my face. In fact, I didn’t even notice as I had other companies in other sectors that did the opposite trick (e.g. beating analysts estimates and issuing stronger guidance). Stock like Apple (AAPL) +16.28%, BlackRock (BLK) + 13.01%, Lazard (LAZ) +9.13% and Gentex (GNTX) +8.54% all had great quarters. Instead of losing $1,500 in October, I show a portfolio value increase of nearly $1,500.

A great diversification allowed me to not suffer from bad news coming from a few companies. This doesn’t mean I should ignore what happened to both Hasbro and Texas Instruments. In fact, I review each of my holdings quarterly by reading their latest earnings statement.

Here’s what I wrote to my DSR members in our weekly newsletter about these black sheep:

Texas Instruments – A Classic Miscalculation

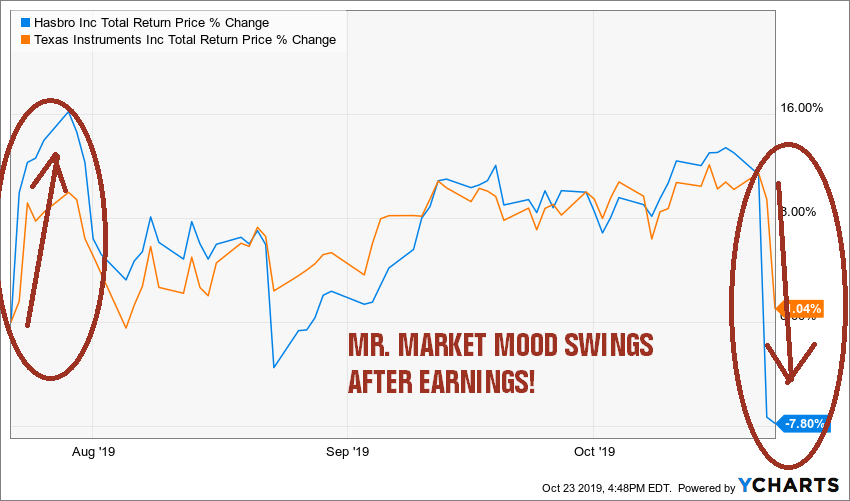

If you can remember what happened 3 months ago, you would probably smile seeing TXN dropping like a rock this week. The exact opposite happened for both TXN and HAS during their Q2 earnings day:

Source: Ycharts

When I talk about noise… What really happened?

First, TXN’s results have been bad for about a year now. Texas Instruments is facing many headwinds at the same time. We are at the end of an investing cycle in technology, the trade war is affecting business with China (duh!) and the automotive industry is also in a slowdown (hence, less high-tech cars are being sold).

Second, we thought we were done with bad news last quarter… And management slapped investors in the face by decreasing their Q4 forecasts… missing analysts’ expectations once again. Q4 forecast sees revenue of $3.07-3.33B (consensus: $3.6B) and EPS of $0.91-1.09 (consensus: $1.28).

Third, we don’t see the end of that trade war. Uncertainties are the worst thing (and the best thing) that could happen to a stock. It’s the worst for current shareholders as it is hard to price a stock when the future remains unclear. However, it’s a great opportunity if you missed the train, and you want to add TXN to your portfolio.

My thought on TXN after this quarter: There are inevitable short-term headwinds happening for the entire semiconductor industry. TXN is not losing market shares or having more problems compared to its peers. It is simply facing a challenging environment. The reasons why I bought TXN in the first place are still valid today. There are no changes in my investment thesis.

Hasbro – Santa Won’t Go to China This Christmas

Hasbro has created more noise than most people can handle by crashing more than 15% down on earnings day.

First, the results weren’t that bad. EPS was down -4.7% and revenue flat (+0.35%). There is nothing to write home about. Most investors would have been okay with such results. But expectations were greater.

Second, as it is often the case when a stock plummets, HAS missed both EPS and revenue growth expectations. Posting bad numbers is one thing, but when you miss EPS expectations by $0.36 (19.5% miss), that’s really bad news.

Third, people are literally trading on fear. The main reason why Hasbro missed its targets is because of potential tariffs. That’s right, those are just threats, but retailers have been “destocking” on fear of what is coming up next. As we have no clue when and how the trade war will happen, many fear there will be a major slowdown for the Holiday period.

My thought on HAS after this quarter: Three words: Star Wars, Frozen. Hasbro is about to enjoy a strong tailwind coming from Disney’s blockbuster movies. The company just came through the bankruptcy of an important client (Toys R Us) and still managed to post reasonable results. The trade war will eventually end, and retailers will increase their order at that point. HAS’s stock price has nearly doubled in the past 5 years, so I’ll hold on to my shares and cash the dividend in the meantime. It creates a good entry point for those who didn’t invest yet.

