Throughout the years, I’ve studied, researched and tried many different investing styles. Since 2010, I’ve become a dividend growth investor, but not the classic buy & hold guy. I divide my portfolio into two distinct sections: a core portfolio and a growth portion.

The core portfolio looks like the classic dividend buy & hold with solid (and boring) companies. I expect to hold these companies for a very long time, if not forever. The growth portion is containing stocks with a strong growth potential over a relatively short period of time (18 to 24 months). My investing process is summarized in 7 investing principles:

- Principle 01: High Dividend Yield Doesn’t Equal High Returns

- Principle 02: Focus on Dividend Growth

- Principle 03: Find Sustainable Dividend Growth Stocks

- Principle 04: The Business Model Ensure Future Growth

- Principle 05: Buy When You Have Money in Hand – At The Right Valuation

- Principle 06: The Rationale Used to Buy is Also Used to Sell

- Principle 07: Think Core, Think Growth

As a long term dividend blogger, I’m often asked what are my favorite dividend growth stocks. It’s hard to make a short list as there are so many great companies out there. Based on my 7 investing principles, I’ve selected 5 I really like right now.

3M (MMM)

Business Model

3M produces products like Scotch tape, projector systems, Post-it notes, Tartan track, and Thinsulate. This is a conglomerate that produces products for many industries and for both personal and business use. Their manufacturing, research, and sales offices are all over the world.

Investment Thesis

3M’s competitive advantages are legendary. Industrial clients are reluctant to abandon such a world class company for any competitors as they know MMM will deliver quality products. 3M shows one of the strongest business models among the dividend kings and its dividend growth potential will continue to be one of its most interesting characteristics for investors. By becoming the leader in R&D in many sectors and offering efficient products that work, 3M has created an unique economic moat that can’t be matched by its competitors.

Potential Risks

There isn’t much risk associated with 3M besides the fact that their growth in the upcoming years may not be spectacular. This is not a company to buy in the hope of showing double digit returns, but this is a company you can buy and sleep well at night.

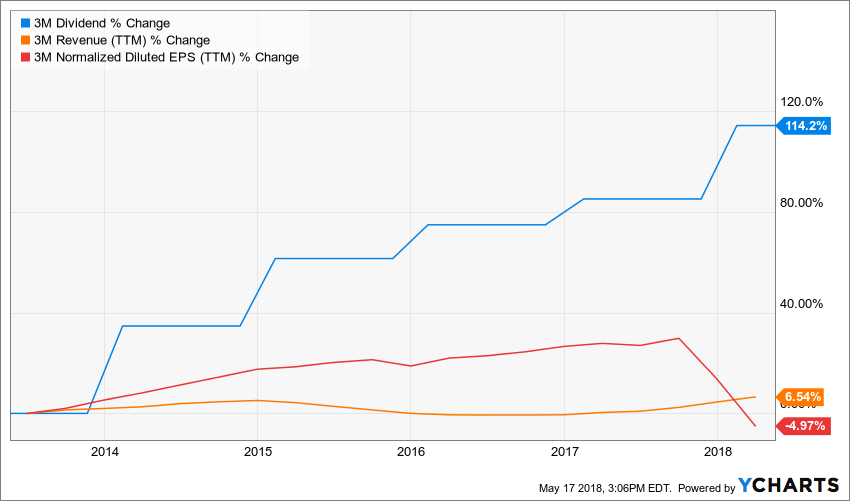

Dividend Growth Perspective

3M has been paying dividends to its shareholders for over a century and shows more than 50 consecutive years of increase. Over the past couple of years, MMM has been even more generous with their dividend increase and the payout ratio has jumped over 50%. Still, there is plenty of room for management to increase it in the future.

APPLE (AAPL)

Business Model

Apple Inc. designs, manufactures, & markets mobile communication & media devices, personal computers, portable digital music players and sells a variety of related software, services, accessories, networking solutions & third-party digital content. For its fiscal year 2017, AAPL counted on its smartphones to generate 62% of its total revenue. Its second largest revenue segment is Services for 13% of its revenue.

Investment Thesis

Apple released its new iPhone and posted its earnings shortly after for a record quarter. There is definitely a continuous interest for premium products (at a premium price!). Both revenues and earnings are going higher and higher at the same pace! Apple first growth vector remains its iPhone. It is also growing its services division at a double-digit pace. During the recent quarter, this segment posted at +18% year over year growth. Services such as Apple Pay, Apple Music and Apple TV are just the beginning. The more people buy iPhones, the more they are inclined to use services attached to them. The Tax bill will make additional money available for Apple, which could turn into additional shares repurchase and dividend increase.

Potential Risks

There are not many dark clouds coming over Apple at the moment. The company enjoys strong growth vectors and the company keeps showing strong sales. However, there are no techno companies sheltered from innovation. Apple protects its core product with a strong product ecosystem and additional services. Yet, the coming of a new popular phone hurting AAPL sales is always a possibility.

