At the end of June, I produced a complete analysis of the five biggest Banks in Canada. While this post was featured on Seeking Alpha, I thought of publishing this second Canadian sector analysis on my blog. I think you will like seeing which telecom is the best one to hold for a dividend growth investor.

I will highlight the differences in their business models, dividend profiles and other important fundamentals along with their current stock valuations.

Business Model

BCE (BCE) is the largest communications company in Canada. The company recently acquired CTV for 1.3 billion dollars. This acquisition included major subsidiaries such as TSN. BCE also owns 15% of the Globe and Mail, ownership of Bell Aliant Regional Communications Income Fund and stakes in both the Montreal Canadiens & the Toronto Maple Leafs NHL teams.

BCE has a strong leadership position. Bell also has clear objectives which are to Improve Customer Service, Accelerate Wireless business, Leverage Wireline Momentum, Invest in Broadband Networks and Services, and Achieve a Competitive Cost Structure. Bell is definitely strong enough to continue its growth through the acquisition of market share in different communication segments in Canada.

Rogers (RCI.B) is a diversified communications and media company. The company is divided into three divisions: wireless, cable and media. While the Rogers business is similar to Telus when we compare wireless and cable services, RCI.B has an extra division called media. Rogers broadcasting has increased, notably through the acquisition of the Toronto Maple Leafs and the ownership of the Blue Jays that will certainly feed Rogers Sportsnet.

Rogers is well established in various markets and it has recently made another interesting play: they secured the rights to NHL broadcasting exclusivity for 10 years. The deal by itself should not add huge profits to the table but if RCI is able to leverage its broadcasting to promote their other brands (such as mobile services), this contract will be worth every penny.

Shaw Communications Inc (SJR/B) is at its heart a Western Canadian cable and satellite TV company (founded in 1966) that has rapidly been trying to diversify in order to compete with the other three major Canadian telecoms. Its recent forays into high-speed internet access and wireless communications have seen varying degrees of success. It serves more than 3.4 million customers and boasts over 625,000 kilometres of fibre-optic cable. Their satellite TV division reaches almost a million homes across Canada.

The main difference between Shaw Communications (SJR/B) and the other “Big Three” Canadian telecoms is its specialization in the Cable and Satellite TV sectors. It has around 60% of the market share in this area and a very solid market base in Western Canada (that was only strengthened by the purchase of the Winnipeg-based Canwest Global franchise). For the short term at least, it appears that this characteristic will be a major competitive advantage.

Telus (T) offers residential phone, internet, TV and mobile phone services. Back in 2008, Telus also bought Emergis, a leading electronic healthcare solutions provider and then created Telus health Solutions. Considering the number of wireless subscribers, Telus is the 3rd largest provider in Canada. Interesting enough, T gets 49% of its revenue from Wireline and 51% from Wireless.

Telus continues to outperform its peers and the stock market year after year. The best part is that T is doing this while continuing to increase its dividend year after year. It went from $0.24/share in 2009 to $0.40/share in 2014. There is still a lot of room in Ontario and Quebec for this company to raise its profit in the upcoming years. Telus TV services are growing very fast, stealing clients from Shaw at the same time. It currently shows 800,000 TV customers and 75% of its mobile subscribers are on a smartphone. Therefore, it means higher bill per customer for Telus.