Numbers are as at November 4th 2019 (before the bell):

Canadian portfolio (CAD)

|

Company Name |

Ticker | Market Value |

| Alimentation Couche-Tard | ATD.B.TO | $6,812.92

|

| Andrew Peller | ADW.A.TO | $5,444.80 |

| National Bank | NA.TO | $5,460.00 |

| Royal Bank | RY.TO | $6,399.00 |

| CAE | CAE.TO | $6,726.00 |

| Enbridge | ENB.TO | $7,800.45 |

| Fortis | FTS.TO | $5,372.73 |

| Intertape Polymer | ITP.TO | $5,142.00 |

| Lassonde Industries | LAS.A.TO | $3,729.39 |

| Magna International | MG.TO | $5,035.80 |

| Sylogist | SYZ.V | $1,989.70 |

| Cash | $568.61 | |

| Total | $60,481.40 |

My account shows a variation of +$95.78 (+0.15%) since the last income report.

There is not much to tell about my Canadian holdings as they usually report a few weeks after the bulk of U.S. reports. I’m expecting some good news from the financial sector and consumer cyclical as well (I hope Magna will follow a similar trend to Gentex).

You can read about how I managed my portfolio as a Canadian (e.g. mixing both CDN and US investments): Investing the Canadian Way – Tricks I use to Boost My Returns. I discuss my sector allocation, how I manage currency fluctuations and my favorite sectors.

Numbers are as at November 4th 2019 (before the bell):

U.S. portfolio (USD)

| Company Name | Ticker | Market Value |

| Apple | AAPL | $7,930.42 |

| BlackRock | BLK | $6,568.38 |

| Disney | DIS | $5,973.75 |

| Garrett Motion | GTX | $29.88 |

| Gentex | GNTX | $6,702.20 |

| Hasbro | HAS | $4,436.24 |

| Lazard | LAZ | $3,812.76 |

| Microsoft | MSFT | $8,623.20 |

| Resideo Tech | REZI | $49.35 |

| Starbucks | SBUX | $7,072.85 |

| Texas Instruments | TXN | $5,902.00 |

| United Parcel Services | UPS | $4,421.87 |

| Visa | V | $9,046.50 |

| Cash | $388.27 | |

| Total | $70,957.67 |

The US total value account shows a variation of USD $1,345.47 (+1.9%) since the last income report.

As mentioned, several of my holdings killed it this quarter. This helped increase my portfolio by almost 1.5K.

Apple is a money-making machine

AAPL posted its highest Q4 revenue ever leading to operating cash flow of nearly $20B. It beat both EPS and revenue growth expectations. The company posted strong results for iPHone sales, wearables and services. Revenue breakdown: iPhone, $33.4B (consensus: $32.77B); iPad, $4.66B (consensus: $4.67B); Mac, $7B (consensus: $7.5B); Wearables, Home and Accessories, $6.5B (consensus: $5.94B); Services, $12.5B (consensus: $12.22B). Even better, management came with strong 2020 guidance: revenue between $85.5B and $89.5B and gross margin between 37.5% and 38.5%.

BlackRock remains the king of assets management

While earnings were down vs last year, BLK posted better results than expected by the market. Revenue increased by 3% driven by higher base fees and technology services revenue. Q3 net inflows of $84B vs. outflows of $3.11B in the year-ago quarter; reflects “strength in fixed income, cash and alternative strategies, as clients re-balanced, de-risked and sought uncorrelated sources of return in the face of significant global market volatility,” said Chairman and CEO Laurence D. Fink. Investment advisory, administration fees and securities lending revenue of $2.98B increased from $2.88B a year ago.

Lazard is looking ahead and smiles

While Lazard posted a modest quarter with a small revenue decrease, management seems highly positive for their financial advisory segment. The financial firm was recently implicated in the purchase of Fitbit by Google for $2.1B and by the sell of Chilquinta Energía in Chile by Sempra for $2.23B. Financial Advisory operating revenue was $304M, approximately even with the third quarter of 2018 while asset management revenue were down 6% mostly due to smaller assets under management (-4% vs last year and -3% sequentially). The company continues to be in a solid position where LAZ returned $130M to shareholders, which included: $50M in dividend and; $79M in share repurchases.

Gentex doesn’t look back in the mirror

GNTX posted a good quarter considering several headwinds hurting its industry. Automotive net sales rose 3.4% to $464.3M in Q3, driven primarily by strength in Full Display Mirror shipments, as well as an 18% increase in exterior auto-dimming mirror unit shipments. Total auto-dimming mirror shipment units +6% Y/Y to 10,841. Management is using extra cash flow to buy back shares (3.6M shares during the quarter at an average price of $27.07 per share, for a total of $96.6M.). GNTX expects to outperform its peers this year. It’s a keeper.

My entire portfolio quarterly updated!