Dividend Growth Perspective

During the last 5 years, AAPL shows a +66.42% total dividend growth for a 10.72% CAGR. Don’t be fooled by the 1.50% yield as AAPL doubles its payment every 7 years going forward. Both payout and cash payout ratios are very low. With strong sales growth and consistent earnings progression, the company should keep up with a double-digit dividend growth for several years.

BLACKROCK (BLK)

Business Model

BlackRock is not only the world’s largest asset manager by assets under management (AUM), but it is also a dominant leader in one of the fastest growing investment products: ETFs. As low-cost fees and passive investing solutions tend to grow stronger, more money is being transferred toward BLK. BlackRock offers investment products in all asset classes enabling it to generate fees regardless of whether investors are bullish or bearish.

Investment Thesis

BlackRock is a winner and a keeper for decades to come. BLK net inflow assets under management continue to increase quarter after quarter. In other words; there is always new money coming in. The company is a leader in a growing investment field (ETFs) and has a strong relationship with several institutional clients. Institutional investors are more inclined to stay with their providers for several years than switching from one company to another in the short term.

Potential Risks

The main problem is BLK’s extremely high price. The stock gained more than 40% in the past year. No matter how much you love it, BLK will be among the biggest losers if a market correction occurs. It could also be a victim of its own success. The market is going into cheaper and more efficient investing products. BLK’s actively managed products could suffer much while its less-profitable products (ETFs) will grab market share.

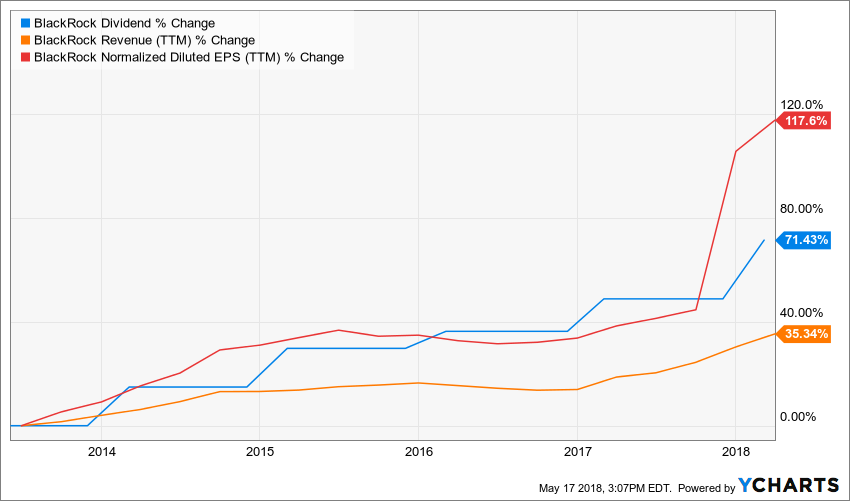

Dividend Growth Perspective

The company has shown an impressive dividend growth rate track record for the past 7 years. Over the past 5 years, BLK maintained a 10%+ annualized dividend growth rate. Even better, the current payout and cash payout ratios are well under control. We expect a double-digit dividend growth rate for the next decade and should reward shareholders with another 15% dividend increase this year.

WALT DISNEY (DIS)

Business Model

Disney is the king of content. In 2006, IT bought Marvel for $4 billion. Six years later, Disney sealed another $4 billion deal with the Lucasfilm purchase. Both deals prove Disney’s incredible ability to generate billions of dollars with purchased content. Over the past 5 years, DIS blockbuster movies and theme parks showed strong potential and have driven both revenues and earnings up. Now that the company announced during its latest quarter it will stream ESPN along with the rest of its content, DIS just unlock another world of opportunities.

Investment Thesis

Through the acquisition of Marvel and Lucas Film, Disney has built a never-ending universe of blockbuster movies. For example, since its acquisition, Lucas Film has brought 2 movies – Star Wars: The Force Awaken & Rogue One: A Star Wars Story – and generated over $3 billion in revenue. I expect the next Star Wars (Episode VIII to be launched on Dec 15th, 2017) to generate over $1.5 billion in revenue. Disney has already planned 1 production per year for its Star Wars franchise through 2020 and another trilogy afterward.

Potential Risks

While the DIS media network (driven by ESPN) is a strong cash cow, the steady decline of cable subscribers is worrying the market. For this reason, each piece of news confirming the issue brings the stock price down. While streaming services are only expected in 2019, any rumors around it will affect the stock price. In the meantime, DIS can count on several blockbuster to support its growth.