Dividend Perspectives

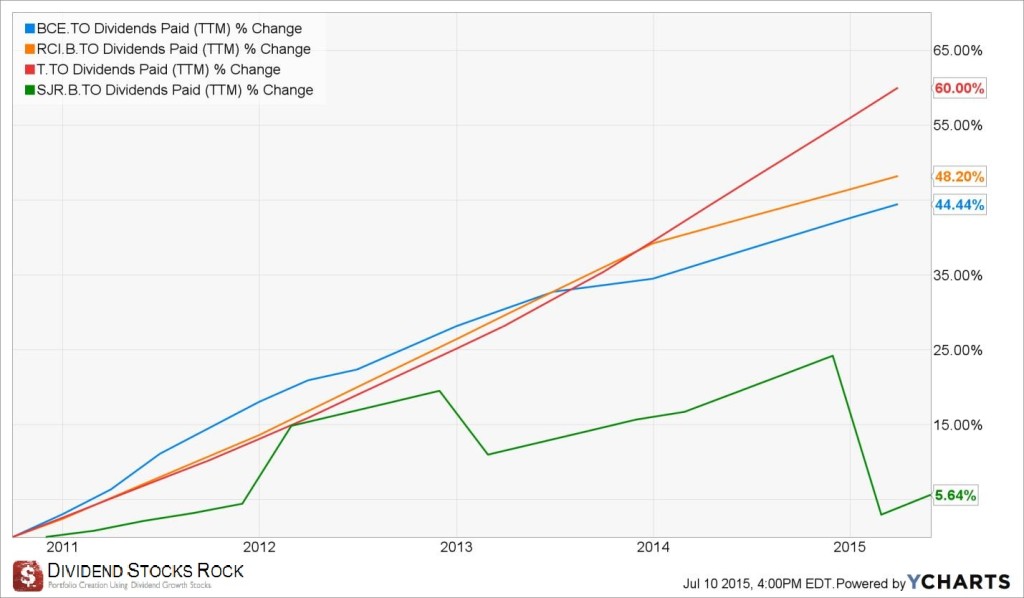

The first metric I will look at is the dividend growth over the past 5 years to see how companies behave with their shareholders.

Unfortunately, Shaw’s dividend graph is skewed because of the timing of its dividend payment. I’ve doubled verified its dividend payment and it was never cut. However, Shaw’s dividend growth is quite inferior to its peers.

While Rogers and BCE are racing side-by-side, Telus has been increasing its dividend by 10% each year and wins the dividend growth race over the past 5 years. But does this strong dividend payment increase affect its ability to keep moving forward? Here’s the answer:

As you can see, Telus is also a champ in term of payout ratio. Only Shaw shows a better payout ratio but it was also the less generous dividend payer over the past 5 years. BCE ratio worries me as the company wasn’t the strongest to increase its revenue lately and is giving all its profit to investors. I understand a dividend yield near 5% for a company evolving in a relatively safe and stable environment is attractive for any investor, but I’m more concerned about future payment growth. Overall, Rogers seems to navigate in the middle of this 4 contender’s race without showing a distinctive aspect so far.

The company effectively meets the first 3 of my 7 investing principles:

#1 A high but not too high dividend yield

#2 A very strong dividend growth history

#3 The ability to keep its dividend growth policy in the upcoming years

On a dividend growth stand point, there is only a single obvious BUY and it’s Telus.

Other Financial Fundamentals

It is one thing to look a company’s dividend payment perspective, but it doesn’t tell you everything about it. To be honest, if you buy any of these 4 telecoms, you will definitely make a good move in terms of dividend payments. They will all continue to pay juicy dividends and if you are looking for income, you should have at least one of these stocks in your portfolio. However, it doesn’t mean they will all show value growth in the future either. This is why I think it’s important to look at other fundamentals that will ensure the company’s future; revenues and earnings!

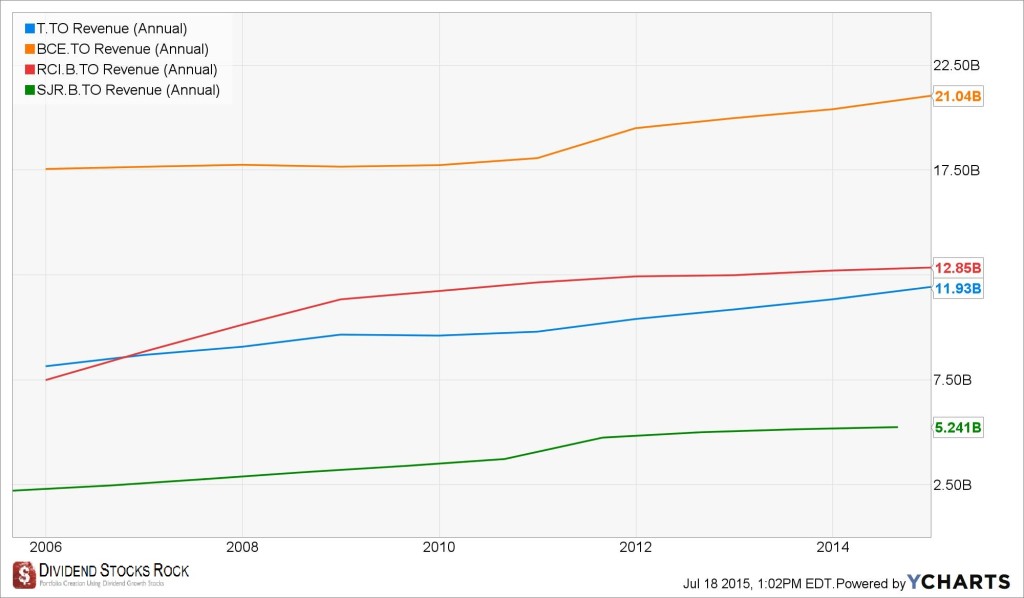

This is without any surprise, we see a small but not impressive revenue growth trend for all telecoms. Since they all evolve in a mature market and the environment is more like an oligopoly than anything else; growth perspectives are not astounding.