Each quarter, we run an exclusive report for Dividend Stocks Rock (DSR) members called DSR PRO. The PRO report includes a summary of each company’s earnings report for the period. We have been doing this for an entire year now and I wanted to share my own DSR PRO report for this portfolio. You can download the full PDF giving all the information about all my holdings. Results have been updated as of September 10th.

Download my portfolio Q3 2019 report.

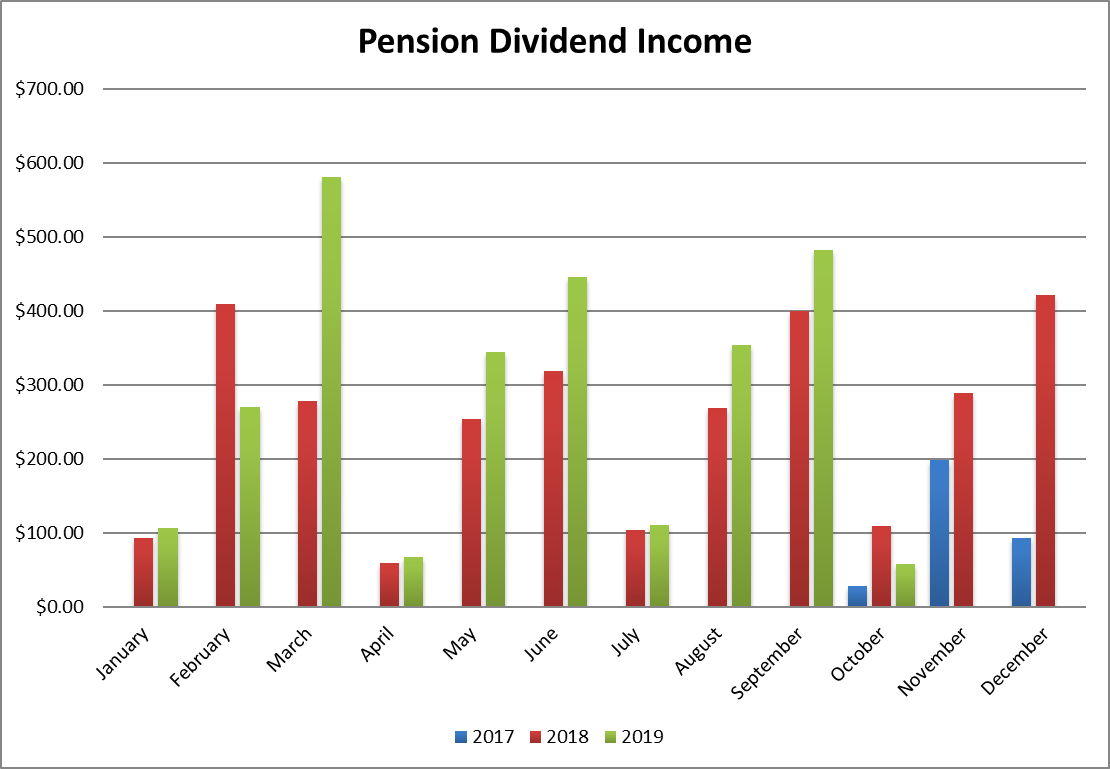

Dividend income: $57.89 CAD (-47%)

I was expecting to beat last year’s dividend payment, but a technicality brought me down 47% vs last year. I received National Bank’s dividend on November 1st instead of October. This was also the month where I received a small dividend from the Garrett Motion spin-off. Overall, my dividend income for October is slightly higher vs last year.

Here is the dividend growth detailed. The growth is compared to October 2018 (not a necessarily a recent dividend increase):

- Andrew Peller: +4.9%

- Gentex: +4.6%

- Currency fluctuation is minimal

When you combine both dividend growth and capital growth in this portfolio, you get great results! I have never been looking for high yielding stocks. I think the balance between dividend growth and capital growth is important in one’s portfolio.

Canadian Holdings payouts: $22.33 CAD

- Andrew Peller: $22.33

U.S. Holding payouts: $27.03 USD

- Gentex: $27.03

Total payouts: $57.89 CAD

*I used a USD/CAD conversion rate of 1.3156

Since I started this portfolio in September 2017, I have received a total of $6,146.68 CAD in dividends. Keep in mind that this is a “pure dividend growth portfolio” as no capital can be added in this account (it’s a LIRA). Therefore, all dividend growth is coming from stocks and not from additional capital.

Final thoughts

In the upcoming weeks, I’ll take a close look at each of my holding. I want to make sure that each of them are still on track with my investment thesis and will be able to increase their dividend in 2020. The heart of the earning season is always a great time to review your financial performance and identify red flags that could potentially hurt your portfolio.

Read: 3 Red Flags Telling You It’s a Bad Dividend Stock

The post October Dividend Income Report – The Importance of Diversification appeared first on The Dividend Guy Blog.