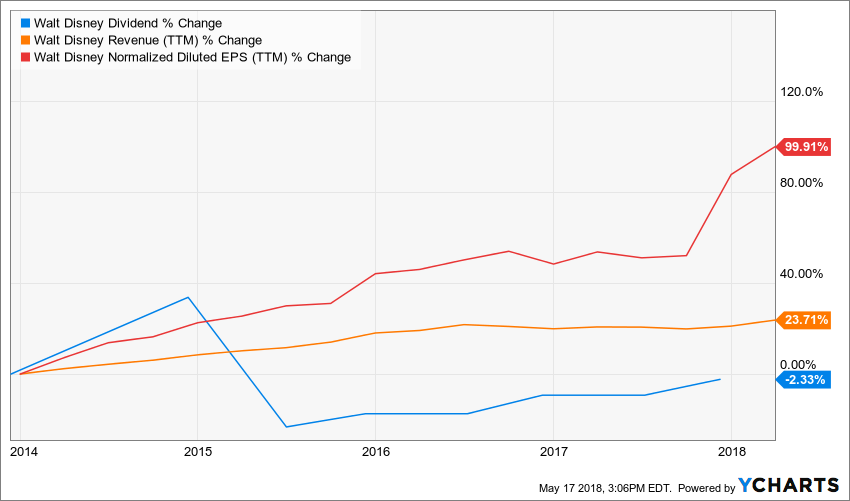

Dividend Growth Perspective

Don’t get fooled by the dividend line in the graph as dividend payment policy went from once to twice a year. Over the past 5 years, dividend payment went from $0.75 to $1.56 annually, a 15.77% annualized growth rate. With a payout ratio of 27%, DIS should keep its distribution in the high single to double digits for many years. The streaming service starting in 2019 will be another cash cow to support its increasing dividend.

GENTEX (GNTX)

Business Model

Gentex makes auto-dimming mirrors to improve drivers’ vision at night. The mirrors automatically darken to eliminate headlight glare for drivers. With a 92.3% market share and 1,000’s of patents to protect its technology, GNTX is far ahead of any other company in this sector. The company also benefits from stricter regulations in Europe to sell its SmartBeam technology enabling a vehicle’s bright headlights to go on and off automatically.

Investment Thesis

Gentex is the leader of its sector with its products on the way to becoming industry standards. On top of that, it shows a stellar balance sheet. If this is the case, GNTX could continue its impressive sales growth for the next 10 years. The company also benefits from being the first to offer this high-quality product. This leads to higher margins for early adoption and puts Gentex #1 in automakers mind for future orders. Gentex is set to continue its growth for at least a decade. Not to mention that its current situation makes it a great potential candidate for an acquisition. Finally, GNTX will also boost its sales with additional products.

Potential Risks

Magna Mirrors, its biggest competitor, has more resources. If it decides to compete with a similar technology, it could win. Also, GNTX doesn’t operate in a vast economic moat and has limited pricing negotiation power with automakers. The automotive parts industry is very cyclical and new technology could hurt (cameras could replace mirrors). However, its strong R&D budget enables it to develop such new technologies.

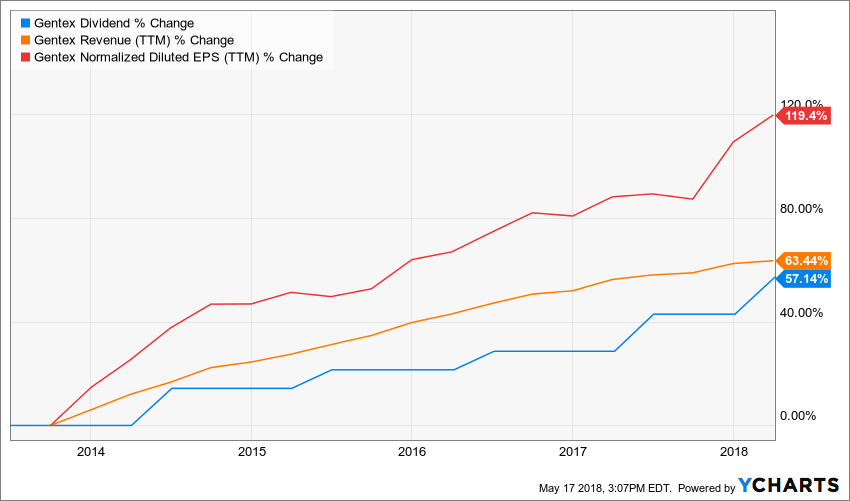

Dividend Growth Perspective

GNTX increased its payouts for 7 consecutive years and it maintained an 8% annualized growth rate over the past 5 years. Management increased its distribution by 11% this year and we can expect additional growth in the next years. Current payout and cash payout ratio give room for future increases. Since Gentex is sitting on a pile of cash and has low debts, there is very low risk for the dividends in case of a recession. Expect high single digit dividend growth numbers for the next decade.

I HAVE 5 MORE FOR YOU…

I couldn’t stop at only 5 picks. This is why I kept on working on that list and end-ed up with 10 US dividend growth stocks. If you want get the full report, you can download it for free right below:

disclaimer: I’m long DIS, BLK, GNTX, AAPL, MMM in my Dividend Stocks Rock portfolios

The post My Favorite Dividend Growth Stocks appeared first on The Dividend Guy Blog.