There are little competitors to buy in order to grow bigger and the Government watches them carefully to make sure they don’t own “too big” a market share in any segment. If we compare the US market to the Canadian mobile phone market, we can see there is still room for growth. Still, we won’t see any of these companies reaching double digit growth in the future. Canadian telecoms remain big & strong enough to occupy the Canadian market and make it very unfriendly to any foreign competitors but they are also too small to think about crossing the border to fight with behemoths such as Verizon (VZ), AT&T (T) or Vodafone (VOD).

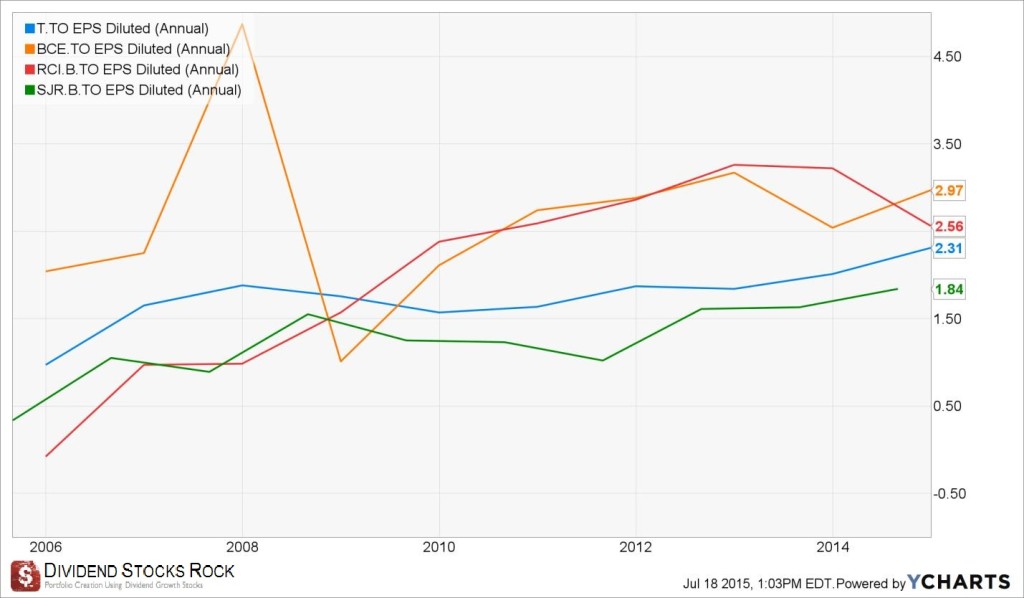

In terms of earnings, we can see there is a good progression after 2009 for all companies. The Canadian economy restarted at that time and the mobile phone penetration rate was better with the growing popularity of several smartphones.

Telus shows the highest revenue & profit per customer and we can expect this customer service leader to continue benefitting from this competitive advantage in the future. Rogers lost lots of momentum over the past 18 months with disappointing results and declining profits. The dividend payment is not at risk by any means yet the company is not showing any interesting perspectives at the moment.

Stock Valuation

Since the market has been quite generous to investors lately, it is very important to know if we are overpaying or not for any stock. In order to assess each stock value; I will use the 5 year PE history to see how the stock market valued the telecoms in the past. Then, I will also use the dividend discount model to see how much each company is worth when considered as dividend paying machines.

The first thing you can notice when looking at the telecom valuations is the big drop between 2013 and 2014. This happened when the Government opened the door to foreign telecoms to buy MHZ bandwidth and enter in the mobile market. While the industry has been controlled by the same big players for decades, the Canadian government wants more competition in order to offer more options to customers. I must admit that I’ve been a client of 3 out of 4 telecoms in my life and I can’t pick up another wireless carrier at the moment as my options run out.

During summer of 2013, there were rumors Verizon (VZ) could be interested in entering the Canadian market. There is no doubt the company could buy the whole market in a heartbeat. However, if VZ enters as a new competitor, it would take years and several hundred million dollars spent in marketing to effectively penetrate the Canadian market. As we saw with the Target (TGT) adventure, Canadians may speak English and be the closest neighbors to the US and their consumer behavior is not the same and it is expensive to learn how to please them. VZ finally decided to buy its stakes held by Vodafone instead and quickly forget about the Canadian opportunity.

Since then, valuations have been on an uptrend and BCE is now more expensive than Telus. BCE’s leadership position coupled with a very strong dividend yield makes it the favorite telecom among many pension fund managers. However, it is unclear as to which company is a bargain or not. This is when the dividend discount model (DDM) will come handy.

In order to use the DDM, I will use the double level dividend discount model calculation spreadsheet from the Dividend Monk’s Dividend Toolkit. I will use a 10% discount rate for all companies. The reason why I don’t use a 9% rate is that I’m adding a 1% premium to my discount rate to cover the event of a foreign competitor entering the Canadian market. Let’s just say I rather play on the safe side.

BCE

Considering the company current payout ratio, I don’t really see how I can expect a bigger dividend increase than 5%. I rarely do this but I will keep both the first 10 years and the years afterward at the same dividend growth rate (5%). As you can see, the company is currently trading at its fair value:

Source: Dividend Toolkit Excel Calculation Spreadsheet

Source: Dividend Toolkit Excel Calculation Spreadsheet

Therefore, there is little to no margin of safety if you buy BCE today.

Rogers

Despite the fact Rogers presented soft financial results in 2014, it doesn’t change the fact that it shows the best wireless “distribution network” across Canada. For that reason, I’ve decided to use a 5% dividend growth for the first 10 years and increase it to 7% in the future. The company will hit multiple challenges but there is a good chance it will benefit from their strong network in the future:

The company shows higher risk than BCE, but could be trading at a very good discount at the moment. Still, investors must remain patient.

The company shows higher risk than BCE, but could be trading at a very good discount at the moment. Still, investors must remain patient.

Shaw

With regards to Shaw, I’m using a higher dividend growth now (7%) and reduce it to a more reasonable level after (5%). The reason to use the same numbers is because Shaw show a very low payout ratio compared to its peers and has the ability to crank up its payment in the upcoming years to compete with its peers.

Source: Dividend Toolkit Excel Calculation Spreadsheet

Source: Dividend Toolkit Excel Calculation Spreadsheet

Even with a relatively optimistic dividend growth scenario, SJR.B seems to be trading at its fair value. Similar to BCE, there is little to no room for a margin of safety if you buy the shares today.

Telus

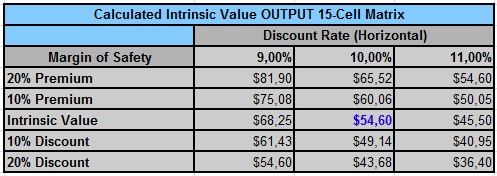

Telus has been fairly aggressive with its dividend growth policy over the past 5 years. The company recently increased its dividend by 5% and the market expects another raise toward the end of the year. Therefore, we will keep a relatively high dividend growth of 8% for the next 10 years and then use 6% for a more reasonable growth rate.

Source: Dividend Toolkit Excel Calculation Spreadsheet

Source: Dividend Toolkit Excel Calculation Spreadsheet

As you can see, Telus is still trading at a 10% discount for the moment.

Final Thoughts

To be honest, I really like an oligopoly as an investor. This provides more stability in term of revenues and earnings and makes my predictions more accurate for the future. On the other hand, this also makes the telecom industry a fairly valued sector without much bargain. The only “deal” you can find in the industry is based on your growth expectations as an individual investor. A safer bet would be to buy one of those companies for its current dividend payment. However, if I have to rank them, I would go with the following ranking:

#4 Shaw Communications (SJR.B.TO): The company is not a big competitor in the mobile industry where the bulk of the money is still to be made. Shaw is also the “less dividend investor friendly” among the group.

#3 BCE (BCE.TO): Is it because I was disappointed as a client or because I don’t see much growth perspective for this “too big” company but I can’t see BCE beating both Rogers & Telus in the upcoming years in terms of financial results. It’s a good play for income seeking investors, but that’s about it.

#2 Rogers Communication (RCI.B.TO): It’s a bit of a gamble, but the fact the stock price has been stagnating over the past two years makes it more interesting. Can it unlock its distribution channel value in the upcoming years? Its growth perspective make it more interesting than BCE and Shaw.

#1 Telus (T.TO): Without much surprise, I prefer Telus in the Canadian telecom industry. #1 in customer service, #1 in profit per user and #1 in dividend growth history over the past 5 years makes it my favorite stock. I’ve been a happy investor / shareholder for several years now and can see how the company will continue to perform in the future.

Disclaimer: I hold shares of Telus.